Nexo (NEXO) Price Prediction: Nexo Price Struggles Despite Mild Accumulation Signals

Nexo continues to struggle for directional strength as market activity leans toward sellers and broader sentiment weakens. The token remains unable to break above several critical resistance zones, while inflow and outflow data signal persistent volatility across the year.

Besides, price action is still tracking below major moving averages, which keeps bearish conditions intact. The latest move reflects a market trying to recover, yet significant hurdles limit any meaningful upside.

Technical Levels Show Heavy Resistance Above Current Price

Nexo trades well below the 50, 100, and 200 EMA, and this alignment confirms sustained downward pressure. Moreover, the 20 EMA has rejected multiple bounce attempts, which reflects active short-term selling.

Key resistance stands at the $0.9750 to $0.9850 area, where Fibonacci and EMA clusters blocked price advances twice. Market analysts treat this zone as the first barrier that buyers must reclaim to shift momentum.

A stronger pivot sits near $1.0110, which aligns with the 0.5 Fibonacci level. A decisive move above this region would signal improving sentiment and a possible shift toward recovery.

Significantly, the $1.0470 zone, which merges with the 200 EMA, forms the strongest resistance overhead. A break above that area would mark a structural change and could open a path toward $1.0980 and higher Fib extensions.

Support remains concentrated at $0.9300 and then $0.9000, where the Donchian lower band adds further importance. Losing these levels would expose the $0.8588 swing low and raise the risk of a continued downtrend.

Momentum Indicators Reflect Cautious Buying Interest

RSI currently stands near 48, which shows mild recovery after recent oversold readings. However, momentum stays below the midline, indicating limited bullish strength. A push above 55 would provide the first signs of renewed demand.

Additionally, the MACD histogram has turned positive, suggesting a reduction in selling pressure. The crossover also supports early bullish interest, although stronger follow-through remains necessary.

Inflow and Outflow Patterns Signal Mixed Market Behavior

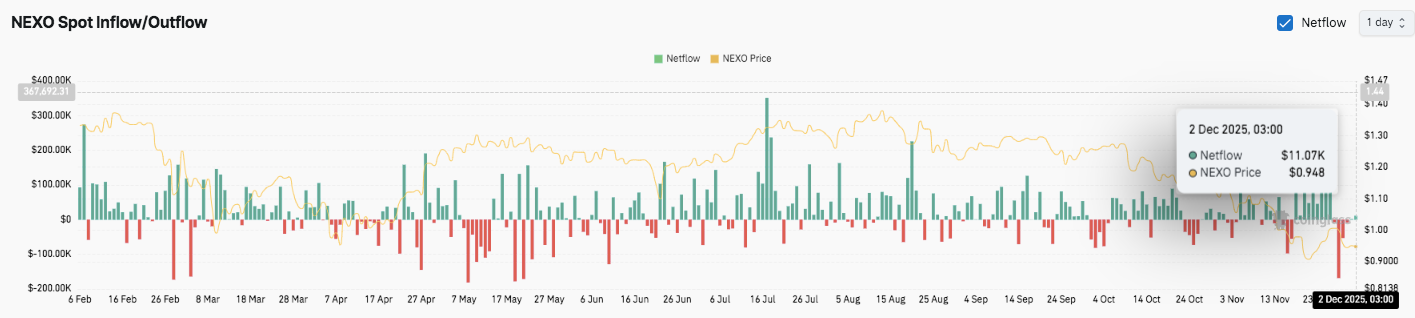

Nexo’s spot flows show alternating accumulation and distribution phases across the year. Early months recorded inflows above $200K, while several outflow spikes above $100K suggested selling into strength.

Activity turned mixed mid-year and shifted toward heavier outflows from October. Consequently, price gradually softened. The most recent inflow of $11.07K on December 2 shows mild accumulation, yet overall conditions still favor caution.

Related: Nexo (NEXO) Price Prediction 2024-2030: Will NEXO Hit $10 Soon?

Technical Outlook for Nexo Price

Key levels remain well-defined as Nexo trades inside a broader downtrend.

Upside zones sit at $0.9750, $1.0110, and $1.0470, which form immediate hurdles. A breakout above these layers could drive price toward $1.0980 and the extended Fibonacci region at $1.1630.

Downside zones include $0.9300 trendline support, followed by $0.9000 and the $0.8588 swing low. The 200-EMA resistance ceiling at $1.0470 is the major level Nexo must flip to establish medium-term bullish momentum.

The technical picture shows Nexo moving inside a declining structure, with price repeatedly rejected at EMA clusters and Fibonacci marks. The setup hints at continued compression, where a decisive break in either direction could introduce larger volatility. The Donchian mid-band has acted as a consistent rejection line, reinforcing the lack of strong buyer conviction.

Related: Nexo Brings Instant Crypto Loans and Savings Products Back to U.S. Users

Will Nexo Rebound?

Nexo’s outlook for the coming weeks depends on whether buyers can defend the $0.9300 support long enough to retest the $0.9750–$1.0110 cluster. This region remains the critical zone that could trigger a shift in momentum if reclaimed.

Technical compression, spot flow rotation, and broader market trends point toward increasing volatility ahead. If bullish momentum builds alongside stronger inflows, Nexo could attempt a move toward $1.0470 and even the $1.0980–$1.1630 extension.

Failure to hold $0.9300, however, risks breaking short-term structure and exposing Nexo to $0.9000 and the $0.8588 low. For now, price sits in a pivotal zone. Recovery potential remains viable, but confirmation through reclaiming resistance levels will determine the next sustained move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr

Alphabet's AI-driven ecosystem accelerates flywheel momentum, driving shares up by 68% in 2025

- Alphabet's stock surged 68% in 2025, outperforming peers like Microsoft and Nvidia , driven by strong AI monetization and cloud growth. - Analysts raised price targets to $375-$335, citing Google Cloud's $15.2B Q3 revenue (34% YoY) and $155B cloud backlog growth. - The company's AI ecosystem spans Search, YouTube, and Workspace, generating premium subscriptions and ad yield through Gemini's 650M MAUs. - Projected cloud revenue could exceed estimates by $40B, but risks include regulatory scrutiny and comp

XRP News Today: Vanguard Changes Position on Crypto ETFs, Pointing to Market Maturity and Increased Demand

- Vanguard Group will enable crypto ETF trading on its platform from December 2, 2025, reversing years of opposition to digital assets. - The firm supports Bitcoin , Ethereum , XRP , and Solana ETFs but excludes memecoins, treating crypto as non-core assets like gold . - Market maturation, $25B+ ETF inflows, and regulatory compliance drive the shift, positioning Vanguard as the last major U.S. broker to adopt crypto ETFs. - The move reflects growing institutional confidence in regulated crypto structures a