Is This the Next Big Crypto Shift? Quantum Tokens Hit $9 Billion

The quantum-resistant crypto sector now exceeds $9 billion in market capitalization, seeing daily trading volumes above $1.5 billion. Investor focus on specialized blockchain projects has surged after Vitalik Buterin, Ethereum’s co-founder, warned about the threats posed by quantum computing that could compromise current cryptographic security. Market Data Reveals Growing Quantum-Resistant Sector Analysts expect quantum resistance

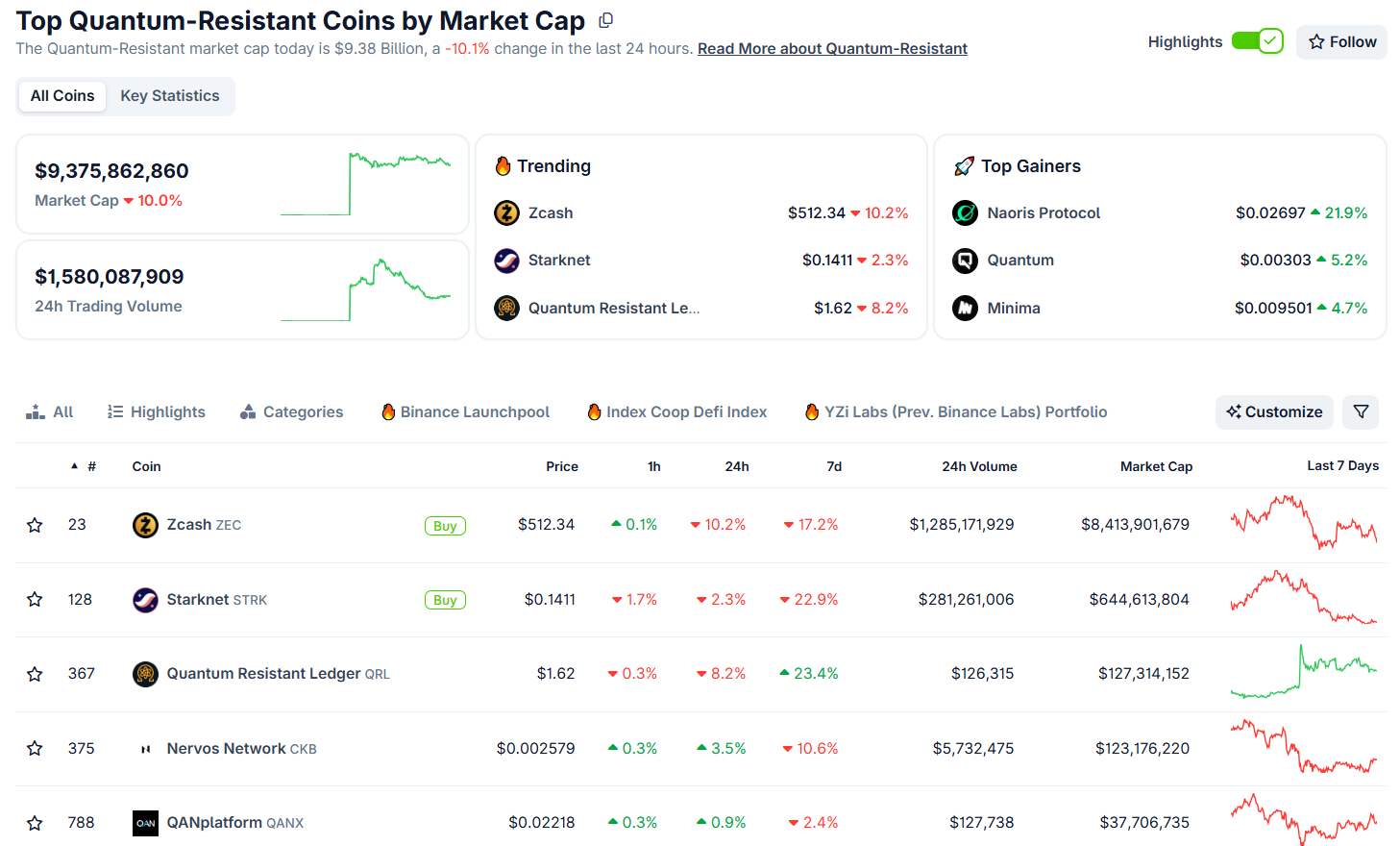

The quantum-resistant crypto sector now exceeds $9 billion in market capitalization, seeing daily trading volumes above $1.5 billion.

Investor focus on specialized blockchain projects has surged after Vitalik Buterin, Ethereum’s co-founder, warned about the threats posed by quantum computing that could compromise current cryptographic security.

Market Data Reveals Growing Quantum-Resistant Sector

Analysts expect quantum resistance to become a key theme by 2026, due to both technological urgency and investor sentiment.

Major projects, including Zcash, Starknet, Nervos Network, Quantum Resistant Ledger, and Abelian, are attracting attention from those seeking protection against future quantum vulnerabilities.

According to CoinGecko data, quantum-resistant tokens reached a market capitalization of $9.37 billion on November 25, 2025, despite a 10% drop over the previous 24 hours. The daily trading volume reached $1.58 billion, indicating strong activity and liquidity.

Quantum Resistant Tokens Market Cap. Source:

CoinGecko

Quantum Resistant Tokens Market Cap. Source:

CoinGecko

These projects stand out with the use of post-quantum cryptographic techniques. Hash-based and lattice-based algorithms are at the heart of these architectures, offering resistance against quantum attacks.

In contrast to blockchains that use elliptic curve cryptography, quantum-resistant tokens employ alternative methods validated by institutions like the National Institute of Standards and Technology.

Zcash leads the sector, trading at $512.34 despite a 10.7% gain. Starknet and Quantum Resistant Ledger follow in the top three.

Technical progress has accompanied the sector’s growth. Zcash recently launched a shielded-balance verifier to enable portable proof of funds, bolstering quantum-resistant privacy.

Buterin’s Warning Catalyzes Industry Attention

Vitalik Buterin, co-founder of Ethereum, has repeatedly warned about the risks quantum computing poses to blockchain security.

He cited Metaculus, a prediction platform, estimating a 20% chance that quantum computers capable of breaking modern encryption might appear before 2030.

Speaking at the Devconnect conference in 2025, he cautioned that quantum breakthroughs could endanger blockchain cryptography as soon as 2028.

Buterin’s warnings highlight the vulnerabilities of elliptic curve cryptography, which support networks like Ethereum and Bitcoin.

His advocacy for quantum-resistant protocols has sparked research and redirected investments toward forward-looking projects.

The legitimacy of quantum resistance has been reinforced by government actions. In March 2025, NIST chose HQC (Hamming Quasi-Cyclic) as its fifth post-quantum encryption algorithm to back up ML-KEM.

NIST had earlier standardized ML-DSA (Dilithium) and SLH-DSA (sphincs+) as signature methods, giving blockchain developers trusted cryptographic options.

In April 2025, the Canadian Centre for Cyber Security backed NIST’s adoption process, showing growing global convergence on post-quantum cryptography.

This regulatory unity is speeding up the adoption of quantum-resistant methods across cryptocurrency infrastructure.

Technical Preparedness Sets Leading Projects Apart

Some blockchain projects have integrated quantum-resistant features proactively, rather than relying on future upgrades.

Zcash uses shielded pools for privacy, even if elliptic curve cryptography fails. Starknet’s proof systems, designed with quantum safety in mind, use hash-based cryptography to guard against quantum attacks.

- Nervos Network enables developers to add NIST-standardized quantum signatures without hard forks.

- Quantum Resistant Ledger has used hash-based signatures since launch, omitting vulnerable elliptic curves.

- Abelian, meanwhile, implemented lattice-based cryptography from its genesis.

Market observers note the importance of proactive implementation. One analyst pointed to Starknet’s second-place rank among quantum-resistant tokens.

The project’s quantum-safe design contrasts with protocols that could face disruptive migration down the line.

This technical edge extends beyond cryptographic tools. Projects with modular, quantum-resistant systems can update security as NIST standards evolve, providing long-term protection while maintaining network continuity.

Psychology and Practicality Shape the 2026 Narrative

Though technical groundwork exists, some question whether quantum resistance is more a market narrative than an urgent need.

The arrival of quantum computers is uncertain. While Buterin estimates a 20% chance before 2030, many expect critical advances after 2034.

This uncertainty allows narrative and psychology to influence valuations. Fear of quantum risk could fuel price volatility, as has happened with previous crypto trends linked to anticipated events. Price action can precede real-world adoption or implementation.

Still, the line between speculation and preparation is often blurred in crypto. Investors focused on potential threats can help fund and validate useful project advances.

Market participants are already citing quantum resistance as a likely “next big narrative in 2026,” naming QRL, QANX, XDC, QTC, MCM, and CKB among likely beneficiaries.

This dual dynamic, technical innovation, and powerful market narrative could benefit real quantum-resistant projects, but also brings scrutiny to valuations.

As 2026 nears, the sector’s future will depend on the interplay of quantum technology, regulatory standards, and shifting sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: MUTM Soars by $19M While MegaETH Plummets: Real Performance Outshines Hype in the Evolving Crypto Landscape

- Mutuum Finance (MUTM) raised $19M in Phase 6 presale, with 250% price growth since 2025 launch and 90% allocation completed. - KuCoin secured AUSTRAC and MiCA licenses, expanding compliance reach across 29 EEA countries while acquiring payment firms to strengthen institutional credibility. - Bitcoin surged past $90K amid Fed rate cut speculation, contrasting MegaETH's $1B token sale collapse due to technical failures, highlighting execution risks in volatile markets. - Crypto exchanges pledged $3.19M for

Bitcoin News Update: Triple Bearish Divergence in Bitcoin Suggests ETF Rally May Be Unstable

- Bitcoin trades near $86.6K, down 31.3% from October peak amid $3.5B November ETF outflows and $2B liquidations. - Technical analysis flags "triple bearish divergence" as price hits higher highs while momentum indicators weaken. - Spot Bitcoin ETFs see $238M inflows but face $90K resistance; Ethereum ETFs gain $175M yet ETH remains below $3,000. - Key support at $85K risks accelerating sell-off to $80K, with 50–60% retracement targeting $34,409–$44,100 if bearish pattern completes.

CME Outage Highlights Cooling Systems as the Global Market’s Major Vulnerability

- CME's 2025 outage exposed cooling systems as critical vulnerability, halting 90% of global derivatives trading via CyrusOne data center failure. - Frozen prices in WTI, S&P 500 futures, and gold triggered erratic movements, with silver dropping $1 amid widened bid-ask spreads. - Despite robust financials ($1.54B revenue Q3 2025), CME faces infrastructure scrutiny as crypto futures growth plans clash with outage risks. - 24/7 crypto trading expansion scheduled for 2026 highlights need for resilient system

Gold Climbs as Fed Faces Uncertainty Over December Rate Cut Amid Limited Data

- Gold prices hit $4,120/oz as Fed rate cut expectations dropped to 33% due to delayed November jobs data, triggering market uncertainty. - JPMorgan and Goldman Sachs project gold to reach $5,055/oz by 2026, citing central bank demand and potential Fed policy neutrality. - Asian markets showed mixed performance while U.S. equity futures wavered, reflecting fragility amid geopolitical tensions and Fed leadership speculation. - Geopolitical risks, including U.S.-Ukraine peace talks and China's semiconductor