XRP Whale Selling Hits $480 Million In 48 Hours As Price Falls Below $2

XRP has fallen below the key $2 psychological support level as bearish pressure intensifies across the broader market. The altcoin’s decline has accelerated over the past week, prompting significant selling from major holders. This shift in behavior from large investors has amplified downward momentum and weakened XRP’s short-term outlook. XRP Whales Switch Their Stance Whales

XRP has fallen below the key $2 psychological support level as bearish pressure intensifies across the broader market. The altcoin’s decline has accelerated over the past week, prompting significant selling from major holders.

This shift in behavior from large investors has amplified downward momentum and weakened XRP’s short-term outlook.

XRP Whales Switch Their Stance

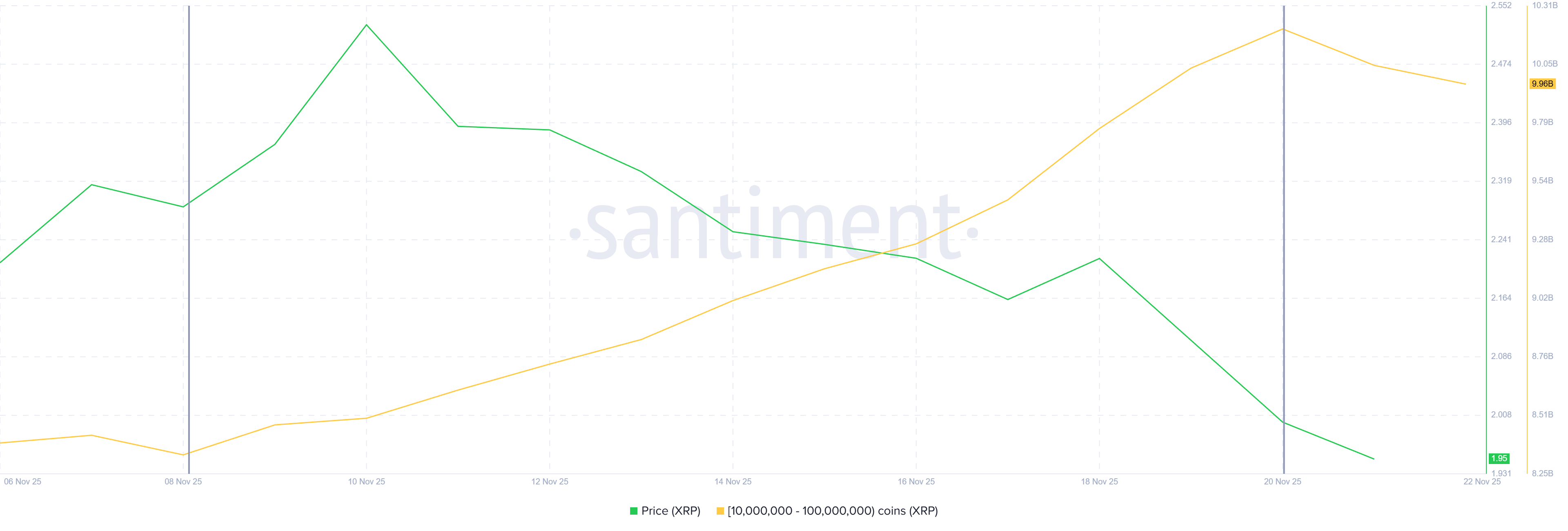

Whales have moved decisively from accumulation to heavy selling. Addresses holding between 10 million and 100 million XRP have dumped more than 250 million tokens in the past 48 hours alone, worth over $480 million.

This selling wave follows more than 20 consecutive days of accumulation by the same group of holders.

Such an abrupt shift signals a loss of conviction among large investors who had previously supported XRP’s rise. Their exit removes a crucial source of market strength and may prolong XRP’s decline. Without renewed confidence from whales, recovery momentum could weaken further and keep prices under pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source:

Santiment

XRP Whale Holding. Source:

Santiment

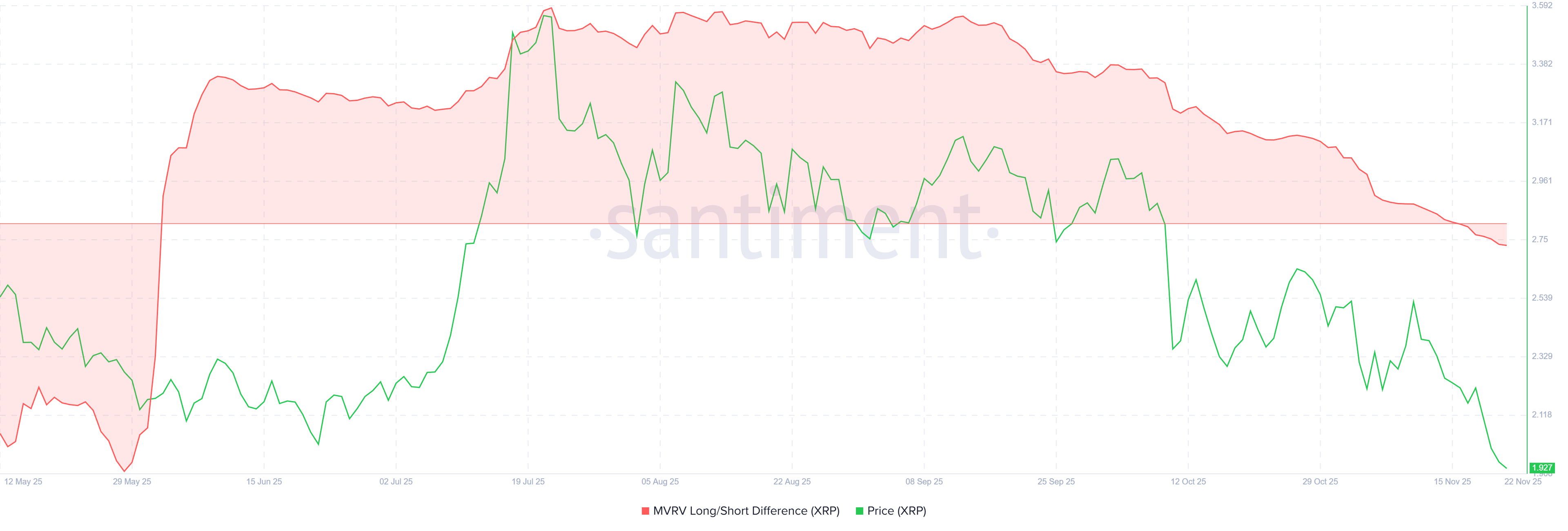

Macro indicators also highlight growing fragility. The MVRV Long/Short Difference has slipped below zero for the first time in five months, indicating that long-term holders have lost profitability. This shift pushes profit opportunity toward short-term holders, who tend to sell quickly once prices rise.

If XRP’s price rebounds even modestly, short-term holders may capitalize on their gains by selling, which could suppress upward movement. This dynamic often keeps volatility elevated and limits breakout potential.

XRP MVRV Long/Short Difference. Source:

Santiment

XRP MVRV Long/Short Difference. Source:

Santiment

XRP Price May Need Support

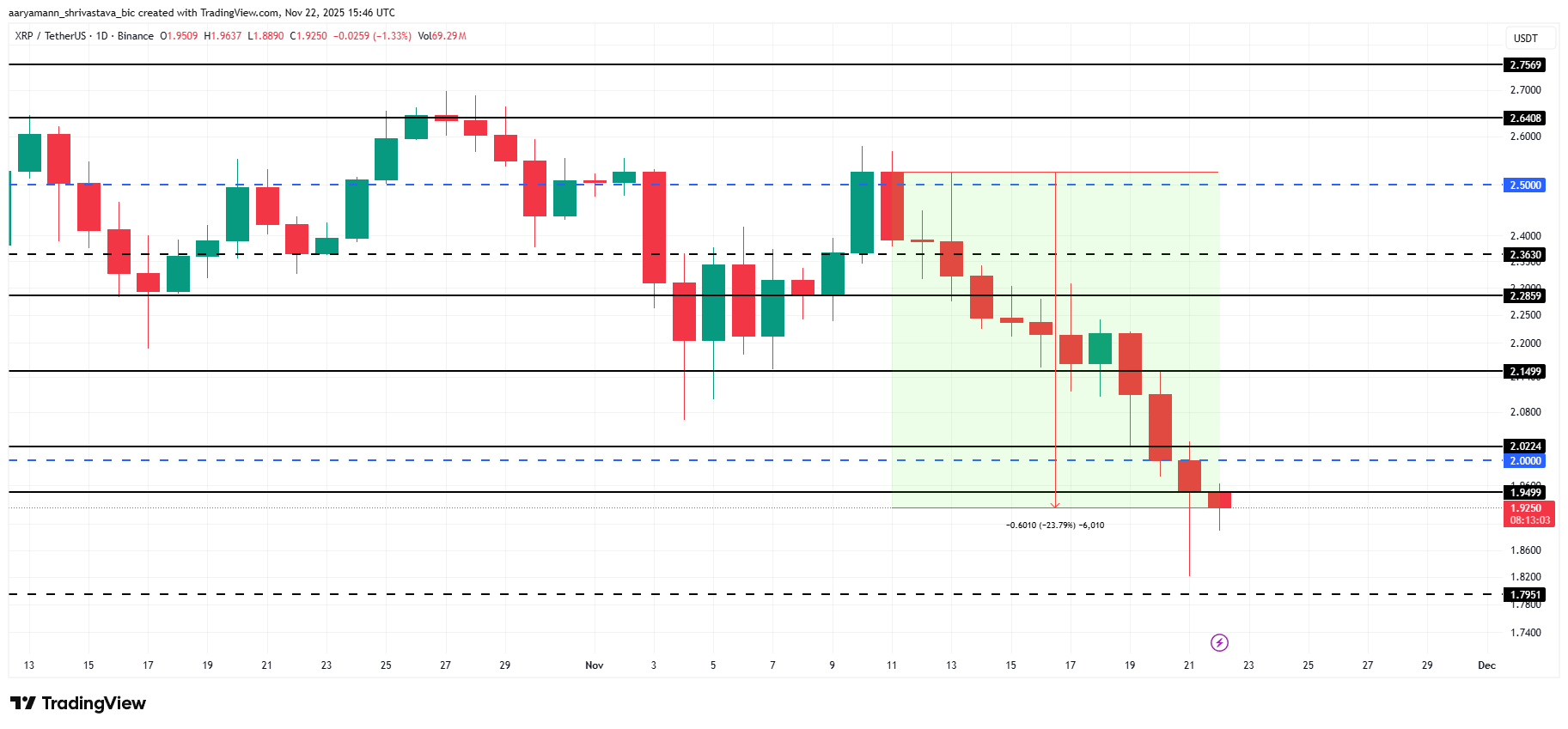

XRP has fallen 23% over the past 11 days and trades at $1.92, sitting just under the $1.94 resistance level. The drop below $2.00 marks a significant psychological break and reinforces the current bearish sentiment across the market.

If whale selling accelerates and macro indicators worsen, XRP could fall further toward $1.79 or even lower. Such a move would deepen losses and extend the current downtrend as market sentiment weakens.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if investor support stabilizes or broader market conditions improve, XRP may be able to reclaim $2.00 as support.

A successful recovery could lift the price toward $2.14 and higher, helping reverse recent losses and invalidating the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Hybrid Investment Strategies Drive Surge in Bitcoin Purchases Amid Ongoing Market Slump

- Cardone Capital buys 185 BTC for $15. 3M at $82,500/coin, expanding its real estate-crypto hybrid portfolio amid crypto market weakness. - Bitcoin falls below $90K for first time in seven months as U.S. ETFs lose $3.79B in November outflows, with BlackRock's IBIT accounting for 63%. - Grant Cardone's hybrid model contrasts with pure-play crypto treasuries, using real estate cash flow to fund Bitcoin accumulation and claiming $125M in year-one EBITDA. - Market fears a prolonged bear market as Bitcoin drop

Bitcoin Updates Today: The Future of Bitcoin in 2026 Hinges on Federal Reserve's Actions on Inflation

- Bitcoin's 2026 recovery depends on Fed inflation policy linked to CPI, PPI, and PCE metrics. - Persistent CPI/PCE inflation above 2% delays rate cuts, increasing Bitcoin's opportunity cost as non-yielding asset. - PPI input cost trends influence manufacturing pricing, prolonging inflation risks for Bitcoin's bearish environment. - PCE's alignment with consumer behavior shifts could accelerate Fed rate cuts, boosting Bitcoin's appeal as monetary easing hedge. - Housing/energy inflation volatility and Fed

Bitcoin Updates: MSTR Takes on Crypto Hedging Burden, Revealing Weaknesses in the Market

Bitcoin ATM Firm Weighing $100 Million Sale Following Money Laundering Charges