JPMorgan applies to the US SEC for a Bitcoin structured note product

Jinse Finance reported that JPMorgan has applied to the U.S. Securities and Exchange Commission (SEC) to launch a leveraged structured note product, allowing investors to bet on the future price of bitcoin through the BlackRock iShares Bitcoin Trust exchange-traded fund. According to the prospectus, this product features a special mechanism: if the bitcoin ETF price is equal to or higher than the set price on December 21, 2026, JPMorgan will redeem the notes, with each note (face value $1,000) paying at least $160. If the price is below this threshold, the notes will continue to be held until 2028. In the latter case, investors can obtain 1.5 times the gains of bitcoin, and JPMorgan states that the potential return is "uncapped." However, this product carries high risk; if the price of bitcoin drops by 40% or more, investors will lose most of their initial investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Merlin Chain is about to undergo a mainnet upgrade, with an expected downtime of 12 hours.

Bitwise announces Dogecoin ETF details, initial DOGE holdings around 16.429 million, management fee rate at 0.34%

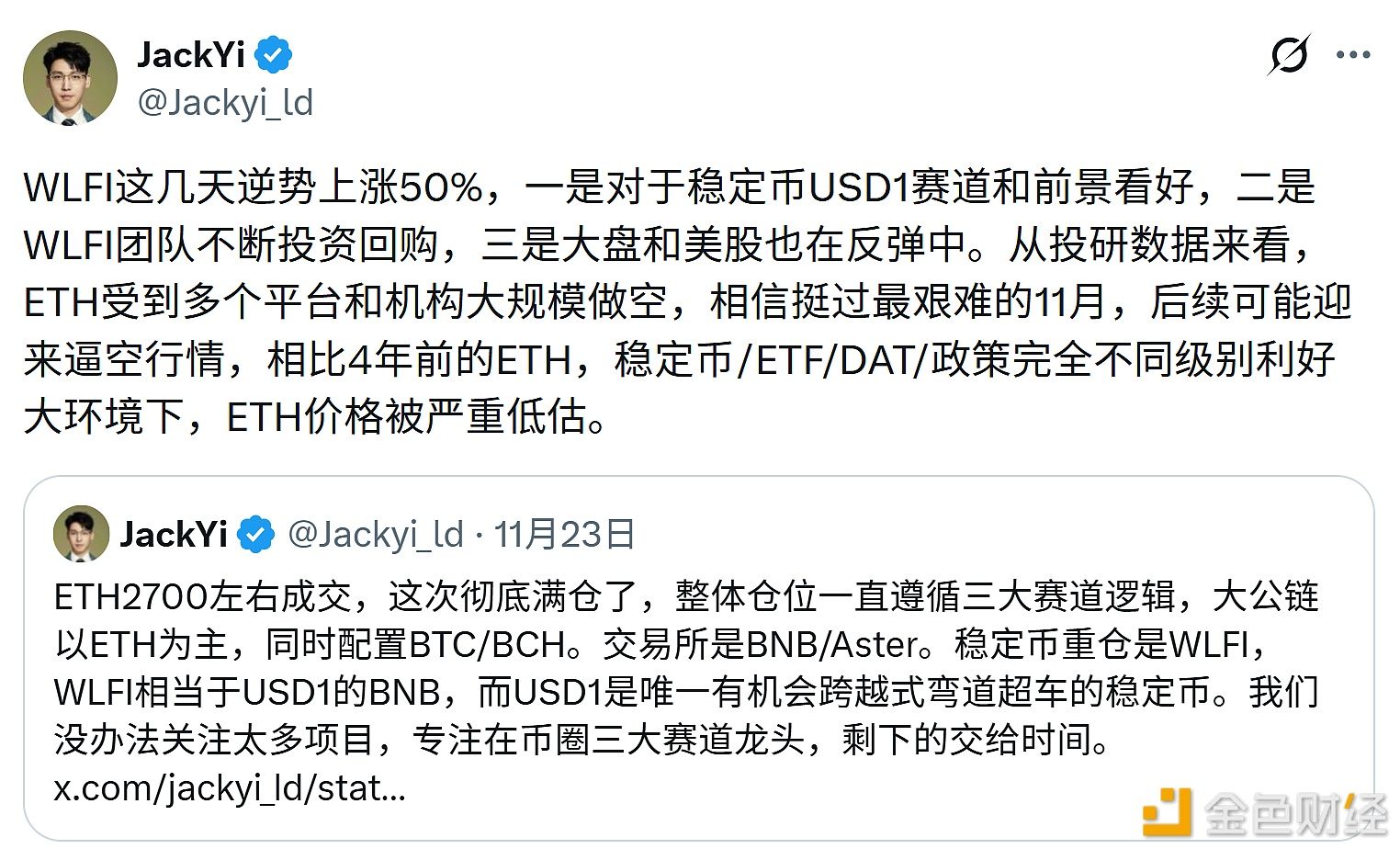

JackYi: ETH may experience a short squeeze rally after November

WLFI spent 7.79 million USD on-chain to buy back approximately 46.56 million WLFI tokens.