When the market is divided, true influence comes from those who dare to define the rules. Michael Saylor of MicroStrategy, Brian Armstrong of Coinbase, and Vitalik Buterin of Ethereum are all writing the future of the crypto market in distinctly different ways.

1. Saylor’s Declaration: Bitcoin Is the Balance Sheet

● “We are not a fund, not a trust, we are a publicly traded company with a $500 million software business.” MicroStrategy Executive Chairman Michael Saylor’s statement on social media was both a response to JPMorgan’s analysis and a firm defense of the company’s business model.

● Facing the risk of being removed from the MSCI major stock index, Saylor remained unfazed. According to JPMorgan’s analysis, this change could lead to an outflow of up to $8.8 billions, but Saylor’s response was even more striking: “Index classification cannot define us.”

Key Points:

● Positioning bitcoin as a “productive capital asset”

● The company’s financial structure can withstand an 80-90% drop in bitcoin price

● Bitcoin only needs to grow 1.25% annually to sustain operations

Saylor is not only defending MicroStrategy’s business model, but also redefining how listed companies can integrate bitcoin into their corporate financial strategies. His stance represents a new concept: bitcoin is not a speculative tool, but a core component of corporate asset allocation.

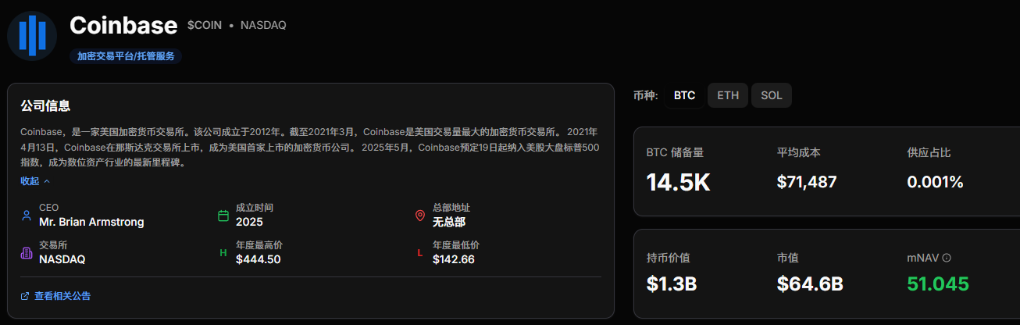

2. Regulatory Frontline: Armstrong’s Legislative Battle

● This weekend, Coinbase CEO Brian Armstrong launched a crucial battle in Washington. He publicly announced that the legislative work on the crypto market structure bill is “90% complete”, a statement that sent a ripple through the entire industry.

● More notably, Armstrong revealed that previous restrictions on DeFi in the draft have been removed, clearing a major obstacle for the development of decentralized finance. His actions go beyond lobbying, mobilizing community power through the Stand With Crypto platform to put pressure on Congress.

● Armstrong’s efforts represent a key step in the crypto industry’s journey from the margins to the mainstream. His confidence sends a clear signal: the crypto industry is shifting from passively adapting to regulation to actively participating in rule-making.

3. The Cool Observer: True Indicators of Institutional Confidence

CryptoQuant CEO Ki Young Ju offered a more measured market assessment this weekend.

● He pointed out that it is still too early to assert that confidence among US institutional investors has fully recovered, basing his judgment on the fact that Coinbase’s hourly bitcoin premium remains negative.

● This subtle but important indicator reveals the true state of institutional capital flows. Young Ju’s analysis provides a rare rational voice for the market, maintaining objectivity amid widespread optimism or pessimism.

● His view reminds us that the true state of the market is often hidden in details overlooked by ordinary investors.

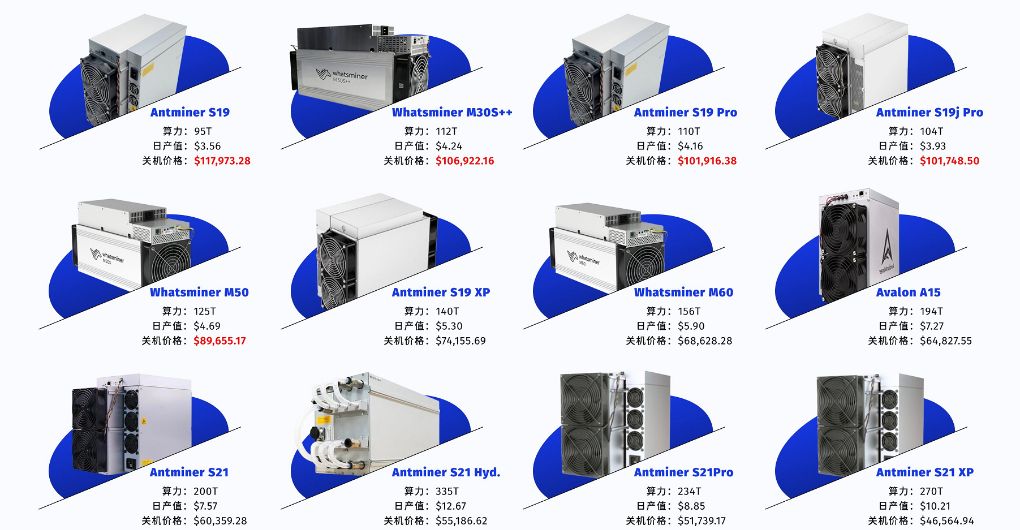

4. Crisis Watcher: The Severe Challenges Facing Mining

● Swan Desk CEO Jacob King issued a warning that cannot be ignored: bitcoin mining has entered its least profitable period in a decade. He predicts that in the coming months, bitcoin will face “chaos” due to issues such as miners shutting down operations.

● This warning directly points to the fundamental security of the bitcoin network. If a large number of miners shut down due to profit pressures, it will not only affect network hashrate but could also shake market confidence in bitcoin’s infrastructure. King’s warning highlights the disconnect between fundamental analysis and price analysis in the crypto market; the survival of miners will become one of the key variables affecting bitcoin’s future trend.

5. Traditional Perspective: Cramer’s Leverage Analysis

● CNBC commentator Jim Cramer analyzed the reasons for the current crypto crash from a traditional financial perspective. He pointed out that the chain liquidations caused by high leverage in the market are a major driver of this downturn, bluntly stating that buyers “will not be forgiven” in this decline.

● Cramer’s analysis reveals the increasingly close linkage between the crypto market and traditional financial markets. As institutional capital pours in, the operational logic of traditional markets is being replayed in the crypto space.

● His view confirms a fact: the crypto market is no longer an isolated entity, but an organic part of the global financial system.

6. The Optimist: BitMine’s Cycle Judgment

● BitMine Chairman Tom Lee maintained a relatively optimistic stance this weekend. He believes that the current crypto price cycle has not yet peaked, and the ultimate top may appear in 12-36 months.

● Lee set a target price for bitcoin between $150,000 and $200,000 by the end of January next year, showing his strong confidence in the medium- to long-term trend. More importantly, he sees the market downturn as a “golden opportunity” and stated that the company is advancing plans to establish an Ethereum validator network in the US.

● Lee’s optimistic stance represents the voice of investors focused on long-term trends, maintaining strategic composure amid short-term market fluctuations.

7. The Tech Worrier: VanEck’s Quantum Warning

● VanEck CEO Jan van Eck expressed deep concerns about bitcoin’s technological prospects. He specifically pointed out the threat of quantum computing to bitcoin and questioned bitcoin’s privacy.

● Van Eck stated bluntly that if bitcoin’s “fundamental logic breaks down,” the company will exit its investment. This statement reflects how institutional investors, while embracing crypto, remain keenly aware of its technological risks. His concerns point to a dimension often overlooked in the crypto space: the disruptive risks brought by technological iteration.

In this information-explosive weekend, the voices of crypto giants paint a complex market picture. From Armstrong’s regulatory optimism to VanEck’s technological concerns, from Saylor’s steadfast belief to King’s mining warnings, each voice represents a dimension of the market.

These seemingly contradictory views precisely reflect the essence of the crypto market: it is full of opportunities, yet fraught with risks; there are both steadfast believers and cool-headed observers. In this diverse and complex environment, the wisdom of investors lies not in believing any single voice, but in distilling their own judgment from these different perspectives.