The Zcash ETF Nobody Asked For: Why Critics Fear a Wall Street Takeover

Grayscale’s decision to convert its Zcash Trust into an ETF has ignited one of the most polarizing debates in the privacy-coin ecosystem. For Zcash advocates and decentralization purists, the move represents something far more consequential than a new investment product. To them, it signals a potential takeover of a privacy-focused cryptocurrency by the very institutions

Grayscale’s decision to convert its Zcash Trust into an ETF has ignited one of the most polarizing debates in the privacy-coin ecosystem.

For Zcash advocates and decentralization purists, the move represents something far more consequential than a new investment product. To them, it signals a potential takeover of a privacy-focused cryptocurrency by the very institutions it was designed to avoid.

A Privacy Coin in an ETF? Critics Say It Breaks the Mission

The filing, submitted on November 26, 2025, seeks to transform a trust holding over 394,000 ZEC, valued at roughly $197 million, into a fully regulated exchange-traded fund (ETF).

$ZEC is Encrypted Electronic Cash 🛡️ $ZEC helps make private, on-chain transactions possible.Grayscale Zcash Trust (Ticker: $ZCSH) is the only U.S publicly listed fund providing exposure solely to $ZEC through certain brokerage accounts.See important… pic.twitter.com/b29J7CE0iO

— Grayscale (@Grayscale) November 26, 2025

Eric Van Tassel, a user on X (Twitter), argues that a ZEC ETF is fundamentally incompatible with Zcash’s purpose.

“I hope ZEC never gets one, as once that happens, an asset is no longer decentralized,”Eric said, calling ETFs “a Trojan horse.”

Eric’s critique is not about ETFs as financial instruments; it is about the control structures they create. Unlike spot trading on crypto exchanges, ETFs concentrate influence among Wall Street firms that make trading, market-making, and custodial decisions.

For a privacy coin, that concentration is existential.

“An ETF effectively means that an asset value will be highly influenced and controlled by Wall Street,” Eric warned.

SEC filings show the Grayscale Zcash Trust controls about 2.4% of ZEC’s circulating supply, already giving the asset one of the highest institutional concentrations among privacy coins. Converting the trust to an ETF would further expand its influence.

The crypto industry has already seen the downside. When the Grayscale Bitcoin Trust (GBTC) converted to an ETF in January 2024, redemptions created intense sell-side pressure. The general sentiment is that a similar redemption wave could hit Zcash.

Data reinforces this concern, showing markets still remember the days when GBTC outflows repeatedly pushed Bitcoin lower. Eric argues those dynamics are no accident.

“The recent dump was influenced by these giant institutions that now control many of these assets… Their ultimate goal is to either destroy crypto or completely control it as a part of their CBDC agenda,” he added.

Meanwhile, the Grayscale Zcash Trust is already flashing warning signs.

- NAV/Share: $42.59

- Market Price: $35.05

- Discount: approximately 18%

Such a steep discount shows shareholders may be anticipating further price pressure, or at least are unwilling to pay full value for assets that may soon face ETF-linked selling pressure.

The trust currently manages $205.7 million, charges a 2.5% expense ratio, and has 4.83 million shares outstanding. High fees and regulatory ambiguity may explain why investors expect turbulence ahead.

Why Zcash Has Outperformed, And Why That Might End

Despite regulatory headwinds, ZEC has significantly outperformed several major altcoins in recent months. Critics argue this is precisely because it is not yet under ETF control, leaving its price action more organic and less susceptible to institutional flows.

“The fact that Zcash does not currently have an ETF might be a good reason why Zcash has been moving so well,” Erin noted.

He even speculates that Bitcoin’s ETF-driven structure has capped its upside:

“I see $140,000 to $150,000 max out of Bitcoin this cycle… Money will roll into the assets that these ETFs don’t control,” he indicated.

The SEC, not the Electric Coin Company (which develops Zcash), will determine the fate of the Zcash ETF. If approved, it would mark the first-ever ETF tied to a major privacy coin, potentially rewriting the regulatory path for similar assets.

But the implications go beyond policy. Zcash was built for financial privacy amid a surveillance era.

The question now is whether that mission can withstand the gravitational pull of Wall Street, or whether, as critics warn, an ETF would transform ZEC from a decentralized, privacy-focused tool into a tightly managed institutional asset.

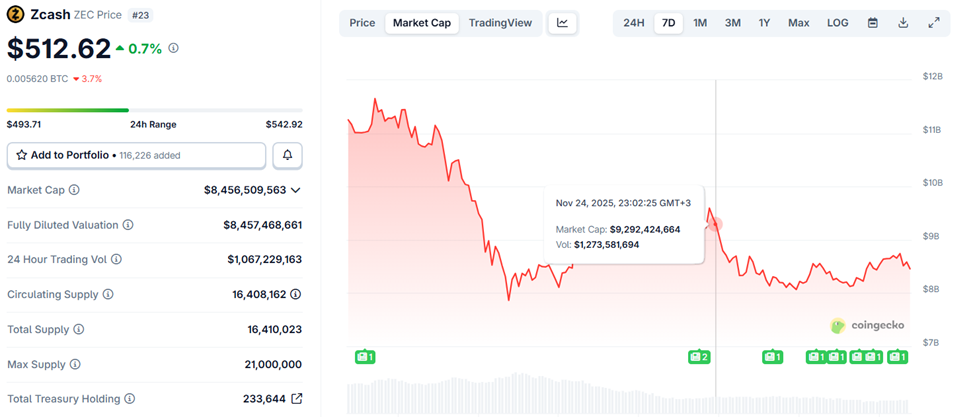

Zcash (ZEC) Price Performance. Source:

CoinGecko

Zcash (ZEC) Price Performance. Source:

CoinGecko

Perhaps, these fears explain why Zcash’s ZEC token is only up by a modest 0.7% in the last 24 hours despite Grayscale’s expressed interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Has Bitcoin's Drop to $87K Signaled a Temporary Pullback or the Onset of a More Significant Decline?

- Bitcoin fell below $87,000 amid ETF outflows, whale selling, and macroeconomic pressures, marking its largest correction since spot ETFs launched. - Institutional withdrawals, including $151M in ETF outflows and BlackRock's $2.47B IBIT losses, reflect waning confidence and profit-taking amid tightening monetary policies. - On-chain data shows mixed signals: mid-sized wallets accumulate Bitcoin while whales offload, while regulatory uncertainties in the U.S. and EU amplify selling pressure. - Technical in

Stellar News Update: Technology-Fueled Commodity Markets Grow Through Stellar and Abaxx Collaboration

- Stellar Trading Systems partners with Abaxx Exchange to expand global commodity trading access via Singapore-based USD gold futures. - Intralot S.A. reports EUR 548M revenue in Q3 2025 but faces UK 40% remote gaming tax hike threatening pro forma EUR 1B revenue goals. - Strive Asset Management and Polymarket advance crypto adoption through institutional BTC treasury models and CFTC-approved prediction markets. - Market developments highlight evolving interplay between digitized commodity infrastructure a

Bitcoin News Update: Bitcoin's Value Drops in Parallel with Declining Political Clout of Trump

- Bitcoin maintains market dominance with Altcoin Season Index at 24, indicating most altcoins lag behind. - Bitcoin’s price decline correlates with waning Trump support, as highlighted by economist Paul Krugman. - BlackRock’s IBIT ETF sees $3.2B unrealized gains as Bitcoin rebounds to $90,000. - Technical indicators show mixed near-term prospects, while a few altcoins like Aster surged over 1,200%. - Analysts suggest regulatory clarity or tech breakthroughs could trigger next altcoin season after prolonge

XRP News Today: Is the $2.25 Barrier for XRP the Gateway to a Bullish Surge or a Signal for a Bearish Turn?

- XRP stabilized near $2.226 support, showing ETF-driven demand and improved technical indicators amid market rotation. - A $2.25 breakout is critical for confirming an upward trend, with failure risking a retest of $2.15 support. - Broader crypto-USD rotation and Bitcoin halving anticipation create favorable conditions but remain sensitive to equity market shifts. - Traders must monitor $2.25 resistance and maintain tight risk management as ETF inflows and macroeconomic factors shape near-term volatility.