JUST Price Prediction: Breakout Stalls As Sellers Test Support After Parabolic Rally

JUST price today trades near $0.0425, easing over 3% in the past 24 hours after a strong breakout that lifted price into a major multi-month resistance zone. The rally paused immediately at the upper boundary of a long-term triangle formation, leading to profit-taking as the market tests whether the breakout has real follow-through.

Price Hits Major Resistance After Strong Rally

The daily chart shows JUST breaking above a rising wedge base and driving into the horizontal ceiling near $0.0440, which has capped every major rally since April.

Price remains above all major EMAs, which now sit between $0.0348 and $0.0388, establishing a broad support zone beneath current levels. The reclaim of the EMA stack is structurally bullish, but the reaction at resistance determines whether the breakout transitions into trend expansion or stalls into consolidation.

RSI sits near 74, signaling overbought conditions and increasing risk of short-term cooling. The indicator also shows repeated bearish divergence signals on previous peaks, making the current stall notable as traders gauge whether momentum will fade again.

A failure to hold above the rising support line drawn from the late October low exposes a deeper pullback toward the EMA cluster.

Intraday Charts Show Initial Retest Of Support

On the 30-minute chart, JUST is testing the rising trendline that supported the breakout. Price briefly slipped below the line before reclaiming it, showing early signs of bid absorption.

Supertrend sits overhead at $0.0437, reinforcing that upside is encountering resistance. The Directional Movement Index shows a fading bullish impulse, with ADX flattening while +DI slips beneath related metrics. This supports the idea that momentum has cooled and the rally is transitioning into a retest phase.

A close below the trendline would shift focus toward the $0.0410 to $0.0395 region, where early support formed before the breakout acceleration.

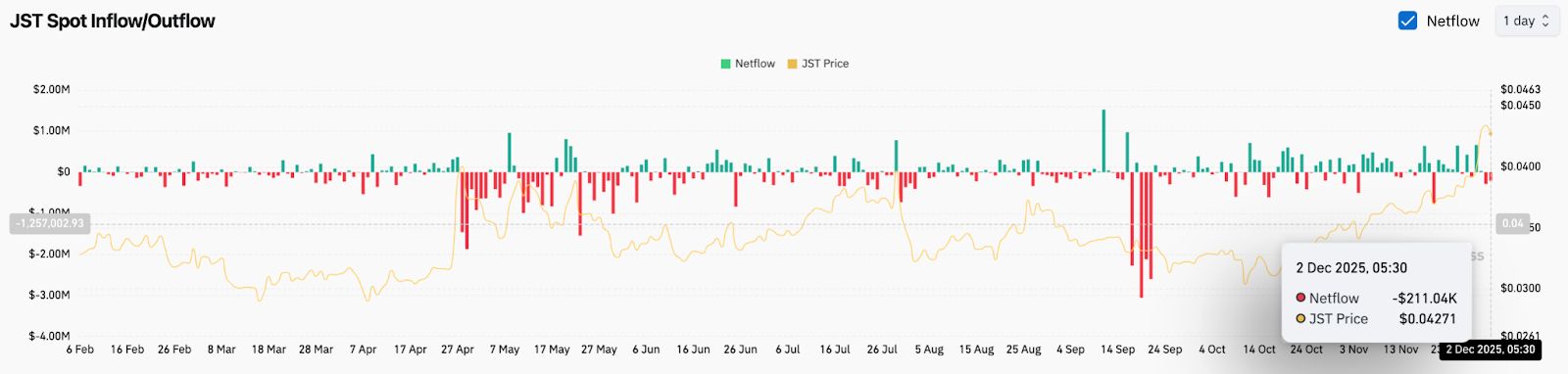

Spot Flows Show Light Distribution

Spot flow data shows a small $211,000 outflow on December 2, reflecting mild distribution after the breakout. Recent days show a mix of green and red prints, indicating balanced participation rather than heavy accumulation or aggressive profit-taking.

This flow profile matches price action. The rally was driven by technical breakout mechanics rather than large-scale inflow, and the current stall reflects traders managing risk rather than exiting en masse.

If spot flows turn positive again, the breakout could regain momentum. Sustained outflows would indicate further cooling.

Outlook. Will JUST Go Up?

JUST remains in a constructive higher timeframe structure after reclaiming the full EMA stack and breaking out from a multi-week base. The current pullback is a standard retest of resistance turned potential support. The next move depends on whether buyers defend that level.

- Bullish case: A bounce from $0.0410 followed by a close above $0.0440 signals continuation toward $0.0460 and $0.0500. Sustained higher lows confirm trend expansion.

- Bearish case: A break below $0.0410 turns the move into a deeper retracement toward $0.0395 and potentially $0.0380. Losing the EMA stack shifts structure back into range-bound behavior.

JUST must hold the rising support to maintain the breakout thesis. Reclaiming $0.0440 turns the pullback into trend continuation, while losing $0.0410 exposes a cooldown toward the mid-$0.03 area.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a