Crypto Markets Wiped $1Trillion, but Raoul Pal sees a Strong Bitcoin Recovery

-

Crypto market lost $1 trillion, but Raoul Pal says sharp Bitcoin recoveries are normal.

-

Raoul Pal compares current crash to past cycles where Bitcoin bounced back strongly.

-

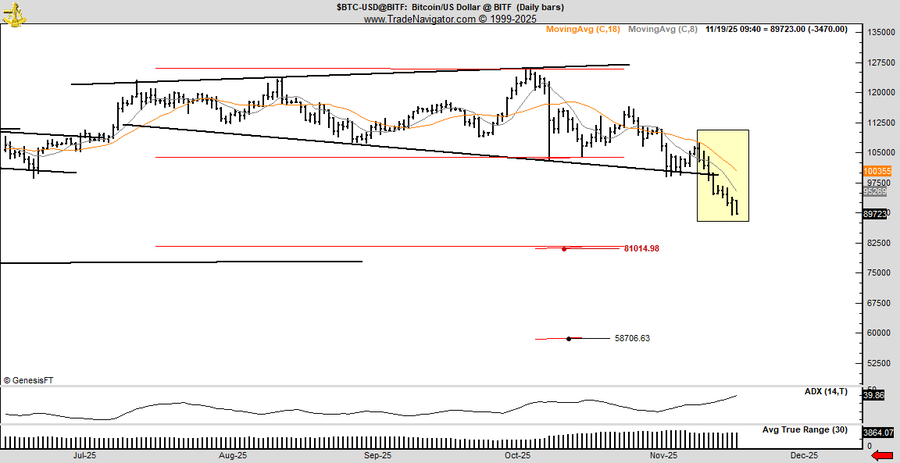

Analyst Peter Brandt warns Bitcoin could fall deeper toward $81,000 or even $58,000.

The crypto market is going through one of its toughest periods in over the past weeks, wiping out roughly $1 trillion from the market. Prices are falling fast, traders are panicking, and rumors about weakened market makers are adding more fear to the fire.

But while the drop looks scary, macro investor Raoul Pal believes this kind of heavy shake-out has happened before and often leads to strong recoveries.

Bitcoin’s Historical Pattern Repeating Again

In his post, Pal shared a striking long-term Bitcoin chart, comparing today’s drop with the shocking crash of 2021. Back then, Bitcoin fell 56% in just one month, Ethereum dropped 62%, and Solana plunged 68%.

Everyone panicked, and then the market suddenly flipped, and crypto exploded to new all-time highs.

That wasn’t the only time. From 2019 to 2020, Bitcoin fell 72% before bouncing back stronger. Between 2016 and 2017, Bitcoin saw seven drops of more than 30% each, yet the overall trend remained upward.

Each time, altcoins fell even harder. Each time, fear won in the short term, and patience won in the long term.

Pal’s View: Pain Now, Opportunity Later

Despite the chaos, Pal remains calm. He says he is adding to his positions during this drop because he sees the long-term trend as strong. However, he also reminds everyone that each person’s risk level and time horizon are different.

Pal also shared an important price point to watch. According to him, if Bitcoin can break above the $85,000 level and turn it into a strong support, the next target would be $89,326. He believes this zone could act as the next step before Bitcoin decides its bigger move.

Bitcoin Could Drop to $58K

While some analysts expect a recovery, veteran trader Peter Brandt is warning that Bitcoin could still see a deeper drop.

According to him, Bitcoin made a small breakout on November 11, but instead of building strength, the price kept falling for eight straight days, creating “lower highs.” This shows that sellers are still in control and buyers are not able to push the price up.

Based on his analysis, he sees $81,000 and $58,000 as important levels Bitcoin could revisit if the selling continues. A drop to $58,000, he said, could trigger strong panic among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: DeFi's Vulnerability Exposed—Centralized DNS Attacks Lead to User Asset Loss

- Aerodrome and Velodrome DEXs suffered DNS hijack attacks, redirecting users to phishing sites via compromised registrars like Box Domains. - Attackers exploited centralized domain vulnerabilities to steal ETH, NFTs, and stablecoins, mirroring a 2023 incident that caused $100K+ losses. - Platforms urged users to bypass main domains and use decentralized mirrors, highlighting ongoing risks in DeFi's off-chain infrastructure. - Experts recommend DNSSEC and ENS adoption as solutions, while Dromos Labs plans

Ethereum Updates Today: Mutuum Finance Leads the Next Crypto Era with Utility-Focused DeFi Advancements

- Mutuum Finance (MUTM) leads crypto's utility-driven shift, raising $18.8M in Phase 6 presale at $0.035. - Its hybrid P2C/P2P lending protocol optimizes DeFi liquidity, addressing 83-95% idle capital inefficiencies. - Certified by 90/100 audit score and 2025 testnet launch, MUTM targets $2.50 by 2030 (7,000% gain). - Phased pricing model and 45.5% early allocation drive urgency, outpacing memecoins with structural growth. - Analysts position MUTM as Ethereum alternative, prioritizing real-world adoption o

Solana (SOL) Price Forecast for Q1 2026: Are Network Improvements and Ecosystem Expansion Enough to Support an Optimistic Perspective?

- Solana's 2025 Firedancer/Alpenglow upgrades enhance scalability, positioning it as a top Layer-1 competitor with faster consensus and lower costs. - Strategic partnerships with Coinbase and PrimeXBT boost institutional adoption, while $3B+ ecosystem revenue highlights DeFi and meme coin growth. - Anticipated spot ETF approvals and Fed rate cuts could inject $6B+ liquidity, potentially pushing SOL toward $279 in Q1 2026 if upgrades gain traction. - Risks include regulatory scrutiny of key projects and unr

The Federal Reserve's Change in Policy and Its Unexpected Effects on the Solana Ecosystem

- Fed's 2025 policy shift ends QT, cuts rates 0.25%, triggering global market shifts and Solana's DeFi ecosystem repositioning. - Solana leverages Fed liquidity injections through Coinbase's Vector acquisition and Wormhole's Sunrise gateway to boost DeFi scalability. - Network TVL drops 4.7% amid macro uncertainty, while SIMD-0411 proposal reduces Solana's issuance by $2.9B by 2029 to reinforce scarcity. - Fed's $72.35B liquidity injection correlates with Solana's $3.65B daily trading volume spike, yet reg