Bitcoin ETFs Hit Record $11.5 Billion Volume as Most Investors Slip Into Losses

Despite market volatility, the 12 Bitcoin ETFs posted net inflows of more than $238 million as some investors bought the dip.

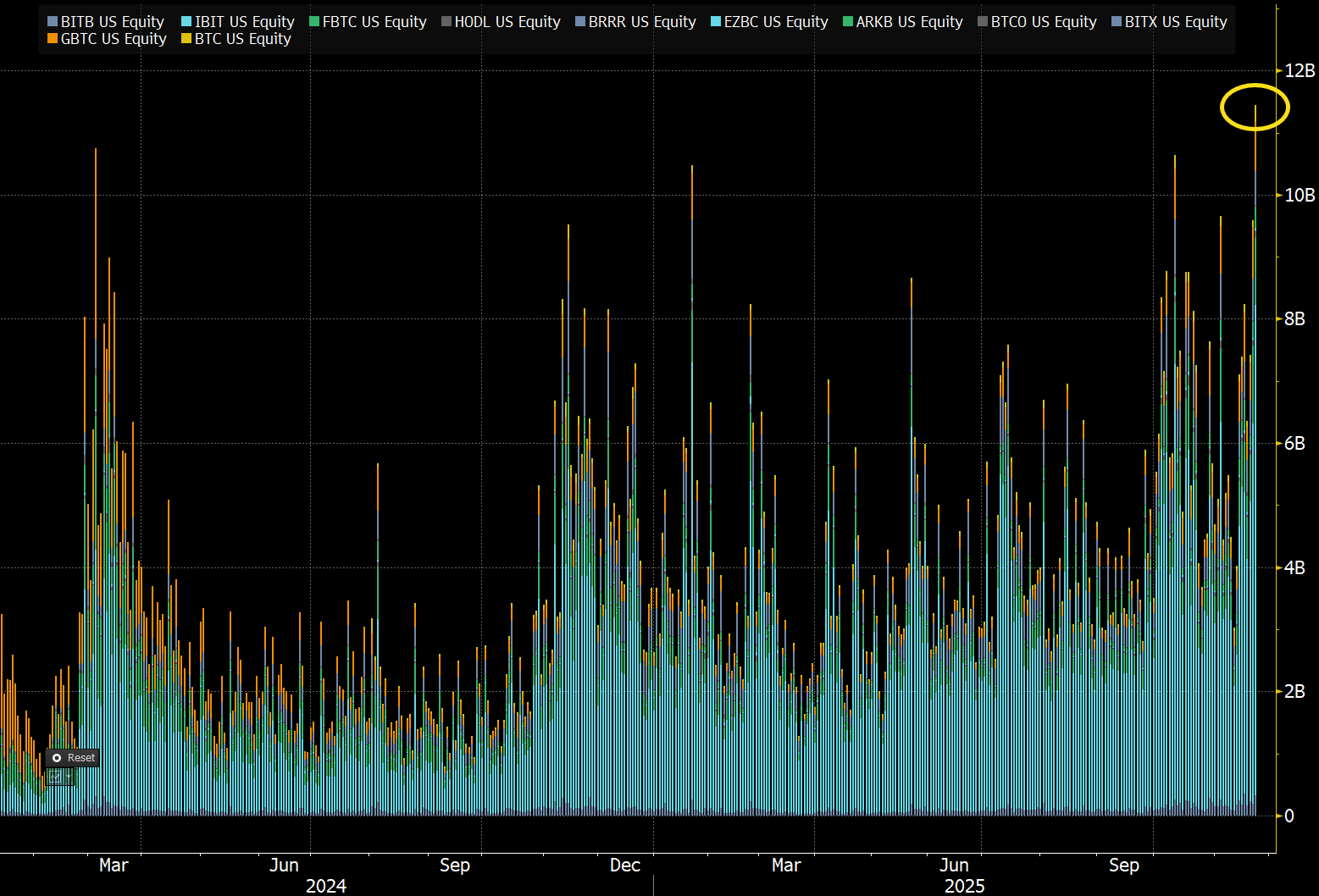

US spot Bitcoin exchange-traded funds just posted their busiest trading session ever, even as the recent slide in the cryptocurrency’s price has left the average ETF investor holding losses.

The surge in activity marks a new phase in the market’s adjustment to this month’s selloff in the sector.

BlackRock’s IBIT on Top as $238 Million Inflows Return Amid Market Stress

On November 21, Bloomberg Senior ETF Analyst Eric Balchunas reported that the 12 spot Bitcoin ETFs recorded $11.5 billion in combined trading volume.

US Bitcoin ETFs Record Trading Volume. Source:

Eric Balchunas

US Bitcoin ETFs Record Trading Volume. Source:

Eric Balchunas

Balchunas described the spike in volume as “wild but normal,” noting that ETFs and other asset classes tend to record elevated turnover during periods of market stress.

He said such bursts of activity often signal the release of liquidity as investors reshuffle positions.

The elevated turnover reflected brisk two-way participation, with some investors cutting exposure while others took advantage of lower prices to add to positions.

BlackRock’s IBIT led the surge, generating $8 billion in turnover and accounting for more than 69% of all spot Bitcoin ETF trading that day. This was IBIT’s highest-volume session since launch, though the fund still ended the day with $122 million in outflows.

“Also, no surprise record week for Put volume in IBIT.. this is one thing that may help people stay the course, they can always buy some puts as a hedge while they stay long,” Balchunas added.

Meanwhile, other Bitcoin ETFs, led by Fidelity’s FBTC, posted net inflows of more than $238 million.

Despite this inflow, the 12 Bitcoin investment vehicles are on course for their worst trading month, with net outflows of more than $3.5 billion.

US Bitcoin ETFs Monthly Flows. Source:

SoSoValue

US Bitcoin ETFs Monthly Flows. Source:

SoSoValue

This substantial outflow and record session come as the average spot Bitcoin ETF holder has slipped into the red.

Data from Bianco Research shows the weighted average purchase price for spot Bitcoin ETF inflows stood at $91,725 as of November 20.

The average Spot BTC ETF holder is now in the red.

— Jim Bianco (@biancoresearch) November 20, 2025

Bitcoin’s drop below that level this week pushed most holders, including those who entered the market in January 2024, into unrealized losses.

Bitcoin fell roughly 12% this week to as low as $80,000 before recovering to $84,431 as of press time. This price performance extends a month-long slide and reinforces the risk-off sentiment across digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: DeFi's Vulnerability Exposed—Centralized DNS Attacks Lead to User Asset Loss

- Aerodrome and Velodrome DEXs suffered DNS hijack attacks, redirecting users to phishing sites via compromised registrars like Box Domains. - Attackers exploited centralized domain vulnerabilities to steal ETH, NFTs, and stablecoins, mirroring a 2023 incident that caused $100K+ losses. - Platforms urged users to bypass main domains and use decentralized mirrors, highlighting ongoing risks in DeFi's off-chain infrastructure. - Experts recommend DNSSEC and ENS adoption as solutions, while Dromos Labs plans

Ethereum Updates Today: Mutuum Finance Leads the Next Crypto Era with Utility-Focused DeFi Advancements

- Mutuum Finance (MUTM) leads crypto's utility-driven shift, raising $18.8M in Phase 6 presale at $0.035. - Its hybrid P2C/P2P lending protocol optimizes DeFi liquidity, addressing 83-95% idle capital inefficiencies. - Certified by 90/100 audit score and 2025 testnet launch, MUTM targets $2.50 by 2030 (7,000% gain). - Phased pricing model and 45.5% early allocation drive urgency, outpacing memecoins with structural growth. - Analysts position MUTM as Ethereum alternative, prioritizing real-world adoption o

Solana (SOL) Price Forecast for Q1 2026: Are Network Improvements and Ecosystem Expansion Enough to Support an Optimistic Perspective?

- Solana's 2025 Firedancer/Alpenglow upgrades enhance scalability, positioning it as a top Layer-1 competitor with faster consensus and lower costs. - Strategic partnerships with Coinbase and PrimeXBT boost institutional adoption, while $3B+ ecosystem revenue highlights DeFi and meme coin growth. - Anticipated spot ETF approvals and Fed rate cuts could inject $6B+ liquidity, potentially pushing SOL toward $279 in Q1 2026 if upgrades gain traction. - Risks include regulatory scrutiny of key projects and unr

The Federal Reserve's Change in Policy and Its Unexpected Effects on the Solana Ecosystem

- Fed's 2025 policy shift ends QT, cuts rates 0.25%, triggering global market shifts and Solana's DeFi ecosystem repositioning. - Solana leverages Fed liquidity injections through Coinbase's Vector acquisition and Wormhole's Sunrise gateway to boost DeFi scalability. - Network TVL drops 4.7% amid macro uncertainty, while SIMD-0411 proposal reduces Solana's issuance by $2.9B by 2029 to reinforce scarcity. - Fed's $72.35B liquidity injection correlates with Solana's $3.65B daily trading volume spike, yet reg