An options trader bets $1.76 billion on bitcoin breaking $100,000 before the end of the year, but does not expect a new all-time high.

ChainCatcher news, according to coindesk, on Monday a trader opened a "bullish call fly" options position on Deribit with a notional value of 20,000 bitcoin (1.76 billions USD). The net position established allows the trader to profit if bitcoin ends the year between $106,000 and $112,000. This means the trader expects bitcoin to continue rebounding and break through the $100,000 mark by the end of the year, but not to reach a new all-time high.

The report states that currently bitcoin has rebounded from last week's low near $80,000 to about $88,000. Although this rebound is mainly driven by renewed market expectations for a 25 basis point rate cut by the Federal Reserve in December, there has not yet been a return of institutional buying in spot ETF. According to SoSoValue data, on Monday, the 11 spot ETFs recorded a net outflow of $151 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Merlin Chain is about to undergo a mainnet upgrade, with an expected downtime of 12 hours.

Bitwise announces Dogecoin ETF details, initial DOGE holdings around 16.429 million, management fee rate at 0.34%

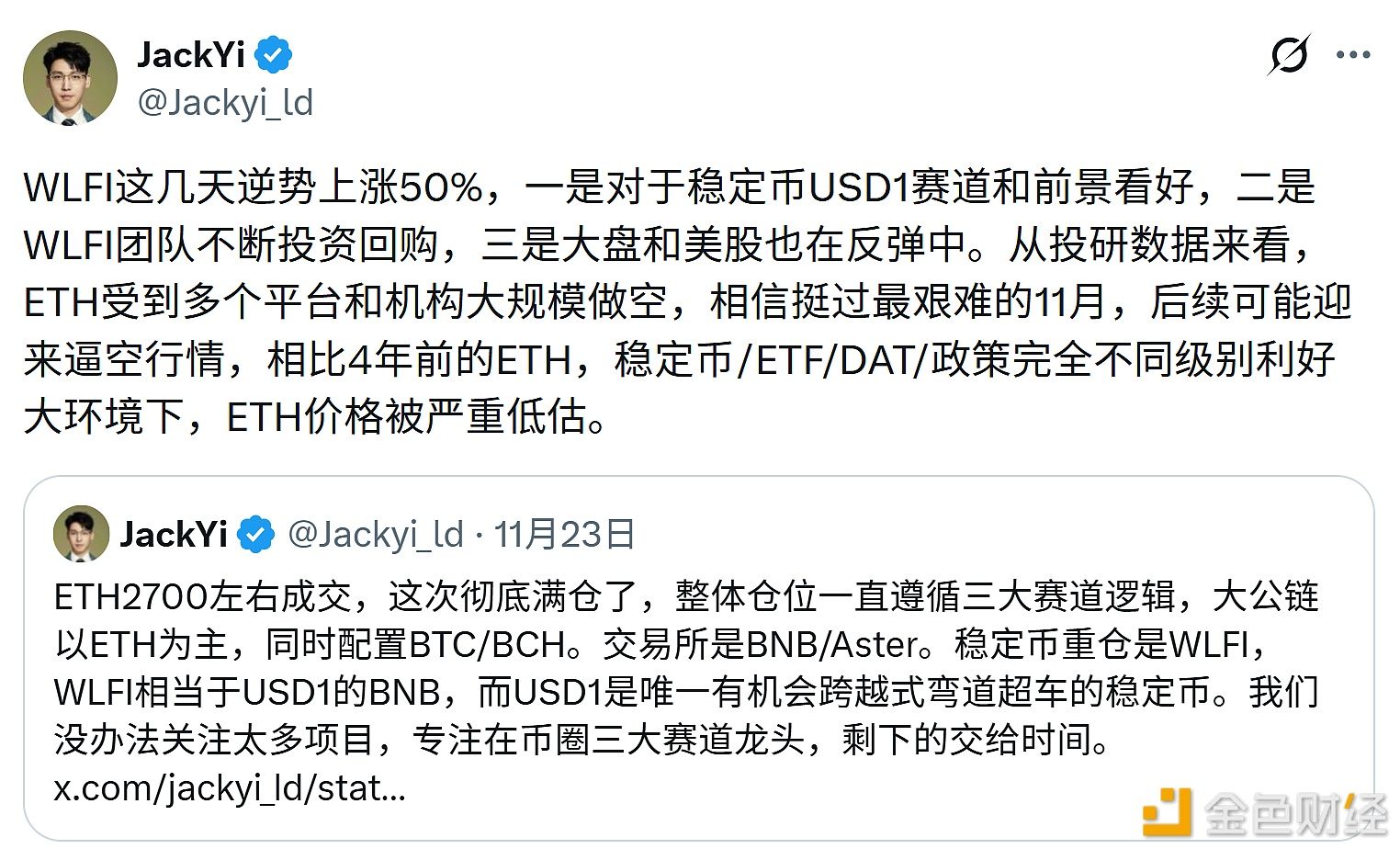

JackYi: ETH may experience a short squeeze rally after November