3 Meme Coins To Watch In The Final Week Of November

Meme coins are finding their footing amid a volatile market, as Bitcoin attempts a recovery. This could help the speculative tokens bounce back even if the broader market recovery is slow. BeInCrypto has analysed three such meme coins that the investors should watch as November nears its end. Pippin (PIPPIN) PIPPIN has become the week’s

Meme coins are finding their footing amid a volatile market, as Bitcoin attempts a recovery. This could help the speculative tokens bounce back even if the broader market recovery is slow.

BeInCrypto has analysed three such meme coins that the investors should watch as November nears its end.

Pippin (PIPPIN)

PIPPIN has become the week’s strongest-performing meme coin after soaring 133% in seven days. The token now trades at $0.067 and has successfully flipped the $0.064 level into support, signaling strong buyer demand and renewed market attention.

If momentum holds, PIPPIN may rebound off this support and climb toward $0.080. The EMAs indicate that the token narrowly avoided a Death Cross, suggesting a resurgence in bullish sentiment. This shift could help propel PIPPIN toward the $0.100 mark as enthusiasm grows.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source: TradingView

PIPPIN Price Analysis. Source:

PIPPIN Price Analysis. Source: TradingView

If investors begin taking profits, PIPPIN may struggle to maintain its gains. A drop below $0.064 could send the price toward $0.052. Losing that support would invalidate the bullish thesis and increase the likelihood of a deeper retracement.

Dogecoin (DOGE)

Dogecoin remains in a downtrend that began nearly a month ago, but momentum could shift following the launch of the Grayscale Dogecoin spot ETF (GDOG).

The new product has sparked renewed interest, raising expectations for a potential rebound in the meme coin’s price this week.

If bullish sentiment strengthens, DOGE may push past the $0.151 resistance and climb toward $0.162. Dogecoin also exhibits a strong 0.95 correlation with Bitcoin, indicating that a BTC rally could potentially amplify its upward movement. This alignment gives DOGE an opportunity to mirror broader market gains.

DOGE Price Analysis. Source:

DOGE Price Analysis. Source: TradingView

DOGE Price Analysis. Source:

DOGE Price Analysis. Source: TradingView

If the ETF fails to generate sufficient enthusiasm, Dogecoin’s downtrend may continue. A drop below the $0.142 support could follow, potentially sending the price to $0.130. Such weakness would invalidate the bullish thesis and signal further bearish pressure ahead.

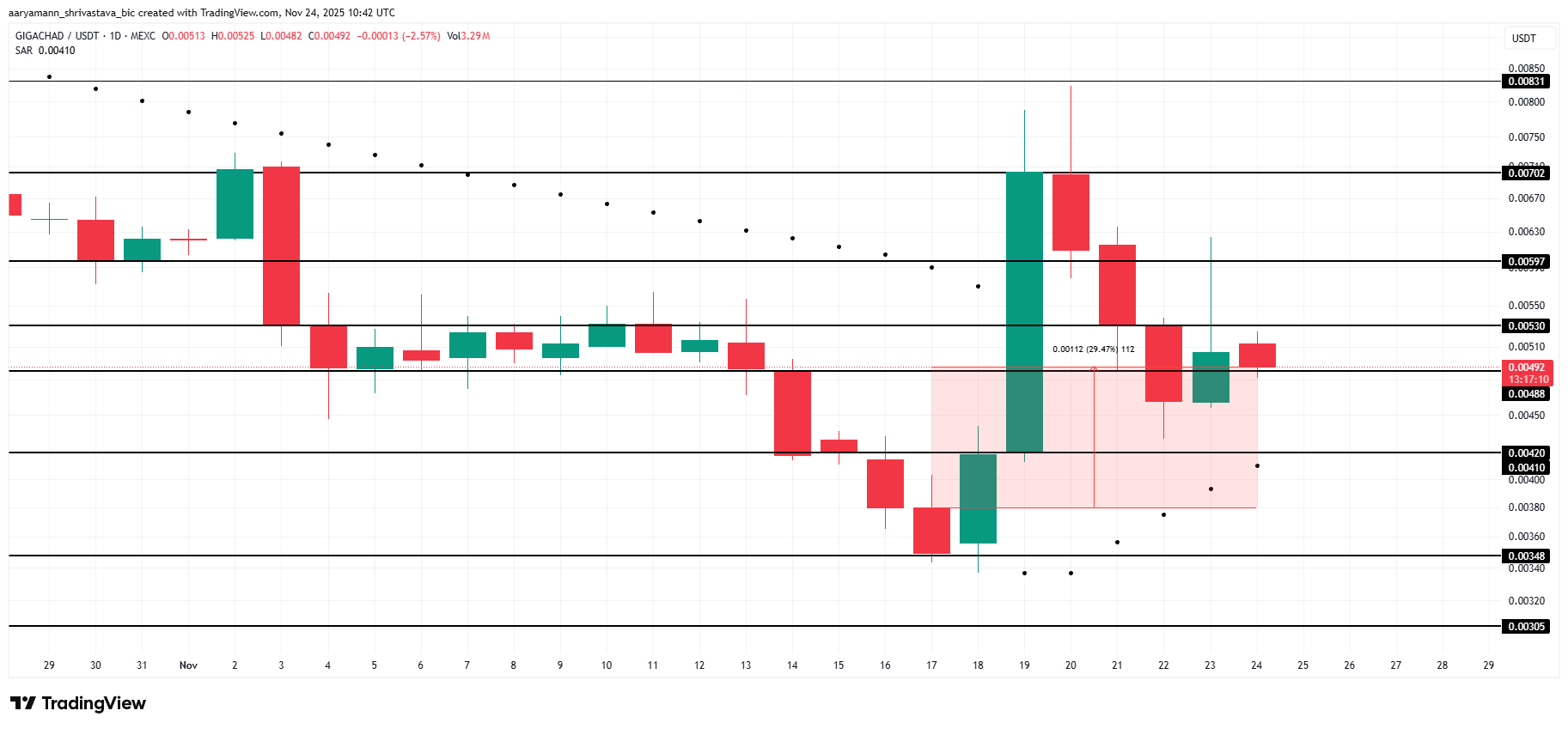

Gigachad (GIGA)

GIGA has surged 27% over the past week, as momentum has shifted decisively from bearish to bullish. The Parabolic SAR confirms an active uptrend, signaling strengthening buyer interest and improving technical conditions that support continued upward movement in the near term.

If this momentum holds, GIGA could break above the $0.0053 resistance and advance toward $0.0059. A successful breach of that level may open the path to $0.0070, extending the rally and attracting additional investor attention as confidence builds.

GIGA Price Analysis. Source:

GIGA Price Analysis. Source: TradingView

GIGA Price Analysis. Source:

GIGA Price Analysis. Source: TradingView

If selling pressure emerges, GIGA could lose its upward traction. A drop below the $0.0048 support level may push the price toward $0.0042 or even $0.0034. Such a decline would invalidate the bullish thesis and increase the risk of a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TrustLinq Converts Cryptocurrency into Spendable Cash for Daily Life

- TrustLinq, a Swiss-regulated firm, launched a crypto-to-fiat platform enabling global payments in 70+ currencies without traditional banking infrastructure. - The platform addresses crypto adoption gaps by converting digital assets to fiat for rent, payroll, and international transfers, bypassing recipient crypto requirements. - Operating under Swiss AML regulations with non-custodial security, it targets individuals and businesses seeking crypto integration for practical financial operations. - Debit ca

Solana News Update: Pump.fun Transfers $436M—Strategic Treasury Move or Exit Strategy?

- Pump.fun denied allegations of cashing out $436.5M USDC , calling transfers routine treasury management amid a $19B crypto market crash. - Critics question timing as revenue dropped 53% to $27. 3M , with funds traced to June's institutional PUMP token sale at $0.004 each. - The team defended moves as reinvestment for ecosystem expansion, citing acquisitions and 12% PUMP buybacks since October. - Social media silence and a 72% PUMP price drop fueled exit speculation, despite $855M stablecoin liquidity rep

Ethereum Updates Today: BlackRock's Bold Move with Staked ETH ETF—Will It Influence Ethereum's Future?

- Ethereum faces bearish technical signals, with price below key averages and a rising wedge pattern suggesting further declines toward $2,050 if support breaks. - BlackRock's proposed staked ETH ETF aims to offer 3% annualized yields with low fees, potentially disrupting DATs by combining institutional custody and transparent staking structures. - Market dynamics show $1.9B in ETF outflows and whale activity shifting ETH to cold storage, while macro factors like sticky U.S. yields weigh on risk assets. -

China: Electricity Too Cheap Revives the Bitcoin Mining Industry