Bitcoin Updates: Tether’s Unstable Peg Reveals Underlying Vulnerabilities in the Altcoin Market

- Altcoin Sherpa warns most altcoins may collapse to zero amid S&P's downgrade of Tether's USDT to "weak" due to Bitcoin exposure and opaque reserves. - USDT's 5.4% Bitcoin reserve allocation raises volatility risks, threatening liquidity for altcoins reliant on stablecoin pairs during market downturns. - Bitcoin's 30% drawdown and ETF outflows exacerbate systemic fragility, while Tether's lack of audits contrasts with competitors like USDC's transparent redemptions. - Complex tokenomics in projects like S

Altcoin Market Faces Uncertain Future Amid Stablecoin Concerns

Altcoin Sherpa, a well-known source for cryptocurrency analysis, has recently expressed a pessimistic view regarding the future of alternative cryptocurrencies. According to their assessment, the majority of altcoins are unlikely to revisit their previous record highs and may even lose all value. This outlook comes in the wake of notable events in the stablecoin industry, including a recent downgrade of Tether’s USDT by S&P Global Ratings.

S&P Global Ratings lowered USDT’s rating from “constrained” to “weak,” citing increased exposure to volatile assets such as Bitcoin and a lack of transparency around its reserves. This downgrade highlights the broader risks within the crypto sector, especially since stablecoins like USDT—pegged to the U.S. dollar—play a crucial role in providing liquidity for trading and facilitating cross-chain transactions.

Tether, the company behind USDT, asserts that its tokens are fully backed by assets including U.S. Treasury bills, corporate bonds, and gold. However, S&P analysts Rebecca Mun and Mohamed Damak pointed out that Bitcoin now makes up 5.4% of Tether’s reserves, a rise from 3.6% previously. This increased allocation to Bitcoin exposes USDT to greater price swings, meaning a drop in Bitcoin’s value could weaken Tether’s reserve position and potentially lead to undercollateralization. Although USDT has maintained its dollar peg so far, the downgrade raises questions about its ability to withstand market stress.

The stability of altcoins is closely tied to the reliability of stablecoins like USDT, which are often used as benchmarks for pricing and trading. If confidence in USDT’s stability falters, trading activity and liquidity—especially for smaller altcoins that depend on stablecoin pairs—could be severely impacted. These vulnerabilities are further amplified by broader market trends, such as Bitcoin’s recent decline of over 30% from its October high and significant outflows from Bitcoin ETFs, both of which have dampened overall market sentiment.

Altcoin Sherpa’s research indicates that without strong liquidity and dependable collateral, many altcoins lack the foundation needed to achieve new highs. The situation is made worse by the often opaque tokenomics of certain blockchain projects. For example, Sei Network’s (SEI) token release plan involves a complex vesting schedule for its 10 billion tokens, distributed among investors, team members, and ecosystem reserves. While these structures are designed to encourage long-term involvement, large token unlocks can put downward pressure on prices if not carefully managed. This supports Altcoin Sherpa’s warning that speculative projects with weak utility or governance are especially at risk during market corrections.

Despite these headwinds, Tether continues to defend its practices, highlighting its position as one of the largest holders of U.S. Treasury bills and its efforts to diversify through real-world asset (RWA) initiatives, such as the XAUT gold-backed token, as noted in S&P’s report. Tether’s gold purchases have even surpassed those of some central banks, signaling a move to strengthen its collateral base and align with emerging trends in asset-backed tokens. Nevertheless, S&P emphasizes that transparency remains a major concern, as Tether has yet to undergo a full audit since its inception. This lack of openness stands in contrast to competitors like USDC, which provide instant reserve updates and allow direct redemptions.

With regulatory oversight of stablecoins increasing, Tether’s response to these transparency and risk management issues will be critical. For altcoins, a recovery will depend on greater market stability, improved clarity around collateral, and the development of meaningful use cases beyond speculation. Altcoin Sherpa’s analysis serves as a reminder that in an environment where trust and liquidity are essential, projects without solid foundations may not survive the next downturn.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

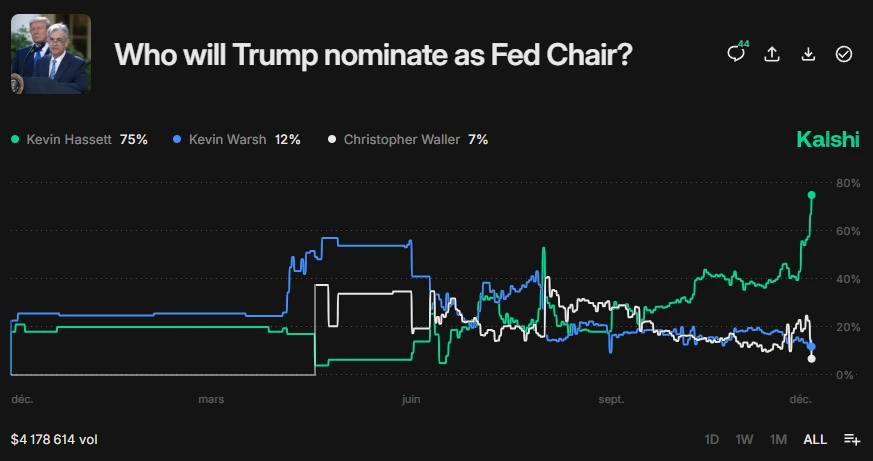

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini