3 Altcoins Facing Major Liquidation Risk in the Final Week of November

Billion-dollar liquidation events have become a new normal in recent months. These events show that traders continue to get caught off guard by market volatility. Several altcoins in the final week of November could create similar surprises. These are the altcoins and the reasons they may trigger major liquidations. 1. XRP XRP’s 7-day liquidation map

Billion-dollar liquidation events have become a new normal in recent months. These events show that traders continue to get caught off guard by market volatility. Several altcoins in the final week of November could create similar surprises.

These are the altcoins and the reasons they may trigger major liquidations.

1. XRP

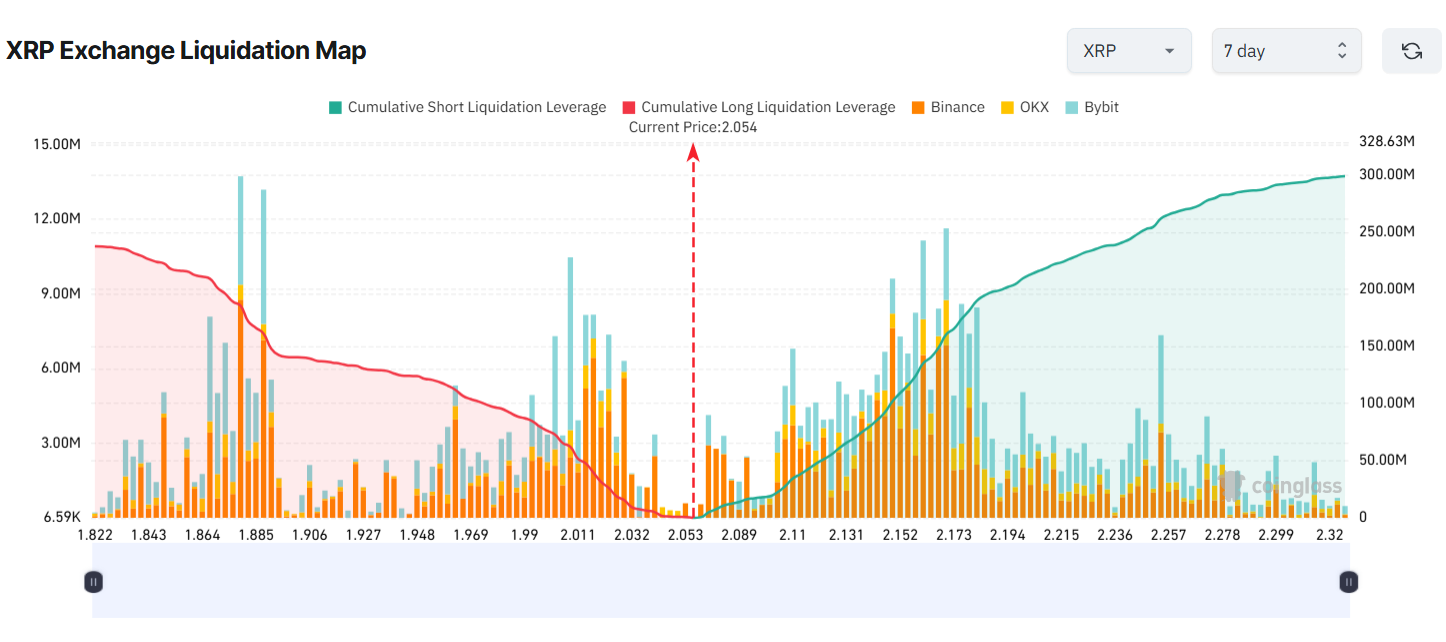

XRP’s 7-day liquidation map shows notable risk levels. If XRP rises to $2.32 this week, approximately $300 million in short positions will be liquidated. If XRP falls to $1.82, around $237 million in long positions will be liquidated.

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

Short traders in the final week of November may face liquidation for several reasons. For example, Grayscale’s XRP ETF will debut on the NYSE on November 24. US-listed XRP ETFs have also posted a cumulative total net inflow of more than $422 million, despite the broader market decline.

However, other reports show that XRP whales have shifted from accumulation to heavy selling in recent days. This selling pressure could push XRP lower and trigger liquidation for long positions.

These conflicting forces may cause losses for both long and short traders, especially as the derivatives market shows signs of heating up again.

2. Dogecoin (DOGE)

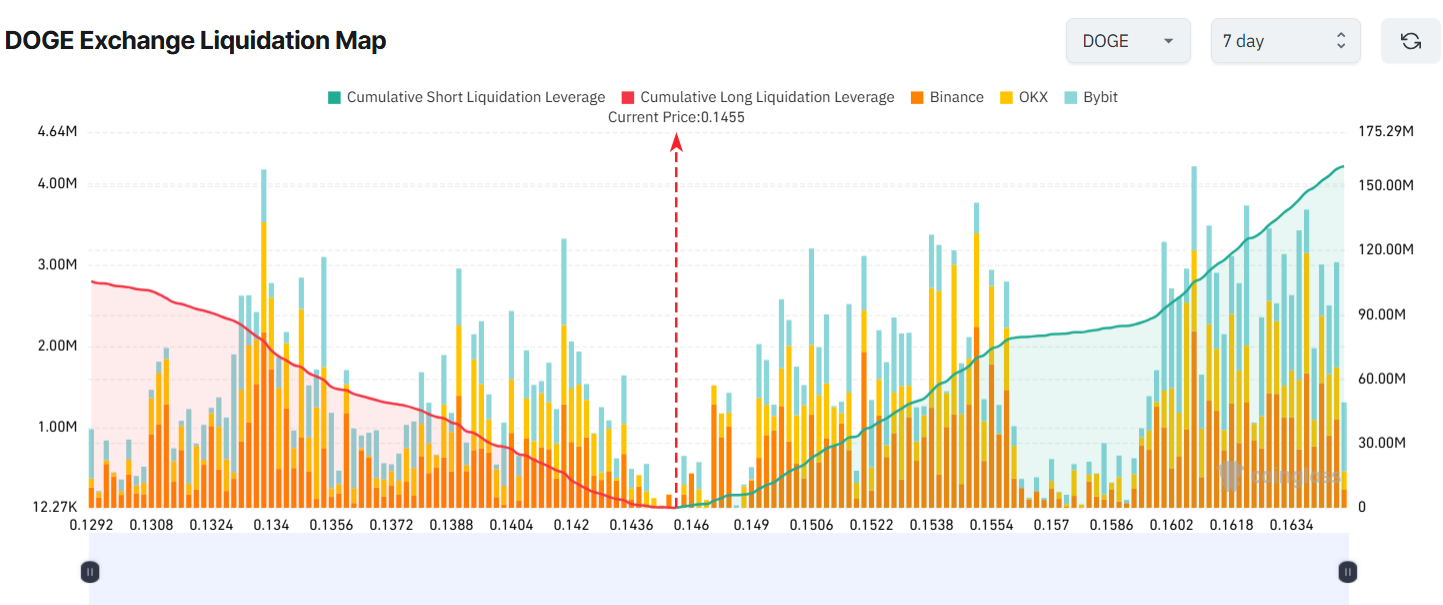

Similar to XRP, Grayscale’s DOGE ETF is also set to launch on November 24. The launch is expected to boost sentiment around the leading meme coin.

ETF expert Nate Geraci believes the Grayscale Dogecoin ETF (GDOG) marks an important milestone. He views it as clear evidence of major regulatory changes over the past year.

“Grayscale Dogecoin ETF. First ‘33 Act doge ETF. Some (many) might laugh. But this is a highly symbolic launch. IMO, the best example of a monumental crypto regulatory shift over the past year. By the way, GDOG might already be a top-10 ticker symbol for me,” Geraci said.

DOGE Exchange Liquidation Map. Source:

Coinglass

DOGE Exchange Liquidation Map. Source:

Coinglass

If these positive factors push DOGE above $0.16 this week, total short liquidations could reach $159 million.

However, another report shows that whales sold 7 billion DOGE over the past month. If this selling pressure continues, it may cap the recovery or even trigger a decline.

If DOGE falls below $0.13, long liquidations could exceed $100 million.

3. Tensor (TNSR)

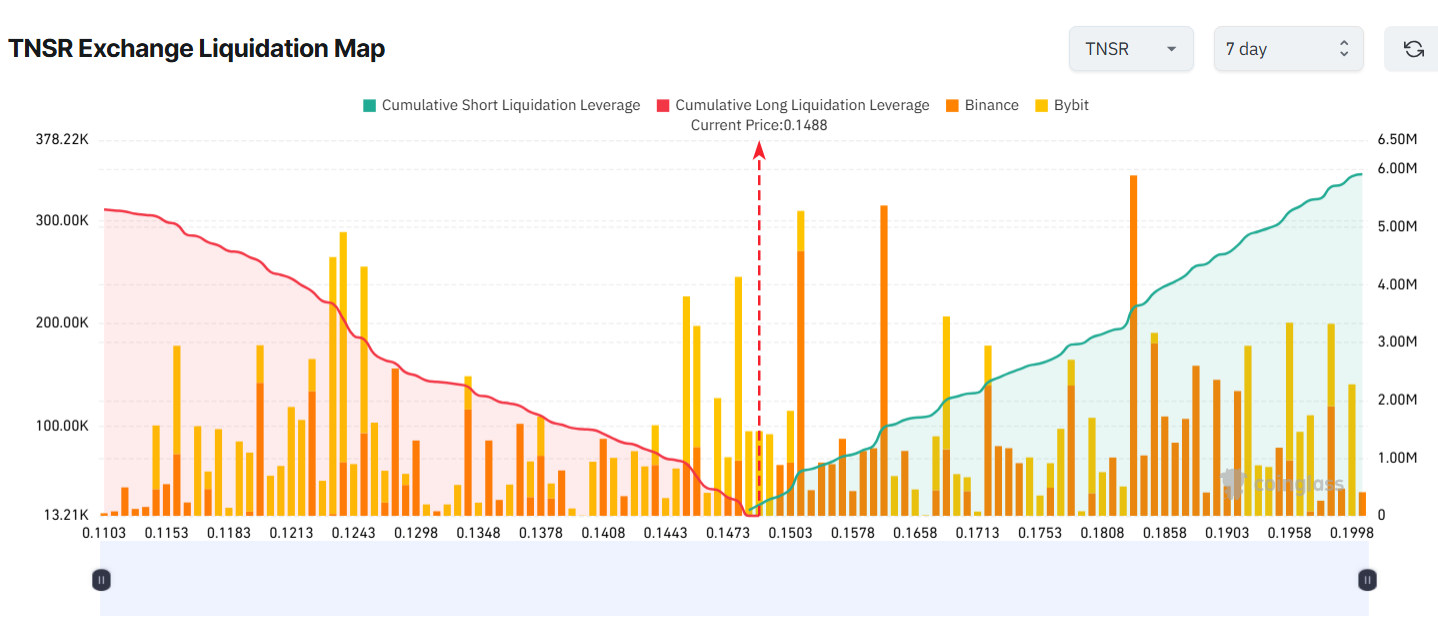

Tensor (TNSR) rallied by more than 340% last week, drawing strong attention from traders. However, the price quickly corrected by nearly 60% from its recent peak at $0.36.

Simon Dedic, founder of Moonrock Capital, argued that the rally looked suspicious. He suggested that the price action showed signs of an “insider pump.”

Tensor and Coinbase have not responded to these accusations. Yet other analysts note that the top 10 wallets hold roughly 68% of the total supply. This concentration creates significant risk and increases volatility.

TNSR Exchange Liquidation Map. Source:

Coinglass

TNSR Exchange Liquidation Map. Source:

Coinglass

These factors could influence TNSR’s price in the coming days. If the price rises to $0.19, short liquidations may reach nearly $6 million. If the price drops to $0.11, long liquidations may exceed $5 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TrustLinq Converts Cryptocurrency into Spendable Cash for Daily Life

- TrustLinq, a Swiss-regulated firm, launched a crypto-to-fiat platform enabling global payments in 70+ currencies without traditional banking infrastructure. - The platform addresses crypto adoption gaps by converting digital assets to fiat for rent, payroll, and international transfers, bypassing recipient crypto requirements. - Operating under Swiss AML regulations with non-custodial security, it targets individuals and businesses seeking crypto integration for practical financial operations. - Debit ca

Solana News Update: Pump.fun Transfers $436M—Strategic Treasury Move or Exit Strategy?

- Pump.fun denied allegations of cashing out $436.5M USDC , calling transfers routine treasury management amid a $19B crypto market crash. - Critics question timing as revenue dropped 53% to $27. 3M , with funds traced to June's institutional PUMP token sale at $0.004 each. - The team defended moves as reinvestment for ecosystem expansion, citing acquisitions and 12% PUMP buybacks since October. - Social media silence and a 72% PUMP price drop fueled exit speculation, despite $855M stablecoin liquidity rep

Ethereum Updates Today: BlackRock's Bold Move with Staked ETH ETF—Will It Influence Ethereum's Future?

- Ethereum faces bearish technical signals, with price below key averages and a rising wedge pattern suggesting further declines toward $2,050 if support breaks. - BlackRock's proposed staked ETH ETF aims to offer 3% annualized yields with low fees, potentially disrupting DATs by combining institutional custody and transparent staking structures. - Market dynamics show $1.9B in ETF outflows and whale activity shifting ETH to cold storage, while macro factors like sticky U.S. yields weigh on risk assets. -

China: Electricity Too Cheap Revives the Bitcoin Mining Industry