Polish Crypto Influencer Says the Supercycle Is Dead, Bitcoin Is Back in a Classic Bear Market

Bitcoin is once again at the center of discussions about market cyclicality, and Polish crypto influencer Phil Konieczny argues that the current declines fit perfectly into his previous forecasts. He emphasizes that Bitcoin is behaving according to a historical pattern, and the market realized too late that the bull market was over. According to him,

Bitcoin is once again at the center of discussions about market cyclicality, and Polish crypto influencer Phil Konieczny argues that the current declines fit perfectly into his previous forecasts.

He emphasizes that Bitcoin is behaving according to a historical pattern, and the market realized too late that the bull market was over. According to him, the current bear market is a natural part of the cycle and should not be ignored.

The cryptocurrency market is going through a difficult phase, but in Phil’s opinion everything is going exactly as it should.

Bitcoin in a Bear Market

Phil Konieczny starts his video from the statement that the current market behaves in a textbook way when it comes to 4-year cycles. He claims that Bitcoin, which trades for around $85,000 today, follows a pattern already seen several times.

In the next part, he emphasizes that historical peaks have occurred earlier each time. Phil explains that in 2017 the peak came in December, in 2021 it arrived in November, and the current peak appeared in October. In his view, these data points confirm the market’s cyclicality.

He also notes that Bitcoin is now entering a natural downward phase. He adds that many people ignored the signals, although they were visible.

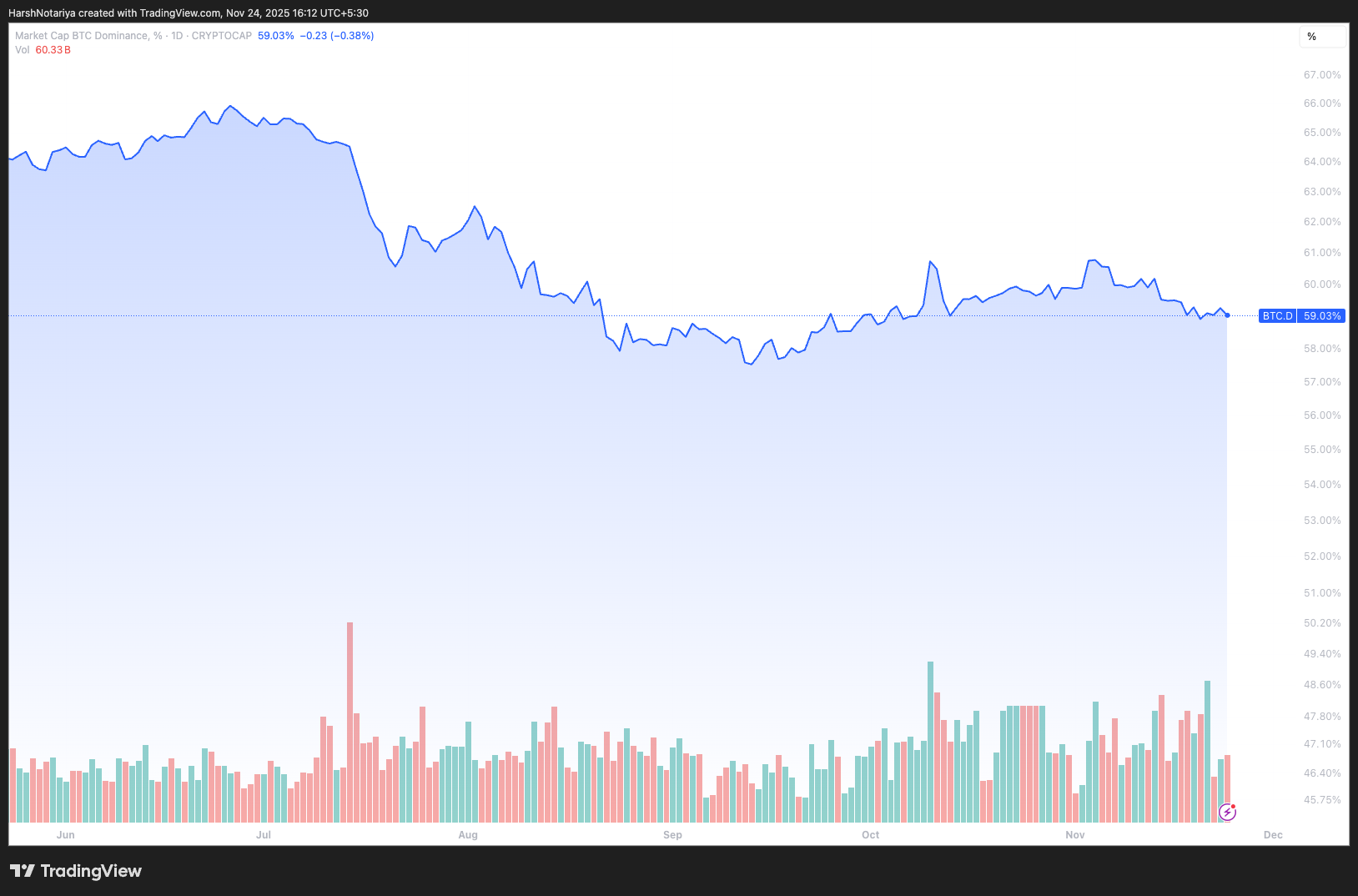

Phil also comments on Bitcoin’s dominance, which in his opinion is not growing as strongly as it should. At the same time, smaller altcoins record huge losses, often at 60–80% per year. This shows the real weakness of the market.

Bitcoin dominance. Source:

TradingView

Bitcoin dominance. Source:

TradingView

Phil’s Key Warnings

Phil Konieczny openly says that the supercycle narrative was wrong. In his opinion, the market gave clear signals that cyclicality continued. He emphasizes that it was unwise to ignore this data.

Meanwhile, Bitcoin is below its 50-week moving average. In Phil’s opinion, this is a classic bear market signal. However, the investors should not ignore the possibilities of a dead-cat bounce.

Bitcoin Trades Below 50-Week EMA For the First Time Since 2023. Source:

TradingView

Bitcoin Trades Below 50-Week EMA For the First Time Since 2023. Source:

TradingView

The Polish influencer warns investors to stay away from altcoins. This is because, the risk of investing on altcoins is too high. Not to mention, many altcoins never recovered from previous bear markets.

Macroeconomics, ETFs and key investor questions about Bitcoin

Phil discusses the macroeconomic situation extensively, which he believes is very worrying. It points to an inverted yield curve that has historically always heralded a recession.

He mentions Americans’ debt and the growing number of company bankruptcies. It also highlights the risks arising from the US–China trade war. In his opinion, these factors significantly limit the growth potential of markets.

Then he discusses the topic of ETFs. He explains that their purchases were one of the main drivers of the beginning of the bull market.

However, he notes that their activity alone is not enough if the macro situation does not improve. Phil ndicates that the correlation between S&P 500 and Bitcoin has become one-sided. This means that stock market declines drag down cryptocurrencies, but increases do not give them the same support.

The Polish influencer sums it up:

- Bitcoin responds to macro and macro looks bad,

- Altcoins have an extremely low chance of making a lasting rebound, the

- The cycle looks the same as the previous ones.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps

Vitalik Buterin Supports ZKsync: What This Means for Layer 2 Scaling

- Vitalik Buterin endorsed ZKsync in late 2025, highlighting its "underrated and valuable" work alongside the Atlas upgrade achieving 15,000 TPS and $0.0001 fees. - ZKsync's zero-knowledge rollups and EVM compatibility enabled institutional adoption by Deutsche Bank , Sony , and Goldman Sachs for cross-chain and enterprise use cases. - The Fusaka upgrade aims to double throughput to 30,000 TPS by December 2025, positioning ZKsync to compete with Polygon zkEVM and StarkNet in Ethereum's Layer 2 landscape. -

The ZK Atlas Enhancement: Revolutionizing Blockchain Scalability?

- ZKsync's 2025 Atlas Upgrade achieves 15,000–43,000 TPS with sub-1-second finality, addressing Ethereum L2 scalability bottlenecks via Airbender proofs and modular OS. - DeFi protocols like Aave and Lido leverage ZKsync's $0.0001/tx costs to unify liquidity, while Deutsche Bank and Sony adopt its trustless cross-chain infrastructure for compliance and transparency. - ZK token surged 150% post-upgrade, with TVL hitting $3.3B and analysts projecting 60.7% CAGR for ZK Layer-2 solutions by 2031 amid instituti

XRP News Update: XRP ETFs Spark Optimism—Is $1,115 Within Reach?

- XRP's price surge to $2.20 is driven by ETF launches, with $422M inflows from Franklin Templeton and Grayscale. - Technical indicators suggest a potential $2.50+ rally if support at $1.84 holds, with long-term forecasts reaching $26.50 by 2030. - Institutional adoption of Ripple's ODL and Ripple USD's $1B+ market cap highlight growing utility beyond remittances. - Regulatory clarity post-SEC ruling and macroeconomic factors remain critical for XRP's $1,115 potential in ultra-bullish scenarios.