President Donald Trump is likely to announce his new Federal Reserve Chair before the end of this week. Several sources, including Scott Bessent, Treasury Secretary, have confirmed that President Trump has already made the decision on the next Fed chair, and the announcement is likely to happen before this year’s Christmas.

According to Walter Bloomberg , President Trump confirmed that the announcement is coming soon, likely between December 2 and 3.

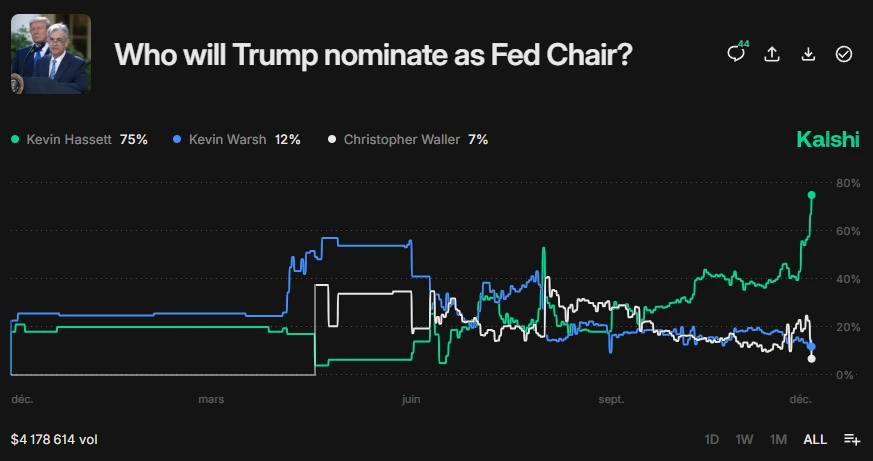

Meanwhile, Kalshi traders are betting a 75% chance that Kevin Hassett, the Director of the National Economic Council (NEC) in the White House, will be named as the next Fed Chair.

Source: Kalshi

The next Fed Chair is expected to expedite the interest rate-cutting process ahead of the 2026 midterm elections. Such a move would be a huge boost for the stock market and the wider crypto industry in the subsequent months.

Moreover, the Federal Reserve ended its Quantitative Tightening (QT) on Monday, December 1. As such, crypto investors are anticipating a macro bullish impact akin to the post-2019 end of the Fed’s QT.

Investors are highly convinced that the Fed will initiate more rate cuts, including a 90% chance for a 25 bps rate cut in December 2025. The declining Fed’s interest rates amid its upcoming liquidity injection are a much-needed fuel for a more bullish outlook ahead.

Meanwhile, Cardano founder Charles Hoskinson has cautioned the crypto industry to avoid depending on legacy institutions and the political class to maintain a macro bullish outlook. Instead, Hoskinson has urged Web3 developers to build products that help onboard the next 500 million retail users seamlessly.