Date: Tue, Nov 25, 2025 | 05:10 PM GMT

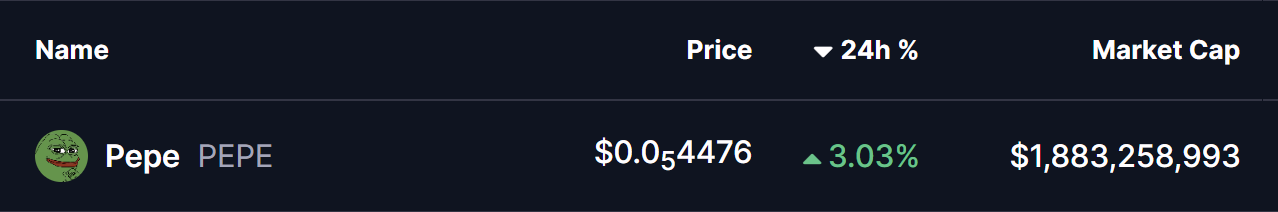

The cryptocurrency market is attempting a recovery after last week’s sharp volatility, which dragged Ethereum (ETH) to a low of $2,622 before rebounding back above $2,900. This broader bounce has brought major memecoins back into mild green territory — including Pepe (PEPE), which is now stabilizing at a critical support level.

PEPE is showing modest gains today, but more importantly, its latest price structure suggests that the token may be preparing for a significant directional shift if its primary support continues to hold firm.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Channel in Play

As shown in the daily chart, PEPE has been consolidating inside a descending channel — a classic bullish reversal pattern often seen during extended corrective phases. Such structures typically signal compressing volatility, setting the stage for a potential trend reversal once buyers regain control.

Recently, PEPE’s decline brought the price down toward the channel’s lower boundary near $0.0000040, a level that has repeatedly acted as a strong demand zone. This region has held once again, triggering a small rebound as PEPE attempts to reclaim momentum.

Pepe (PEPE) Daily Chart/Coinsprobe (Source: Tradingview)

Pepe (PEPE) Daily Chart/Coinsprobe (Source: Tradingview)

Interestingly, the last time PEPE reclaimed the 50-day moving average (50 MA) after stabilizing near its lower channel support — back in July — it exploded with a 72% rally. The current setup shows PEPE trading just below both the descending trendline and the 50 MA, hinting that a similar reaction could occur if buyers confirm strength.

What’s Next for PEPE?

If PEPE successfully sustains above the lower support of the channel and manages to break through the descending trendline, a reclaim of the 50 MA at $0.00000560 could act as a catalyst for renewed bullish momentum. In such a scenario, PEPE may climb toward the upper channel resistance around $0.00000850, opening the door to a possible breakout in the sessions ahead.

However, if bears regain control and price slips below the $0.0000040 support area, the structure may be invalidated. A breakdown from this zone would increase the probability of deeper declines heading into early 2026, signaling continuation of the broader downtrend.

For now, traders will closely watch the interaction with the channel boundaries and moving averages — as the next move from here could decide PEPE’s short-term direction.