Congressional legislation and changes within corporations are transforming the environment for investors

- U.S. Congress enacted three key bills (S.260, H.R. 998, H.R. 2316), reshaping regulatory and financial frameworks with uncertain long-term impacts. - VSEE Health secured Nasdaq's exception to bypass equity rules, aiming to meet compliance by 2025 with $13.2M in pro forma equity. - Intel Corp. exceeded Q3 2025 EPS and revenue forecasts, showing resilience amid macroeconomic volatility ahead of 2026 earnings. - Scilex Holding faced a 100% downside rating from D. Boral Capital, reflecting analyst concerns o

Key Legislative Changes and Market Updates in the U.S.

Recently, the U.S. Congress enacted three major pieces of legislation—S.260, H.R. 998, and H.R. 2316—ushering in significant changes to the nation’s regulatory and financial landscape. While experts continue to assess the full impact of these new laws, the financial sector has already experienced several noteworthy shifts, as reflected in recent corporate news and market analyses.

VSEE Health Granted Nasdaq Exception

In related news, VSEE Health, Inc. has obtained a vital waiver from Nasdaq, allowing the company to retain its listing status. This exception enables VSEE Health to temporarily bypass certain equity compliance standards, provided it can demonstrate compliance by December 1, 2025. The company’s pro forma financial statements reveal $13.2 million in equity, achieved through the exercise of warrants and the conversion of notes. This move highlights the company’s proactive approach to capital management and the broader challenges businesses encounter in meeting exchange requirements during shifting market conditions.

Intel’s Strong Performance Surpasses Expectations

Looking at the technology sector, Intel Corp. (NASDAQ: INTC) is preparing to announce its next quarterly results on January 29, 2026. The company’s most recent earnings report for Q3 2025 demonstrated notable strength, with earnings per share reaching $0.23—well above the anticipated loss of $0.04—and revenue totaling $13.7 billion, surpassing the forecasted $13.1 billion. These results underscore Intel’s ability to exceed market expectations despite ongoing economic uncertainty. Market analysts are closely monitoring the company for continued growth or potential challenges, particularly in light of global supply chain issues.

Scilex Holding Faces Analyst Downgrade

In the realm of equity research, Scilex Holding (NASDAQ: SCLX) recently experienced a significant downgrade from D. Boral Capital, which set its price target at $0.00 and predicted a complete loss in value over the next year. This adjustment aligns with a broader wave of caution among analysts, as four firms have revised their outlooks for Scilex in the past twelve months. The downgrade reflects persistent concerns regarding the company’s valuation and competitive position, though future developments could prompt a reassessment.

Legislation and Corporate Strategy: An Evolving Relationship

The intersection of new legislative measures and company performance remains a central concern for investors. While the recently passed bills are poised to affect industries such as healthcare, technology, and finance, their ultimate influence will depend on how they are implemented and how markets respond. Companies like VSEE Health, Intel, and Scilex exemplify the ways in which businesses are adapting to both regulatory changes and evolving market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

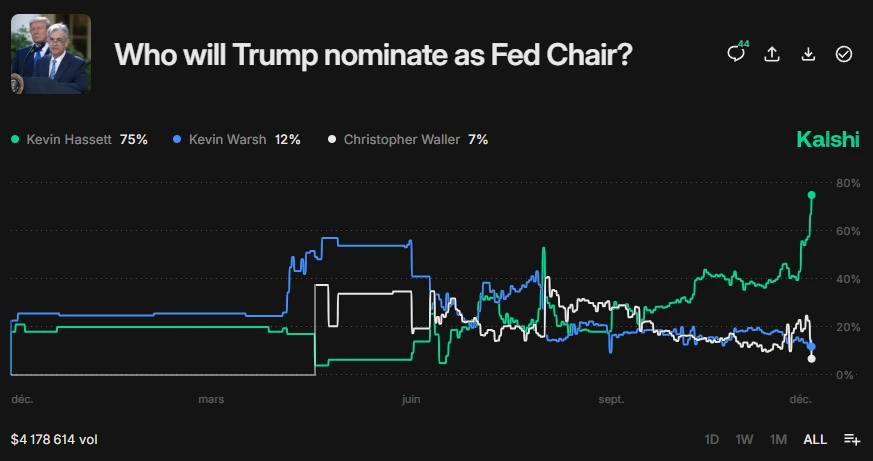

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini