DASH dropped by 11.29% over the past 24 hours as technical analysis points to increased volatility and uncertain predictions

- DASH fell 11.29% in 24 hours on Dec 1, 2025, to $47.27, with 32.39% weekly losses but 24.95% annual gains. - Analysts project wide 2025-2028 price ranges ($18.30-$162.73), reflecting high market uncertainty and mixed bearish/bullish potential. - RSI (54.53) suggests bullish momentum, but price fell below key $55.89 resistance, creating conflicting short-term signals. - MACD and moving averages indicate retained long-term investor confidence despite volatility, with traders monitoring key levels.

DASH Experiences Significant Price Fluctuations

On December 1, 2025, DASH saw its value decrease by 11.29% in just one day, settling at $47.27. Over the previous seven days, the cryptocurrency dropped by 32.39%, and its monthly decline matched the 11.29% daily fall. However, despite these recent setbacks, DASH remains 24.95% higher than it was a year ago, reflecting a blend of long-term growth and short-term instability.

Forecasts for DASH Prices Through 2028

Valdrin Tahiri’s latest technical analysis highlights a wide range of possible price outcomes for DASH in the coming years. For 2025, predictions span from a low of $18.30 to a high of $122.26, with an average estimate of $30.68. This broad range underscores the uncertainty and volatility expected in the market, with potential for both upward and downward movements.

Looking ahead, analysts anticipate a gradual increase in projected price ranges. In 2026, forecasts suggest values between $20.13 and $134.48, averaging $33.75. By 2027, the expected minimum rises to $22.15, with an average of $37.12 and a potential peak at $147.93. For 2028, projections indicate a minimum of $24.36, an average of $40.84, and a maximum reaching $162.73.

Short-Term Technical Signals Show Mixed Outlook

Traders continue to rely on technical indicators such as the Relative Strength Index (RSI) and chart patterns to interpret market trends. Currently, DASH’s RSI stands at 54.53, which is above the neutral threshold of 50, pointing to ongoing bullish momentum. This suggests that buyers are maintaining some control, even though the price recently slipped below a significant resistance level at $55.89. This decline could indicate a brief bearish phase, but the overall upward trajectory since early 2025 remains unbroken.

Chart analysis is also being used to identify potential trend reversals or continuations. Market participants are closely watching horizontal support and resistance zones for clues about future price direction. The recent move below $55.89 is interpreted by some as a possible opportunity for a rebound, while others see it as a sign of further downside risk.

Trading Tools Offer Additional Perspective

Other indicators, including the MACD and various moving averages, are helping traders evaluate the broader market trend. These tools are essential for distinguishing between short-lived price swings and deeper shifts in sentiment. Since the beginning of the year, DASH has climbed 51.34%, signaling that, despite recent volatility, investor optimism persists.

As market conditions shift, traders are expected to monitor key price levels and momentum indicators closely to guide their decisions. The interplay between strong RSI values and bearish moves below resistance levels creates a complex and nuanced short-term outlook for DASH.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

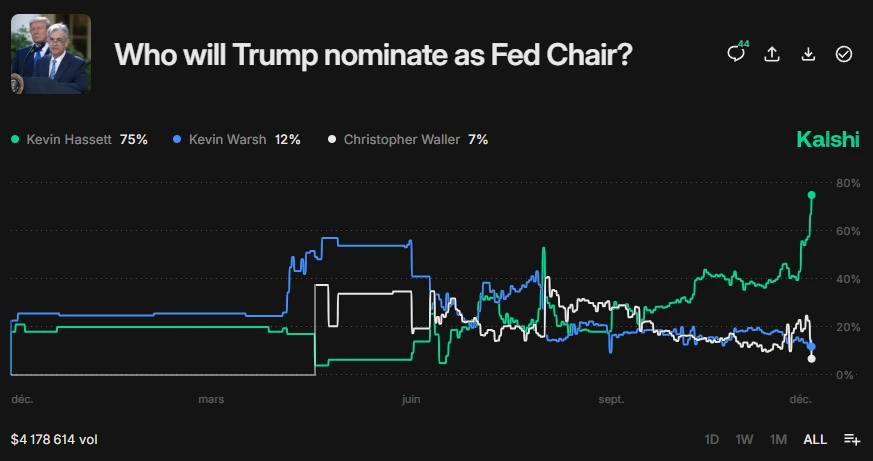

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini