ZK Technology's Price Rally: An In-Depth Analysis of On-Chain Usage and Protocol Enhancements

- ZKsync's Q3 2025 protocol upgrades (OS v0.0.5) achieved 15,000 TPS and 1-second block times, enabling high-frequency trading and institutional compliance via Merkle-proof verification. - November 2025 saw ZK rollups process 15,000 TPS, $3.3B TVL in ZKsync, and $2.98B derivatives volume, driven by enterprise adoption from Goldman Sachs and major banks . - Developer activity surged 230% with solx Compiler beta and LLVM-based tooling, while 35+ institutions tested ZKsync's Prividium for confidential cross-b

Protocol Upgrades: Laying the Groundwork for Scalability and Regulatory Alignment

The protocol improvements made by ZKsync in Q3 2025, notably the deployment of OS v0.0.5, represented a significant leap forward. This version brought in correctness validations, addressed technical liabilities, and reduced block times to below one second with 200 ms intervals,

On-Chain Adoption: Growth in Transactions and Institutional Interest

The Q3 2025 enhancements sparked a notable rise in on-chain usage. By November 2025, ZK rollups were handling up to 15,000 TPS,

Developer Activity: Accelerated Ecosystem Expansion

Developer participation in the ZKsync ecosystem surged in late 2025. The solx Compiler entered beta, allowing contracts to comply with Ethereum’s 24 kB size limit and passing validation for 24 production projects. The zksync-era GitHub repository experienced rapid growth in contributors,

Institutional Adoption: Bridging Compliance and Practical Use

Institutional uptake became a cornerstone of ZK’s expansion. The reversal of Tornado Cash sanctions in late 2025 eliminated regulatory ambiguity, while ZKsync’s selective disclosure features (via Prividium) enabled confidential international payments and intraday repo transactions in a pilot with over 35 financial institutions.

Obstacles and Future Prospects

Despite these advances, ZKsync encountered some short-term challenges.

Conclusion: A Strong Case for Investment

The price rally of ZK technology in November 2025 is grounded in real advancements in scalability, compliance, and institutional integration, rather than mere speculation. With transaction throughput surpassing 15,000 TPS, TVL reaching $3.3 billion, and a 230% jump in developer activity, the ecosystem has proven its ability to sustain growth. For investors, the convergence of protocol improvements, robust on-chain data, and institutional demand provides a solid basis for medium-term value creation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

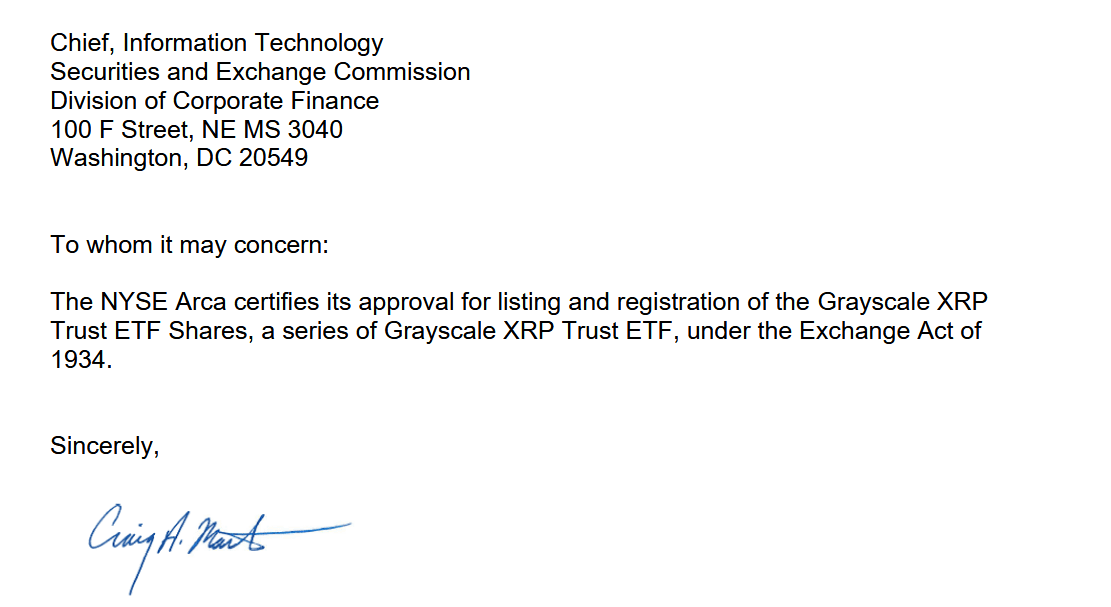

Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch

Crypto Price Today: Bitcoin, Ethereum, XRP and Solana Attempt a Weak Rebound

Bitcoin News Today: "Institutions See Bitcoin as the New Gold Amid Market Downturn"

- Institutional investors like Abu Dhabi’s ADIC and KindlyMD are buying Bitcoin amid its 29% price drop, viewing it as a long-term store of value akin to gold . - ADIC tripled its stake in BlackRock’s IBIT to $518M, while KindlyMD raised $540M to hold 5,398 Bitcoin at $118K average cost, signaling strategic crypto bets. - Despite $3.1B ETF outflows and regulatory risks, Harvard and El Salvador added to Bitcoin holdings, with analysts forecasting potential 2026 recovery if macroeconomic stability returns.

Bitcoin News Update: Index Firms' Reclassification May Trigger $9 Billion Outflow from MicroStrategy

- MicroStrategy risks $9B passive fund outflows if index providers reclassify it as a digital asset vehicle, excluding it from major benchmarks like MSCI USA and Nasdaq 100. - The company holds 80%+ of its value in Bitcoin ($54.4B), creating leverage risks as crypto prices fall and its stock trades below net asset value. - CEO Saylor claims "indestructibility" despite 67% stock price drop and $8.1B debt, while analysts debate whether MicroStrategy should be categorized as an operating firm or crypto fund.