Bitcoin Updates: Bitcoin's Sharp Drop Contrasts with Japan's Economic Stimulus Amid Global Liquidity Puzzle

- Bitcoin fell to a seven-month low below $85,500, triggering $3.79B in ETF outflows as bearish technical signals and Fed rate-cut uncertainty deepened selling. - Japan's $135.4B stimulus package, its largest since 2020, sparked debate over whether liquidity injections or global deleveraging would dominate market sentiment. - BlackRock's IBIT led redemptions with $2.47B losses, while Bitcoin's "death cross" pattern and broken support levels intensified investor caution. - Market analysts split between altc

Bitcoin has dropped to its lowest price in seven months, causing most retail investors to face losses as U.S. spot

The sharp decline happened alongside Japan’s announcement of a $135.4 billion stimulus package on Nov. 21, the country’s biggest since the COVID-19 crisis. Prime Minister Sanae Takaichi’s administration

Bitcoin has broken through major support zones on its way to a seven-month low, sparking heavy redemptions from spot ETFs and deepening pessimism in the market. Investors are closely watching how Japan’s huge fiscal stimulus will impact the market, as experts remain split on whether it will lead to more risk-off behavior or inject new liquidity into digital assets.

The scale of ETF withdrawals has been unprecedented.

Opinions among analysts are mixed.

Japan’s stimulus and Bitcoin’s volatility underscore a contradiction: while a weaker currency policy could theoretically drive up Bitcoin demand, it is instead contributing to global risk reduction. As ETF assets shrink and institutional players adjust their strategies, Bitcoin’s future direction remains unclear. For everyday investors, the takeaway is stark: what was once seen as a reliable hedge against inflation has become a highly unpredictable asset with no assured path forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

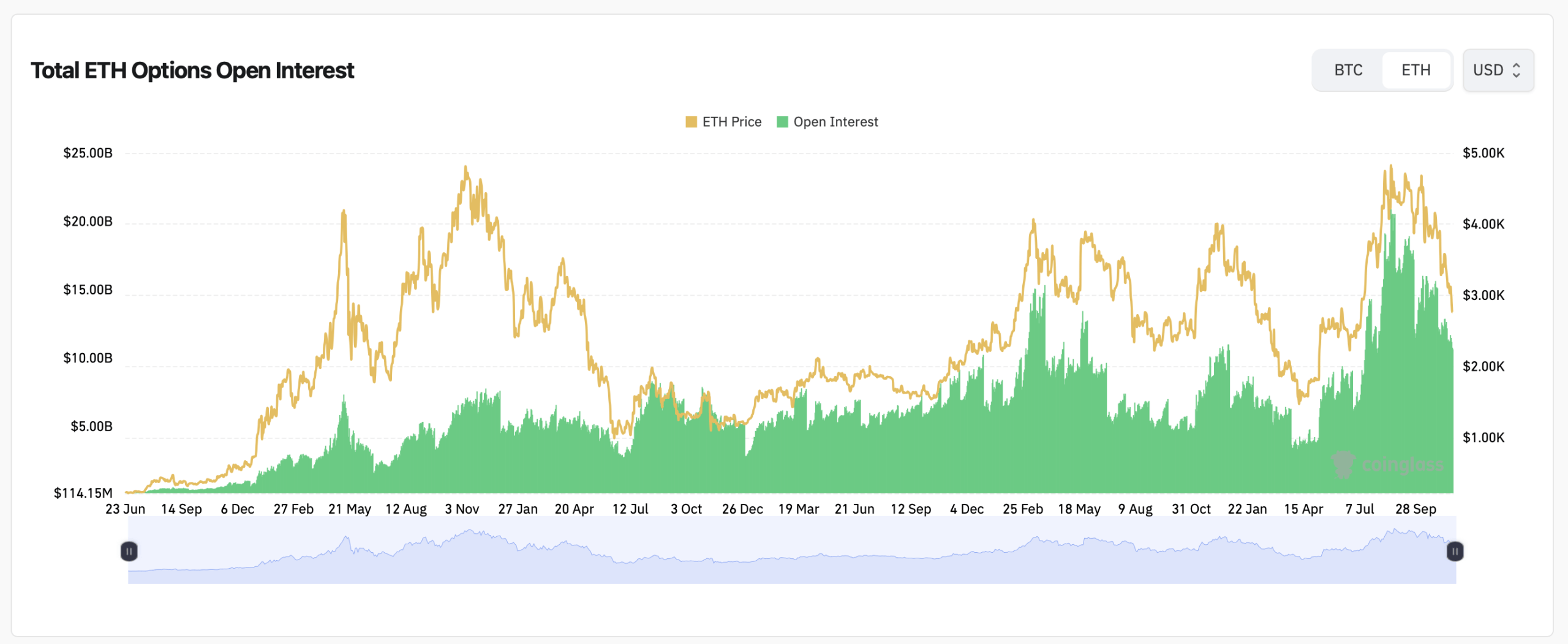

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead