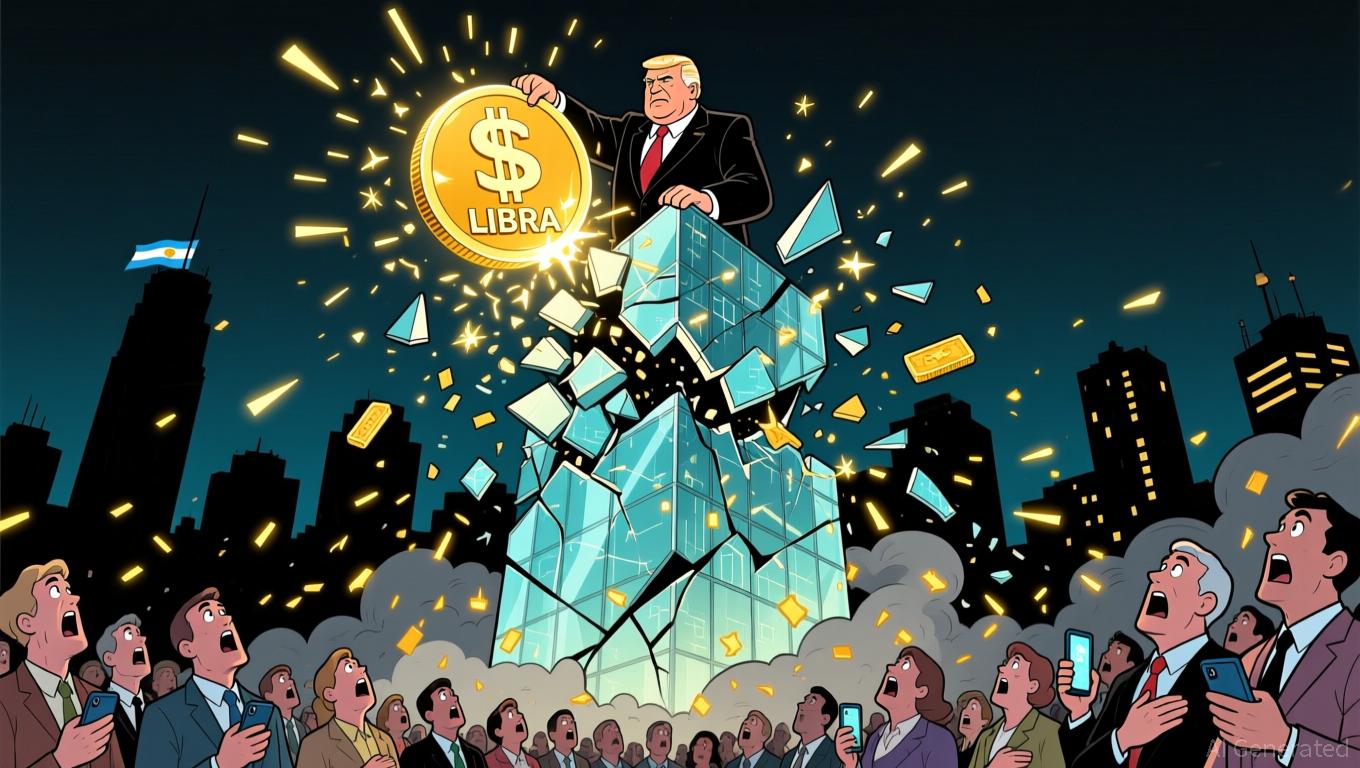

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate

Argentine President Javier Milei is under increasing examination after a congressional committee determined that his endorsement of the failed $LIBRA cryptocurrency amounted to official misconduct, urging a formal probe into his activities. The Chamber of Deputies' investigative panel issued a 200-page document

The report highlights that Milei’s public backing of $LIBRA in February 2025—through a social media post that has since been deleted—sparked a spike in trading activity before the token’s sudden downfall, which experts described as a "rug pull." Investigators claim the president’s involvement was "crucial" to the scheme,

Legal and political fallout is escalating.

The controversy adds to Milei’s mounting difficulties, as his administration is already under fire for alleged corruption involving the National Disability Agency (ANDIS), where his sister is accused of accepting bribes from pharmaceutical deals

As the $LIBRA scandal continues to unfold, the report’s focus on systematic avoidance of regulatory oversight raises larger concerns about cryptocurrency governance in Argentina. The conclusions may shape future legislative discussions on digital assets,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: Altcoin ETFs See Growth While Bitcoin and Ethereum Funds Face $4.2B Outflows in 2025

- Coinbase acquires Vector DEX to expand Solana integration, aiming to become an "everything exchange" with faster trading execution. - Altcoin ETFs (Solana, XRP) attract $632M in inflows, contrasting $4.2B outflows from Bitcoin/Ethereum ETFs amid macroeconomic uncertainty. - Institutional infrastructure advances include GSR's unified trading platform and GoPlus' $5B+ token security API usage, addressing volatility risks. - Market shifts toward diversified assets and institutional-grade tools persist as re

Bitcoin Updates: American Bitcoin Holders Pull Back While Asian Markets Strengthen Amid Changing Crypto Liquidity

- Coinbase's Bitcoin premium index hit -0.0499% on Nov 19, its widest negative level since Q1 2025, reflecting U.S. selling pressure and institutional profit-taking. - U.S. Bitcoin ETFs saw $2.47B in redemptions (63% of total outflows) as prices fell to 7-month lows, contrasting with rising Asian liquidity in spot markets. - Asian markets absorbed BTC inflows while U.S. capital retreated, signaling geographic liquidity reallocation rather than structural demand decline. - Macroeconomic factors including fa

2025's Business Landscape: Strategic Shifts Across Industries Transform Market Dynamics

- 2025's corporate landscape saw GSK transfer £17.995/share treasury stock to employee trusts, reflecting firms using share reserves for talent retention amid tight labor markets. - Formula 1's U.S. sponsorship boom (125 companies in 2025 vs. 44 in 2017) highlighted tech/AI partnerships as innovation-driven sponsorships reshaped the sport's commercial strategy. - Coinbase's acquisition of Solana-based DEX Vector (its 9th 2025 deal) aligned with $1T+ Solana DEX volume growth, signaling crypto exchanges' pus

Solana News Update: Solana ETFs Draw $421 Million Despite Price Drop, Bucking Overall Market Decline

- 21Shares launched a Solana ETF (TSOL) in the U.S., joining Fidelity and Bitwise in driving $421M in inflows despite SOL's 30% price drop. - Institutional interest grows as ETFs highlight Solana's real-world use cases in DeFi and gaming, though technical indicators show bearish momentum. - Regulatory clarity and staking innovations may sustain long-term adoption, but SOL faces critical resistance at $140 amid macroeconomic uncertainties.