The Underlying Cause of the Latest BTC Plunge: Changes in Regulations or Shifting Market Mood?

- The 2025 Bitcoin crash erased $1 trillion in value, driven by global regulatory fragmentation, geopolitical risks, and institutional caution. - Divergent policies (U.S. deregulation vs. EU MiCA) and geopolitical tensions increased compliance costs, destabilizing cross-border crypto operations. - Institutional investors adopted cautious financing while selectively buying undervalued assets, exposing market duality between short-term panic and long-term optimism. - Regulatory uncertainty amplified market s

Regulatory Shifts: An Inconsistent Global Approach

The 2025 Bitcoin downturn occurred amid a patchwork of regulatory approaches across the globe.

Geopolitical Risks: Division and Rising Costs

Geopolitical strife further aggravated the situation. While no single incident directly caused the crash, the uneven enforcement of Bitcoin regulations across different areas increased operational hazards. For instance,

In this way, geopolitical dynamics magnified the effects of regulatory changes. As nations focused on their own economic interests, the absence of a unified system forced investors to navigate a complex web of compliance obstacles.

Institutional Investor Behavior: Prudence and Targeted Optimism

Institutions, often viewed as stabilizing forces during market turmoil, took a two-pronged approach during the 2025 crisis. On one side,

Significantly,

Market Sentiment: A Cycle of Self-Reinforcement?

The interaction between regulatory doubts and institutional strategies created a reinforcing cycle. As

Yet, the crash also highlighted the persistence of long-term investors.

Conclusion: Multiple Forces at Play

No single factor can fully explain the 2025 Bitcoin crash. Regulatory changes and geopolitical divisions undermined market stability, while institutional responses—from conservative financing to selective investment—intensified the decline. Still, the evidence points to regulatory unpredictability as a key driver of market mood. As policymakers continue to adjust their approaches, the road to recovery will hinge on finding the right balance between fostering innovation and ensuring stability.

At present, investors must contend with a landscape shaped by both geopolitical uncertainty and institutional restraint, which will continue to influence Bitcoin’s volatility going forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

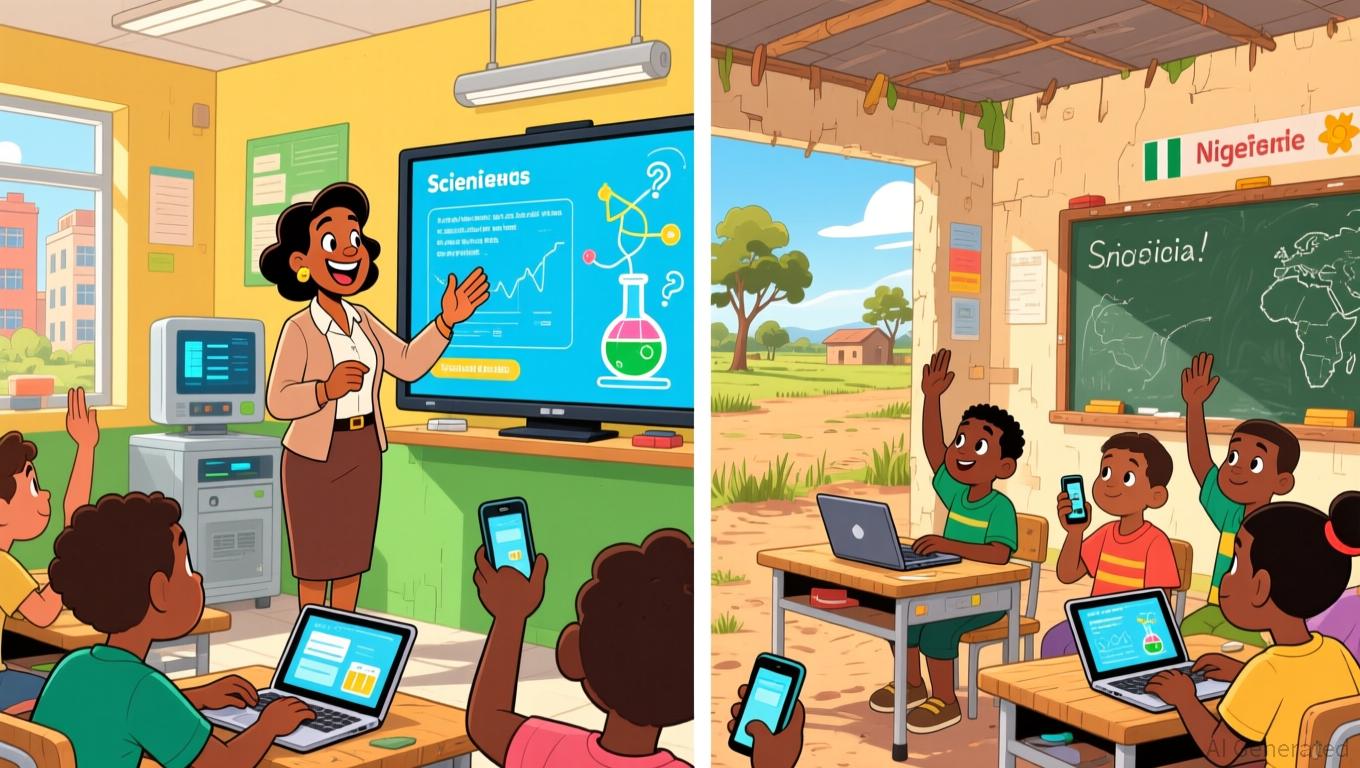

Nigeria's Inspire Live(s) Strives to Guarantee Every Student Across the Country Receives Equal Opportunities

- Nigeria's Federal Government launched Inspire Live(s), a digital learning initiative to expand equitable education access via live online classes. - The program, delivered through Cisco Webex by certified teachers, targets JSS/SSS students with subjects like math, science, and economics. - Part of President Tinubu's "Renewed Hope Agenda," it aims to address teacher shortages and infrastructure gaps but faces rural connectivity challenges. - Implementation includes daily 8:00 a.m.-2:30 p.m. classes, with

Texas Law Paves Way For Official Bitcoin Reserve

Pi Network (PI) Approaches Key Resistance – Is a Breakout on Horizon?

Europe Faces a Pivotal Moment in AI: Embrace Change or Trail Behind the US?

- The IMF outlines a strategic roadmap for Europe to harness AI's transformative power, aiming to boost productivity and economic growth through structural reforms. - AI could yield 1.1% cumulative productivity gains over five years, but disparities risk widening gaps unless adoption becomes more affordable and accessible. - Key recommendations include deepening the EU single market, strengthening financial markets, and aligning energy policies with green transition goals. - Long-term AI adoption could dri