Bitcoin Updates: The Looming Threat of Capitulation—Is Bitcoin Destined to Relive Its Past?

- Bitcoin short-term holders face 20-25% losses amid panic-driven selling, with SOPR dropping to 0.94, a historical capitulation level. - The November 22% price crash to under $85,000 highlights fragile liquidity and macro risk-off sentiment, contrasting with gold's 58% outperformance. - Brazil's crypto market sees stablecoins dominate 90% of volume, while global rate cuts (316 in two years) fail to boost Bitcoin's liquidity-linked performance. - Derivatives open interest plummets, and spot ETFs attract $7

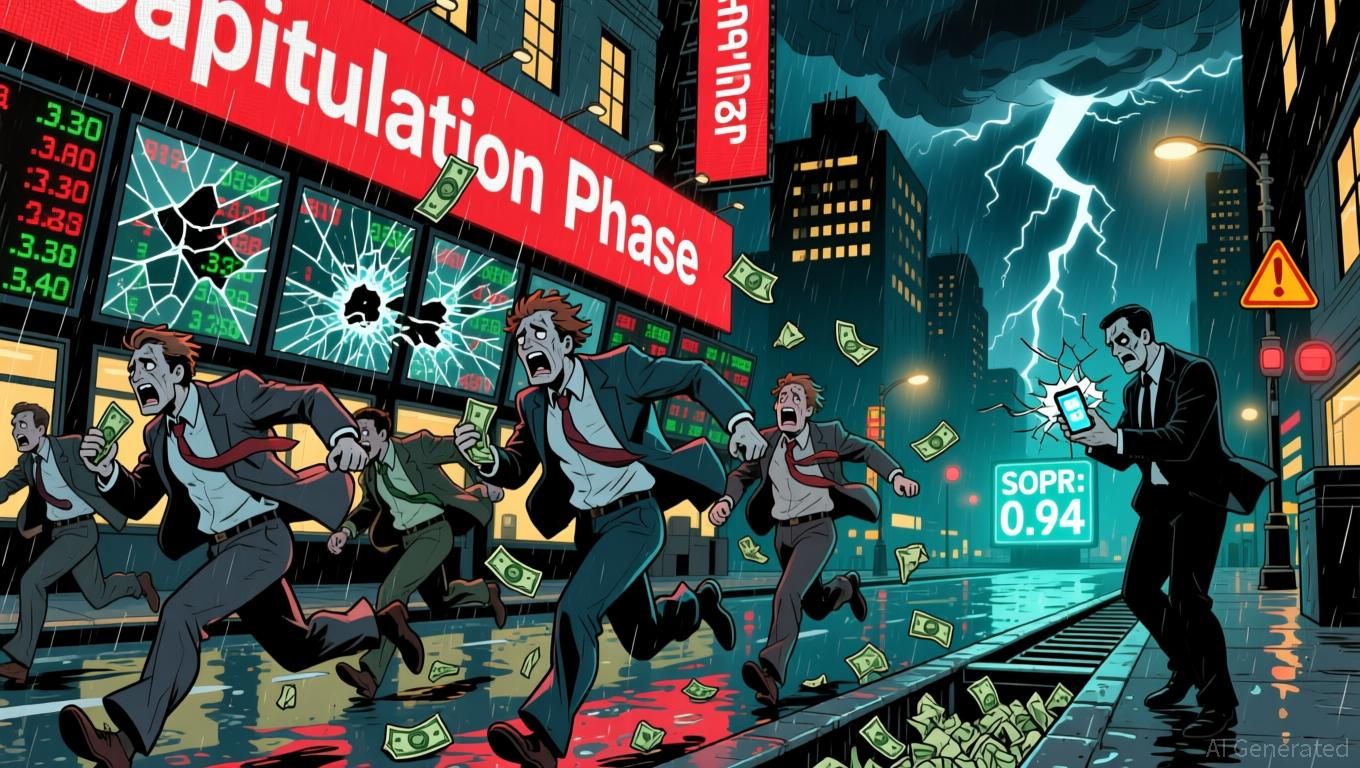

Intense Capitulation Among Bitcoin Short-Term Holders

Recent data reveals that individuals who have held Bitcoin for a short period are undergoing one of the most severe sell-off phases seen in recent years. Over a two-week period, these investors have faced losses ranging from 20% to 25%. This rapid decline, which coincided with Bitcoin’s sharp 22% drop in November to below $85,000, appears to be driven more by panic selling than by calculated decisions. The situation is further complicated by already low market liquidity and a cautious macroeconomic environment.

The Spent Output Profit Ratio (SOPR) for short-term holders has fallen to 0.94—a level that typically signals widespread capitulation among newer market participants. Historically, such readings have preceded periods of stabilization and eventual recovery, although analysts caution that the current market remains fragile.

Shifting Dynamics in the Crypto Market

This wave of capitulation is occurring alongside significant changes in the broader cryptocurrency landscape. In Brazil, for example, stablecoins now account for 90% of crypto trading activity, overtaking Bitcoin as the dominant asset. This shift comes as regulators implement stricter reporting requirements. Globally, central banks have enacted 316 rate cuts over the past two years—the most aggressive monetary easing since the 2008-2010 financial crisis. Despite this, Bitcoin has not responded as expected to increased liquidity, raising questions about its current relationship with monetary policy. In contrast, gold has outperformed Bitcoin by 58% since the introduction of spot Bitcoin ETFs, as institutional investors continue to favor gold’s established market infrastructure.

Signs of Cautious Optimism

There are some encouraging signs for Bitcoin’s future. Open interest in derivatives has dropped sharply, indicating that many leveraged long positions have been liquidated. Additionally, spot Bitcoin ETFs have recently reversed a four-week trend of outflows, attracting $70 million in net inflows over the past week. However, total outflows since January 2024 still amount to $4.35 billion. Some analysts, such as André Dragosch from Bitwise Europe, believe that Bitcoin’s current price does not fully reflect improving macroeconomic conditions and suggest that a relief rally toward $100,000–$110,000 could occur if selling pressure subsides.

Challenges Ahead for Bitcoin

Despite these positive developments, significant risks remain. Diminished liquidity in both cryptocurrency and traditional financial markets has heightened Bitcoin’s volatility, with each wave of selling causing pronounced price drops. Ongoing delays in U.S. Treasury spending and global liquidity constraints continue to weigh on risk assets. Bitcoin’s leveraged nature makes it especially vulnerable to these shocks. While some market observers anticipate a potential rally after a 60-70 day lag, others warn of possible financial turmoil in 2026, citing concerns such as U.S. debt issuance, risks associated with the yen carry trade, and China’s credit market leverage.

Key Levels and Investor Sentiment

Currently, the market is watching to see if Bitcoin can reclaim the $88,000 mark, which would signal a possible local bottom. Stabilizing SOPR readings and declining funding rates suggest that selling pressure may be easing. However, with short-term holders still incurring significant losses and broader economic uncertainties unresolved, a sustained recovery is likely to require both patience and resilience from investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini

AI’s Energy Dilemma: Improved Efficiency Meets Rising Power Demands

- AI is transforming energy operations through predictive maintenance, smart grids, and renewable optimization, but its energy demands strain infrastructure. - Energy firms like Baker Hughes and C3.ai deploy AI to reduce downtime, while platforms autonomously cut building energy waste. - Data centers powering AI drive electricity price spikes (e.g., 13% in Virginia), prompting regulatory scrutiny over tech subsidies and sustainability. - C3.ai faces financial challenges with 20.5% revenue decline expected,

MWXT’s 45% Surge Depends on AI Application Benefits Versus Concerns Over Concentrated Ownership

- MWX Token (MWXT) surged 45.49% weekly, breaking key resistance to $0.2051, driven by renewed investor confidence. - Technical analysis highlights a 4-hour chart triangle breakout, with price consolidating near $0.2049 after rebounding from a 14-day low. - Despite gains, MWXT faces risks from 95.62% token concentration in top 10 wallets and speculative demand, contrasting with broader market volatility.

The ZK Atlas Upgrade: Transforming the Landscape of Web3 Infrastructure?

- ZKsync's 2025 Atlas Upgrade tackles blockchain's scalability trilemma via modular architecture, ZK proofs, and institutional-grade infrastructure. - Technical breakthroughs include 15,000-43,000 TPS speeds, $0.0001/tx costs, and EVM compatibility, attracting Deutsche Bank , Sony , and $300M daily trading volumes. - ZK token surged 50% post-upgrade, with analysts projecting $5.13 valuation due to deflationary tokenomics and 230% developer participation growth. - Institutional adoption spans $1.7B tokenize