Bitcoiners perk up as odds of a December Fed rate cut almost double

Bitcoiners were noticeably more upbeat on social media today as the odds of a US Federal Reserve rate cut in December nearly doubled compared to just a day earlier.

Some crypto market participants are speculating that this could be the catalyst Bitcoin (BTC) needs to halt the asset’s downward trend.

“Let’s see if that’s enough to find a bottom here for now,” crypto analyst Moritz said in an X post on Friday, as Bitcoin’s price trades at $85,071, down 10.11% over the past seven days, according to CoinMarketCap.

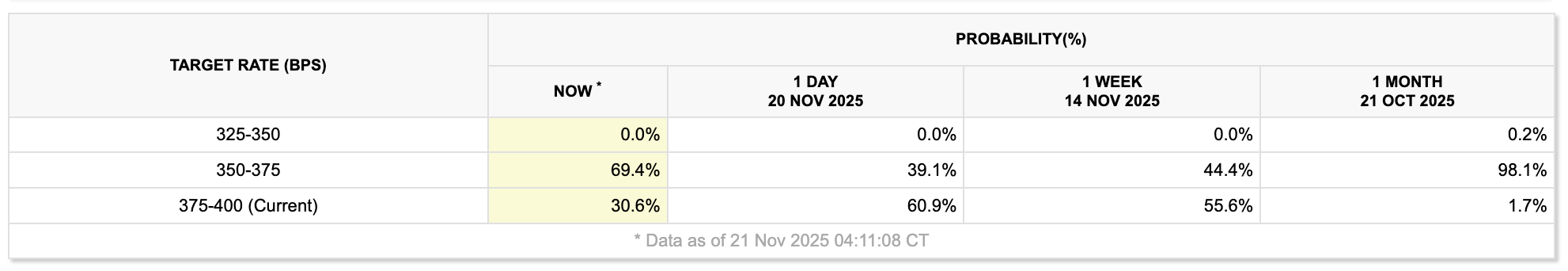

On Friday, the odds of an interest rate cut at the December Federal Open Market Committee (FOMC) meeting almost doubled to 69.40%, according to the CME FedWatch Tool. Just the day before, on Thursday, it was nearly 30.30% lower, at 39.10%.

Many in the wider market attributed the spike at least partly to dovish remarks from New York Fed president John Williams, who said the Fed can cut rates “in the near term” without endangering its inflation goal. Bloomberg analyst Joe Weisenthal said it was the reason the odds have “massively increased.”

The setup is looking “unfathomably bullish,” says analyst

However, economist Mohamed El-Erian warned market participants not to get “carried away” by the comments. Meanwhile, the broader crypto community has reacted even more bullishly. “Usually this would be bullish,” Mister Crypto said in an X post on Friday.

The Fed cutting rates is typically bullish for riskier assets such as Bitcoin and the broader crypto market, as traditional assets such as bonds and term deposits become less lucrative to investors.

Crypto analyst Jesse Eckel pointed to the surging rate cut odds and said, “If you zoom out, the setup is unfathomably bullish.”

“I don’t know why we keep going lower,” Eckel said. “We are going from a tightening cycle into an easing cycle,” he added.

Crypto analyst Curb said, “Crypto will explode in a massive rally.”

The odds of a rate cut were previously “mispriced”

Coinbase Institutional said in a X post on Friday, “While markets are leaning toward ‘no cut’ this time, we believe the odds for a rate cut are actually mispriced. Recent tariff research, private market data, and real-time inflation indicators suggest otherwise.”

Related: BTC ETF outflows are 'tactical rebalancing,' not institutional flight: Analysts

“Since the October FOMC meeting, futures have shifted from expecting a 25bps cut to favoring a hold, mainly due to rising inflation concerns,” Coinbase Institutional said.

“However, studies show that tariff hikes can lower inflation and increase unemployment in the short term, acting like negative demand shocks,” it added.

It comes as sentiment across the entire crypto market has remained weak over the past seven days. The Crypto Fear & Greed Index, which measures overall crypto market sentiment, posted an “Extreme Fear” score of 14 in its Friday update.

Magazine: Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Innovative Tokenomics and Interoperable Cross-Chain Features: The Key to Altcoin Success in 2025

- 2025 altcoin market highlights Bitcoin Munari (BTCM), XRP Tundra, and Mutuum Finance (MUTM) leveraging multi-chain infrastructure and structured presales. - BTCM's fixed-supply model ($0.35 presale) and Solana-based SPL token deployment aim for 2027 Layer-1 migration with EVM compatibility and privacy features. - XRP Tundra offers cross-chain yield via dual-token system (TUNDRA-S/X) with $0.214 Phase 12 pricing and audited Cryo Vaults for Bitcoin holders. - Mutuum Finance (MUTM) nears 99% Phase 6 allocat

Bitcoin Updates: Institutional Funds Move: AI ETFs Gain Momentum Amid Growing Crypto Debt Issues

- Bitcoin and Solana face renewed selling pressure as digital asset treasury companies (DATCos) offload holdings amid $42.7B corporate debt inflows into crypto. - DATCos, underwater on $126K Bitcoin peak investments, approach parity in market-to-net-asset-value ratios, triggering 40% Solana treasury value declines since October. - Institutional capital shifts toward AI ETFs (e.g., Global X AI ETF) as firms prioritize AI infrastructure investments over crypto, linking performance to tech stock volatility. -

Fed Policy Split Drives Derivatives Activity as Crypto Teeters on Brink of Easing

- Fed policy uncertainty drives derivatives bets, with CME FedWatch pricing 69.7% chance of 25-bp December rate cut amid mixed inflation and labor data. - Crypto markets anticipate easing cycle, but remain fragile as Crypto Fear & Greed Index hits "extreme fear" level 14 despite Coinbase's bearish odds assessment. - Crude oil drops on U.S. Ukraine peace plan and OPEC output hike, while dollar strength compounds risks for rate-cut-sensitive commodities. - CME Group faces scrutiny after $2M insider sale, yet

Modern Monetary Theory and the Valuation of Cryptocurrencies: Do MMT Principles Support Rapid Increases in Token Prices?

- 2025 analysis explores whether Modern Monetary Theory (MMT) can justify Momentum (MMT) token's 1,300% price surge. - Token's rise stems from Binance airdrops, U.S./EU regulatory clarity, and institutional investment, not MMT principles. - Academic research highlights crypto valuation duality: network effects coexist with speculative behavior driven by heterogeneous expectations. - MMT influences macroeconomic frameworks (CBDCs, fiscal policy) but fails to predict token-specific surges dominated by retail