Goldman Buys Leading ETF Innovator to Capitalize on Growth in Active Investing

- Goldman Sachs acquires Innovator Capital Management for $2 billion in cash and equity, expanding its active ETF portfolio with $28 billion in assets under supervision. - The deal strengthens Goldman's position in structured ETFs, a 66% CAGR niche market offering downside protection and yield enhancement strategies since 2020. - Innovator's leadership in defined-outcome ETFs aligns with Goldman's strategy to capitalize on shifting investor demand for active management amid tighter monetary policy. - The a

Goldman Sachs to Acquire Innovator Capital Management in $2 Billion Deal

Goldman Sachs Group Inc. has announced plans to purchase Innovator Capital Management, a leader in the defined-outcome exchange-traded funds (ETF) space, for $2 billion through a combination of cash and stock. This move marks a significant step for Goldman as it seeks to strengthen its presence in one of the asset management industry's most rapidly expanding areas.

The transaction, anticipated to close by the second quarter of 2026, will see Goldman Sachs Asset Management's ETF portfolio grow by 159 funds and $28 billion in assets under supervision. This acquisition will substantially expand Goldman's active ETF lineup and further solidify its standing in a sector that has experienced a 47% compound annual growth rate since 2020.

Defined-outcome ETFs, which utilize options and derivatives to help investors achieve specific goals such as downside protection or enhanced yield, have gained considerable traction as more investors look for customized risk management tools. Since its founding in 2017 by Bruce Bond and John Southard, Innovator has become the second-largest provider in this niche, just behind First Trust. The company's $28 billion in assets highlights its leadership in a market segment that has grown at a 66% annual rate, fueled by investors seeking alternatives to traditional bonds and strategies to manage market volatility.

David Solomon, CEO of Goldman Sachs, emphasized that this acquisition fits squarely within the firm's broader strategy to innovate in the active ETF space. He described the defined-outcome ETF category as dynamic and transformative, noting its rapid growth within public markets. The deal also addresses a gap in Goldman's ETF offerings, as its own buffer ETFs—launched earlier this year—have so far attracted only $36 million in assets. By bringing Innovator's established platform into the fold, Goldman aims to leverage its proven track record and extensive advisor network to provide clients with greater access to structured investment solutions.

This acquisition reflects a wider industry trend, as investors increasingly turn away from passive investment approaches in response to tighter monetary policy. Active ETFs, which had lost momentum during periods of low interest rates, are now regaining popularity as market conditions call for more hands-on portfolio management. Innovator's expertise in defined-outcome products positions Goldman to benefit from this shift, especially as structured products have already attracted $11.4 billion in net inflows this year.

Despite the growing demand, some critics remain cautious about the complexity and returns of buffer funds. Hedge funds such as AQR have argued that these products may underperform compared to simpler investment options, and regulators have increased scrutiny of their risk characteristics. Nevertheless, investor interest remains strong, with Innovator capturing $4.1 billion of the $11.4 billion invested in structured outcome products in 2025 alone.

This acquisition is also in line with Goldman's broader asset management ambitions, which include a $1 billion investment in T. Rowe Price and the recent purchase of venture capital firm Industry Ventures. These moves highlight Goldman's commitment to building more resilient revenue streams through wealth management and alternative investments, signaling a shift away from its traditional focus on consumer banking.

Following the deal, Innovator's team of 60 employees will join Goldman's asset management division, bringing with them extensive experience in ETF innovation. Key leaders, including Co-Founder Bruce Bond and President John Southard, will remain in their roles to ensure ongoing product development and distribution continuity.

As the integration unfolds, industry observers will be watching closely to see how Goldman incorporates Innovator's strategies into its broader offerings. The ultimate success of the acquisition will depend on Goldman's ability to scale its structured ETF business while addressing ongoing concerns about product complexity and performance—challenges that will shape the future of this fast-growing market segment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

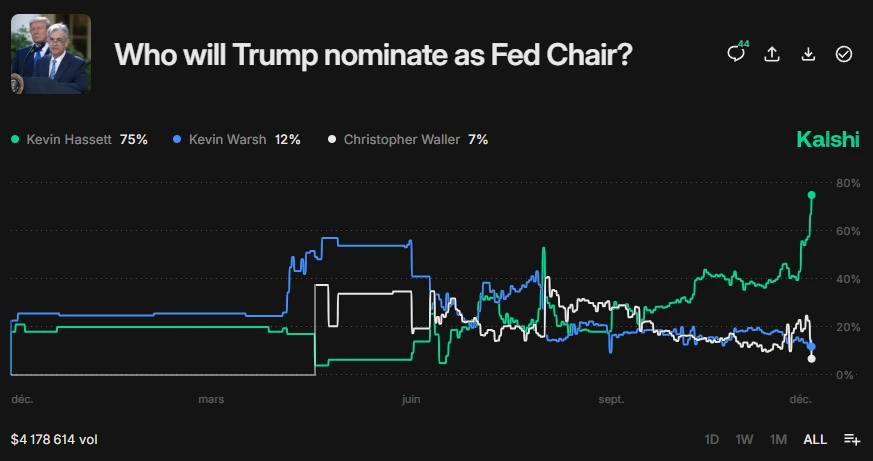

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini