Ethereum Price Rebound or Breakdown? The Fed Might Hold the Key

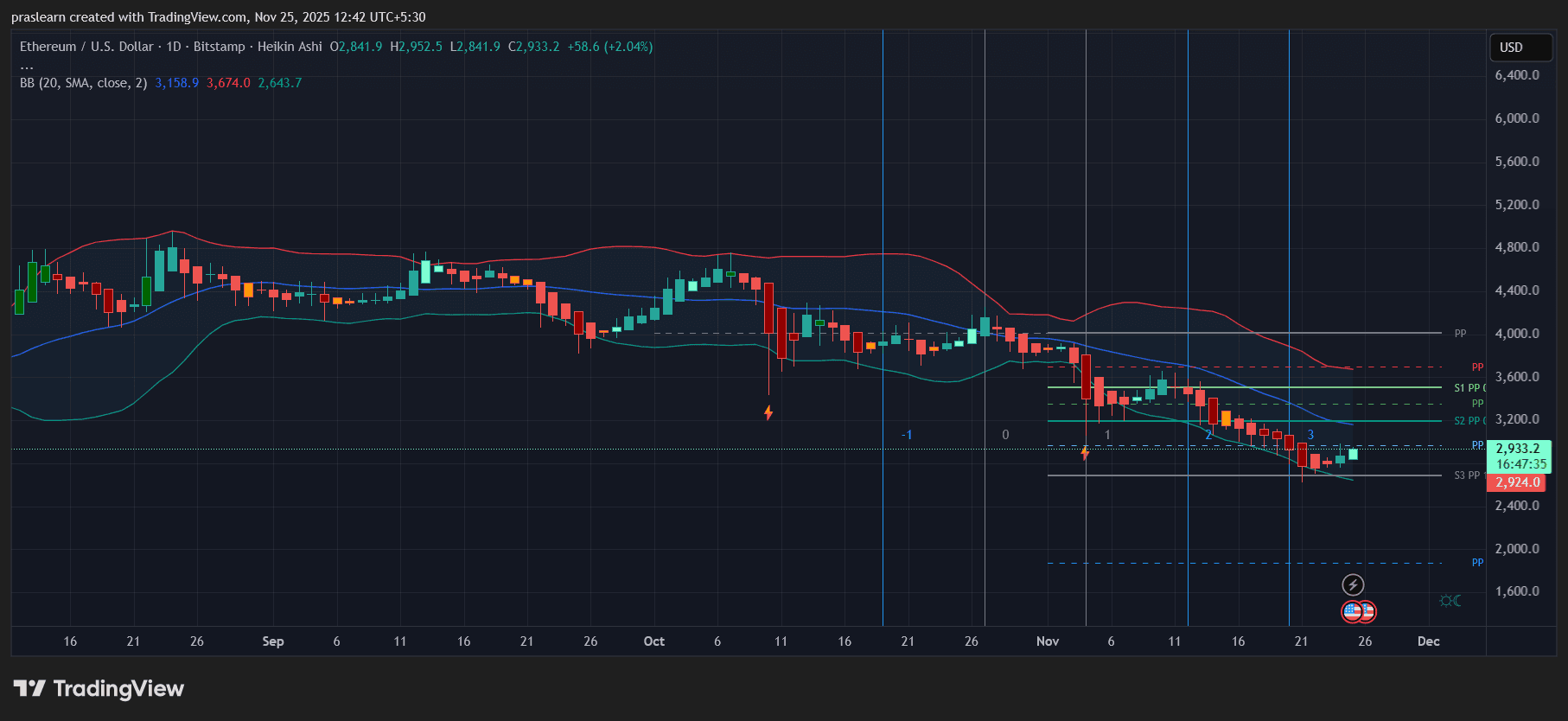

Ethereum price daily chart shows tentative signs of recovery just as the Federal Reserve faces one of its most complicated meetings of the year. With policymakers debating whether to delay or even cancel December’s meeting due to missing job data, markets are reacting with uncertainty. For Ethereum price, this kind of macro hesitation has often fueled volatility—especially when interest rate expectations shift rapidly.

Ethereum Price Prediction: The Fed’s Indecision and Investor Nerves

The Fed’s dilemma is simple but critical. Without November labor data , they’re forced to decide between cutting rates for the third time or holding steady to fight inflation. Historically, rate cuts have spurred risk assets like Ethereum, but the timing matters.

If the Fed delays the meeting , that uncertainty could temporarily stall bullish momentum across crypto. As of now, futures markets are pricing in an 83% probability of a rate cut, but any hint of hesitation could lead to another wave of volatility before the decision.

ETH Price Battles the Mid-Band Resistance

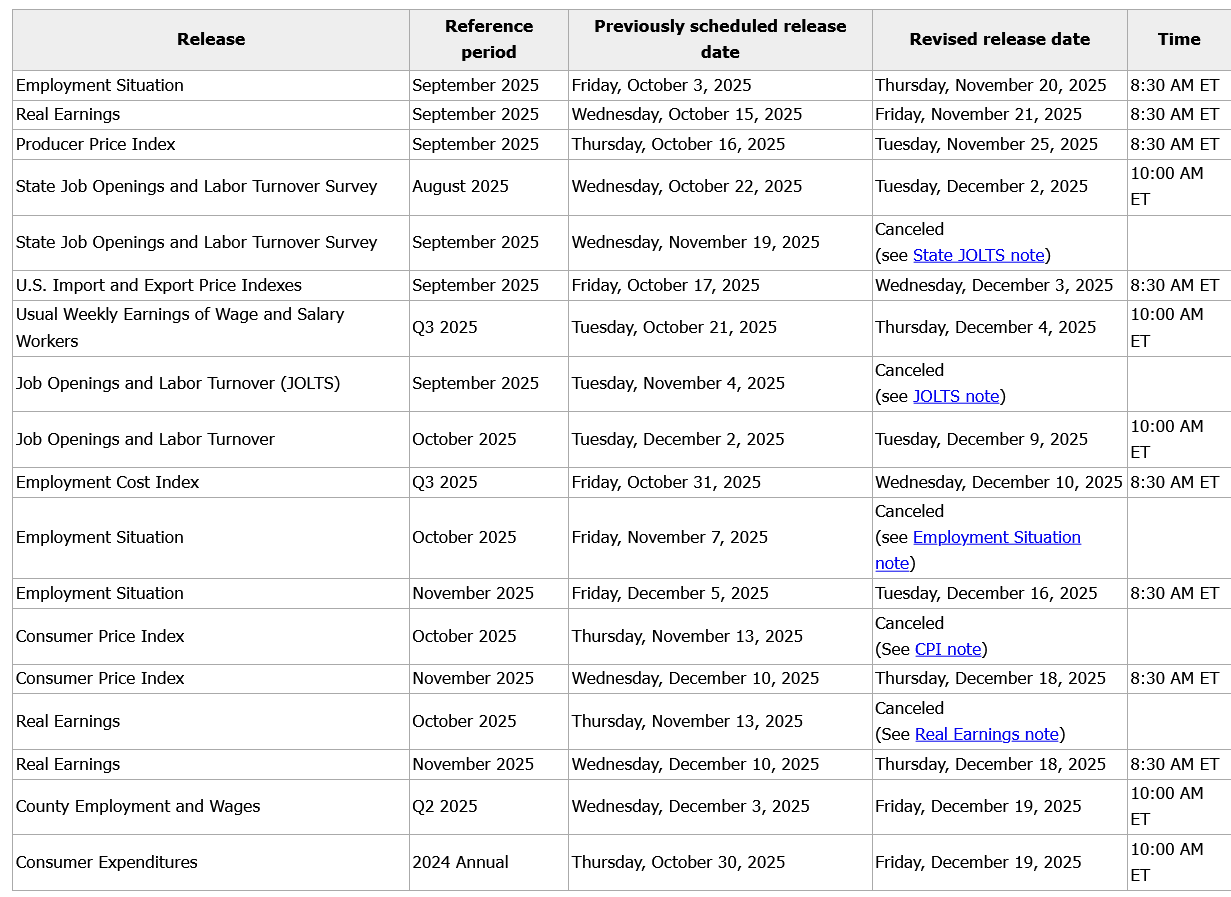

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

On the daily chart, Ethereum price is trading around $2,933, testing the mid-line of its Bollinger Bands after a multi-week downtrend. The recent candles are Heikin Ashi bullish, suggesting short-term reversal strength, but the 20-day SMA near $3,158 remains a key resistance barrier.

- Support Zone: $2,640–$2,700

- Resistance Zone: $3,150–$3,200

- Next Pivot Target: $3,400 if the breakout sustains above the 20-day SMA

ETH’s current movement hints at consolidation before a possible bullish expansion. The Bollinger Bands have started to narrow, which often precedes a volatility breakout. A decisive daily close above $3,200 would likely confirm the start of that phase.

Fed Policy Meets Technical Pressure

Ethereum’s chart behavior over the past two months mirrors investor sentiment toward Fed policy. Each time expectations for a rate cut strengthen, ETH bounces from its lower band—just as it did this week from near $2,640. If the Fed delays the meeting or signals policy uncertainty, traders could take profits early, sending ETH back toward support.

However, if the Fed moves forward and confirms a cut, liquidity inflows could lift ETH price toward the upper Bollinger Band near $3,674. This aligns with the Fibonacci retracement from the last major swing, marking a strong confluence for mid-term resistance.

Short-Term Ethereum Price Prediction: “Vibes Over Data” Market

UBS analysts called the current Fed situation “operating in a fog,” and that sentiment captures Ethereum price setup perfectly. Technicals show ETH price trying to reverse, but conviction remains weak. A lot depends on whether macro clarity returns before December 10.

If ETH maintains support above $2,850 for three consecutive days, the odds of retesting $3,200–$3,400 grow sharply. But a drop below $2,800 would invalidate this rebound and reopen the path to $2,600 or even $2,400 support.

Ethereum Price Prediction: ETH’s Reaction to the December Decision

If the Fed cuts rates or delays its decision but signals dovish intent, Ethereum price could rally toward $3,600 in December. A no-cut stance combined with continued inflation warnings could drag it back into the $2,600–$2,700 zone.

The next move will be less about charts and more about macro confidence. Ethereum’s price is now moving at the intersection of policy uncertainty and trader psychology—and whichever way that breaks, volatility is guaranteed. Ethereum’s rebound from $2,640 shows early strength, but it needs confirmation above $3,150 to prove this isn’t just another relief rally. The Fed’s December meeting will decide whether $ETH reclaims its bullish trend—or slips back into winter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti

XRP News Update: XRP ETFs Spark Optimism—Is $1,115 Within Reach?

- XRP's price surge to $2.20 is driven by ETF launches, with $422M inflows from Franklin Templeton and Grayscale. - Technical indicators suggest a potential $2.50+ rally if support at $1.84 holds, with long-term forecasts reaching $26.50 by 2030. - Institutional adoption of Ripple's ODL and Ripple USD's $1B+ market cap highlight growing utility beyond remittances. - Regulatory clarity post-SEC ruling and macroeconomic factors remain critical for XRP's $1,115 potential in ultra-bullish scenarios.