Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.

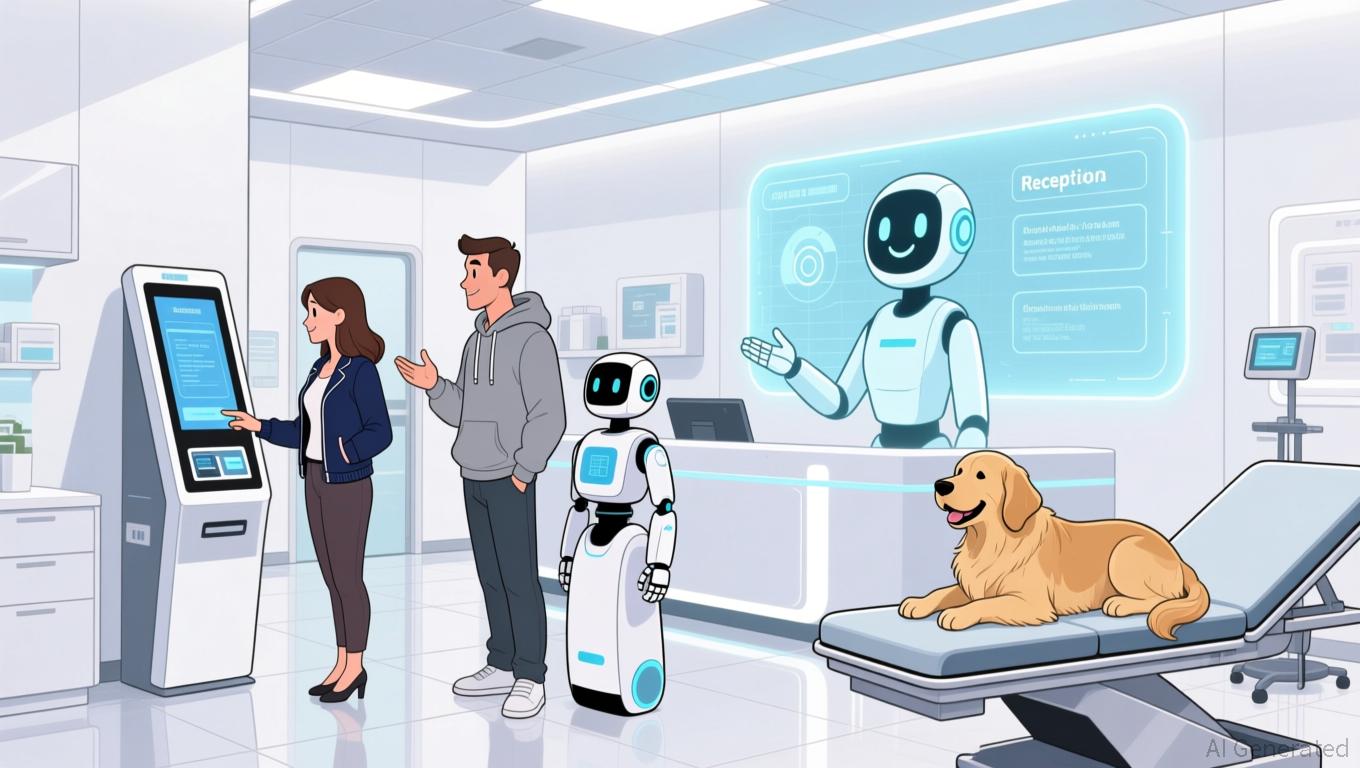

Nexton Solutions, an emerging name in veterinary technology, has raised $4 million in strategic funding, representing a significant milestone in its quest to transform how veterinary practices attract new clients. Its main offering, PetVivo.ai,

The veterinary sector’s dependence on outdated marketing channels—like television commercials and direct mail—has left a gap in addressing the needs of Gen Z and Millennial pet owners, who expect seamless digital interactions

The potential market is enormous: PetVivo.ai is targeting 30,000 veterinary clinics in the U.S. and over 100,000 worldwide.

At the same time, the broader AI landscape is seeing strategic collaborations that could further accelerate such advancements.

For Nexton Solutions, the $4 million investment signals strong investor belief in its capacity to connect traditional veterinary practices with modern digital solutions. With a 14-day complimentary trial and three subscription options, the platform’s official rollout is set to drive rapid uptake. As the company pivots from medical devices to SaaS, its valuation could follow the rapid growth trajectory seen in enterprise AI, where

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti

XRP News Update: XRP ETFs Spark Optimism—Is $1,115 Within Reach?

- XRP's price surge to $2.20 is driven by ETF launches, with $422M inflows from Franklin Templeton and Grayscale. - Technical indicators suggest a potential $2.50+ rally if support at $1.84 holds, with long-term forecasts reaching $26.50 by 2030. - Institutional adoption of Ripple's ODL and Ripple USD's $1B+ market cap highlight growing utility beyond remittances. - Regulatory clarity post-SEC ruling and macroeconomic factors remain critical for XRP's $1,115 potential in ultra-bullish scenarios.