Cardano News Today: Blockchain Dispute: Should Those Responsible for Chain Splits Face Legal Action or Should Open-Source Creativity Be Safeguarded?

- Solana co-founder Anatoly Yakovenko praised Cardano's swift recovery from a November 2025 chain split, calling its resilience "pretty cool" despite a malicious transaction exploiting a deserialization bug. - Cardano's Ouroboros consensus model enabled rapid convergence without hard forks, preserving transaction throughput and avoiding fund losses through emergency node upgrades. - A public debate emerged between Yakovenko and Cardano founder Charles Hoskinson over legal accountability, with Hoskinson adv

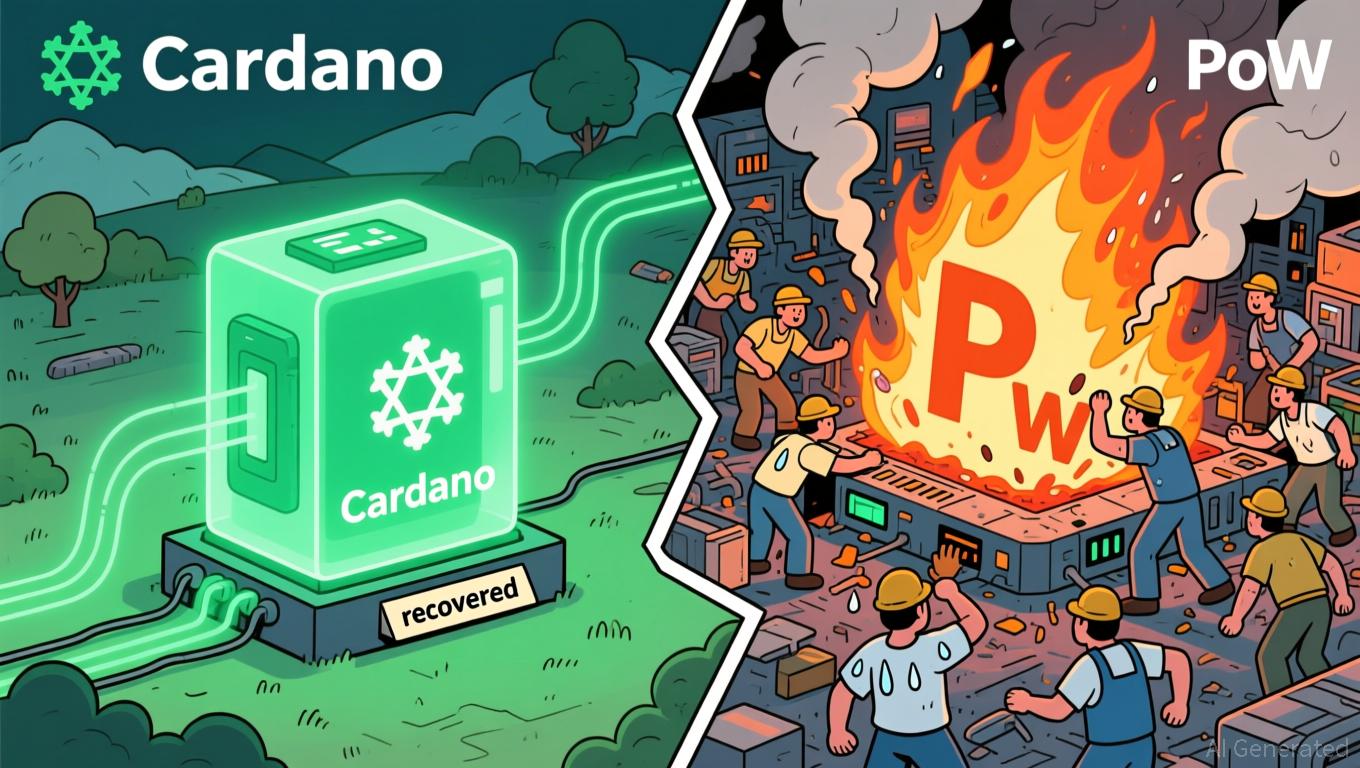

Cardano's network architecture has received public recognition from Solana Co-Founder Anatoly Yakovenko, who applauded its robust design after the blockchain quickly bounced back from a recent chain split. Yakovenko described the blockchain's durability as "pretty cool" and pointed out the complexities involved in developing a Nakamoto-style consensus protocol without relying on proof-of-work.

The chain split also ignited a public discussion between Hoskinson and Yakovenko about whether the event should be handled as a criminal case. Hoskinson maintained that the attack—carried out by a dissatisfied stake pool operator (SPO) who exploited testnet weaknesses—deserved legal consequences, claiming it inflicted "catastrophic harm" on the ecosystem

Cardano's effective management of the situation has strengthened its standing as a resilient PoS blockchain. Observers pointed out that the fork demonstrated the network's capacity to self-heal without stopping operations, which is rare in the cryptocurrency sector

Yakovenko's commendation reflects increasing mutual respect among blockchain leaders, but the incident also underscores persistent challenges in protecting PoS networks from targeted attacks. The ongoing debate about legal responsibility raises important questions about how to balance network resilience with regulatory measures in decentralized systems

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Unprecedented Profits and Regulatory Challenges Prompt Strategic Reassessment in the Crypto Industry

- BitMine Immersion reports record $13.39 FY25 EPS and becomes first major crypto firm to declare a $0.01/share dividend, while planning 2026 Ethereum staking via its "Made-in-America Validator Network." - Kraken Robotics posts $3. 3M Q3 net income with $330.7M total assets, driven by subsea battery production and marine services expansion amid macroeconomic uncertainties. - Grabar Law Office investigates Avantor , enCore Energy, and Fortrea Holdings for alleged securities fraud, including inflated earning

KITE's Initial Public Offering: Evaluating Whether SPAC Listings Reflect Genuine Value or Speculative Excitement

- Blockfusion's $450M SPAC merger with BACC highlights 2025's SPAC market resurgence, targeting AI infrastructure growth amid valuation debates. - The 6x 2028 EBITDA multiple appears conservative for AI data centers but hinges on securing long-term contracts with major tech players. - Past SPAC failures like Hyzon Motors and Kodiak AI underscore risks of speculative overvaluation in pre-revenue tech sectors despite strategic advantages. - Niagara Falls' low-cost energy and Tier 3 infrastructure position Bl

Visa Executives' Share Dealings: Standard Financial Actions, Not Indicators for the Market

- Visa executives conducted routine stock transactions in late 2025, exercising shares to cover tax liabilities and surrendering portions to offset costs. - Senior officers including CFO Chris Suh and Tullier Kelly Mahon executed trades under prearranged plans, aligning with standard insider financial management practices. - Analysts emphasize these moves reflect personal financial strategies rather than market signals, though transparency remains critical amid regulatory scrutiny of executive compensation

Dogecoin News Update: Chainsaw Ambitions Halted: DOGE Ends Operations Eight Months Ahead of Schedule

- Trump's DOGE agency, led by Musk, disbanded eight months early, failing to cut $2 trillion in spending. - Critics accused it of overreaching, while OPM absorbed its functions and former members transitioned to new roles. - Mixed reactions persist, with states creating local equivalents and questions about long-term impact.