Are Big Changes in Store for the Bitcoin Price?

Bitcoin’s recent price action hints that a potential turning point may be underway. After several weeks of steady decline, BTC price has started to rebound from its recent lows, supported by shifting macroeconomic signals that could reshape the landscape for risk assets. The daily chart shows a subtle but promising recovery that could gain strength if the broader financial narrative—centered around U.S. interest rates—tilts in Bitcoin’s favor.

Is Bitcoin’s Reversal Already Underway?

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

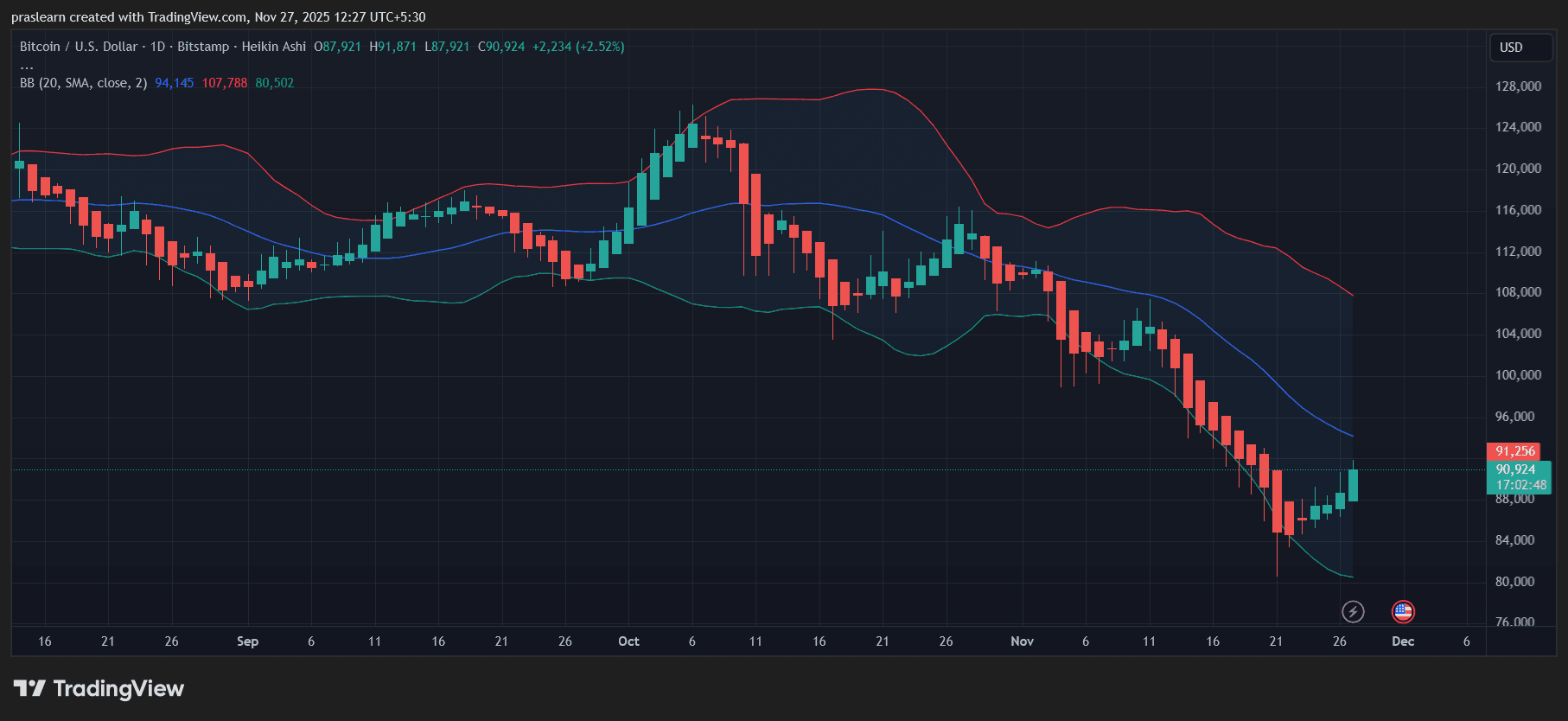

The chart tells a story of exhaustion among sellers. After sliding below $85,000 earlier this month, Bitcoin found support near the lower Bollinger Band, an area that often signals oversold conditions. Over the past few sessions, the Heikin Ashi candles have turned green again, and BTC price has pushed back toward the midline of the Bollinger Bands—around $94,000. This mid-band, a 20-day moving average, acts as the next key resistance zone. A decisive close above it could confirm the start of a short-term uptrend.

Momentum indicators (not shown here) likely reflect this recovery, with early bullish divergence forming as price makes higher lows while selling pressure weakens. In simpler terms, Bitcoin seems to be building a base, and traders are beginning to test the waters again.

Why the Fed Story Matters for Bitcoin Price Prediction?

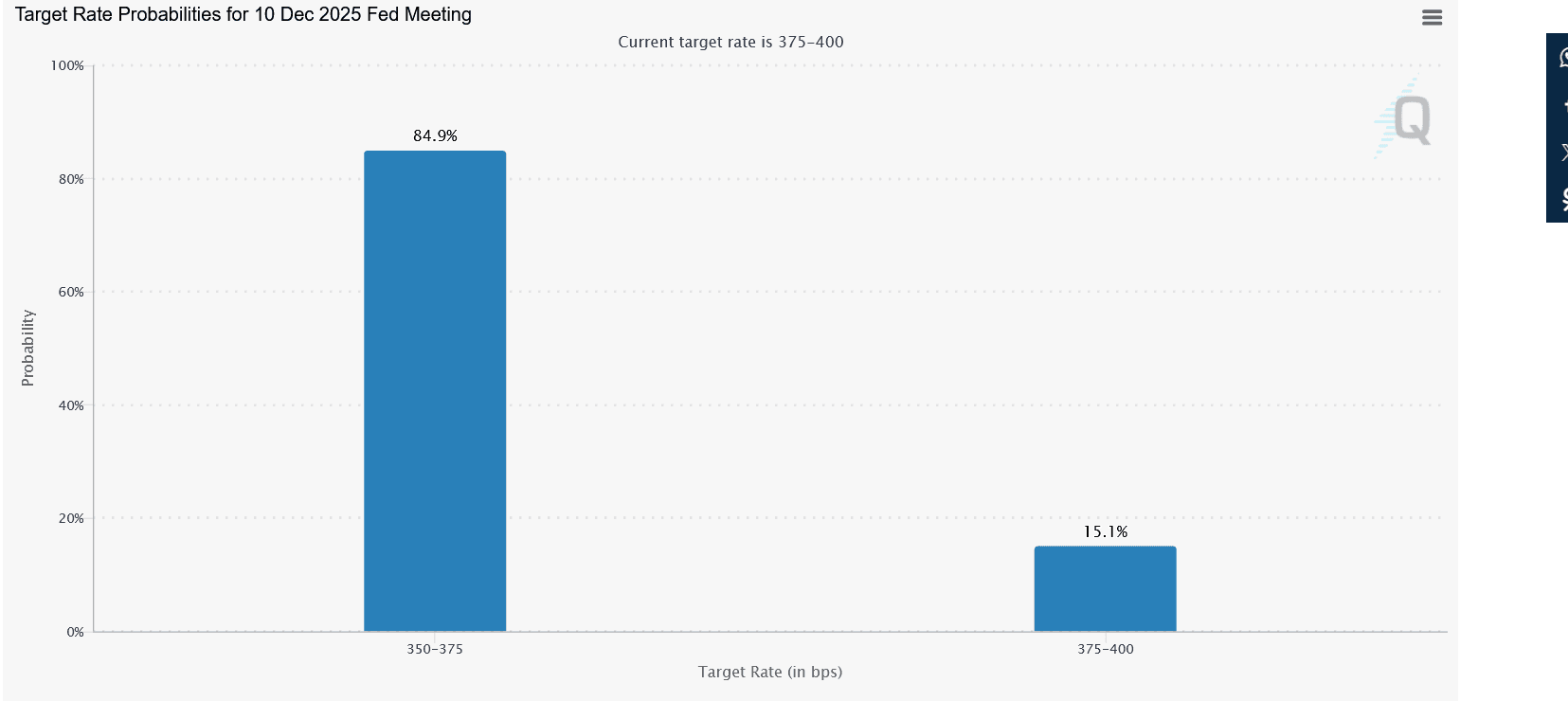

The macro environment could accelerate this shift. With Jerome Powell’s term as Federal Reserve Chair set to expire in May, reports that former Trump advisor Kevin Hassett may replace him have sparked fresh debate on future monetary policy. Hassett’s history of advocating for aggressive rate cuts suggests a more dovish Fed under his leadership—exactly the kind of environment that historically benefits Bitcoin.

Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin. They also weaken the dollar and often trigger inflows into risk assets. If the market starts pricing in deeper cuts ahead of schedule, BTC could see renewed speculative momentum, particularly if U.S. inflation continues to cool as Hassett predicts.

Bitcoin Price Prediction: Key Levels to Watch

From a technical standpoint, Bitcoin price now trades around $90,900 , with short-term resistance at $94,000–$95,000, the midpoint of the Bollinger Bands. A breakout above this zone could open the path toward the $100,000–$104,000 region, aligning with the upper band. However, if BTC fails to sustain above the midline and faces rejection, the $88,000 and $84,000 levels could again come into play as support zones.

The tightening of the Bollinger Bands also suggests volatility is about to return. Historically, such compressions precede strong directional moves—either explosive rallies or sharp reversals. Given the macro backdrop and the current bullish momentum, the odds slightly favor an upward breakout, though confirmation is still pending.

Bitcoin Price Prediction: What Traders Should Expect Next

The next few weeks will likely be decisive. If Bitcoin maintains its climb above $91,000 and closes multiple sessions above the 20-day average, it could attract technical buyers and trigger short covering. Combine that with dovish Fed speculation, and BTC might regain the $100,000 threshold faster than many expect.

On the other hand, uncertainty around Fed leadership, potential Senate confirmation hurdles, or renewed inflation fears could delay this breakout and keep Bitcoin range-bound into December.

$Bitcoin’s structure is improving, and the narrative is shifting in its favor. The market seems to be quietly positioning for a macro-driven breakout, but confirmation requires sustained follow-through. The mix of a recovering chart, contracting volatility, and political pressure for lower interest rates could create the perfect setup for $BTC next big move.

In short, the question isn’t whether big changes are coming—it’s when they’ll unfold.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.