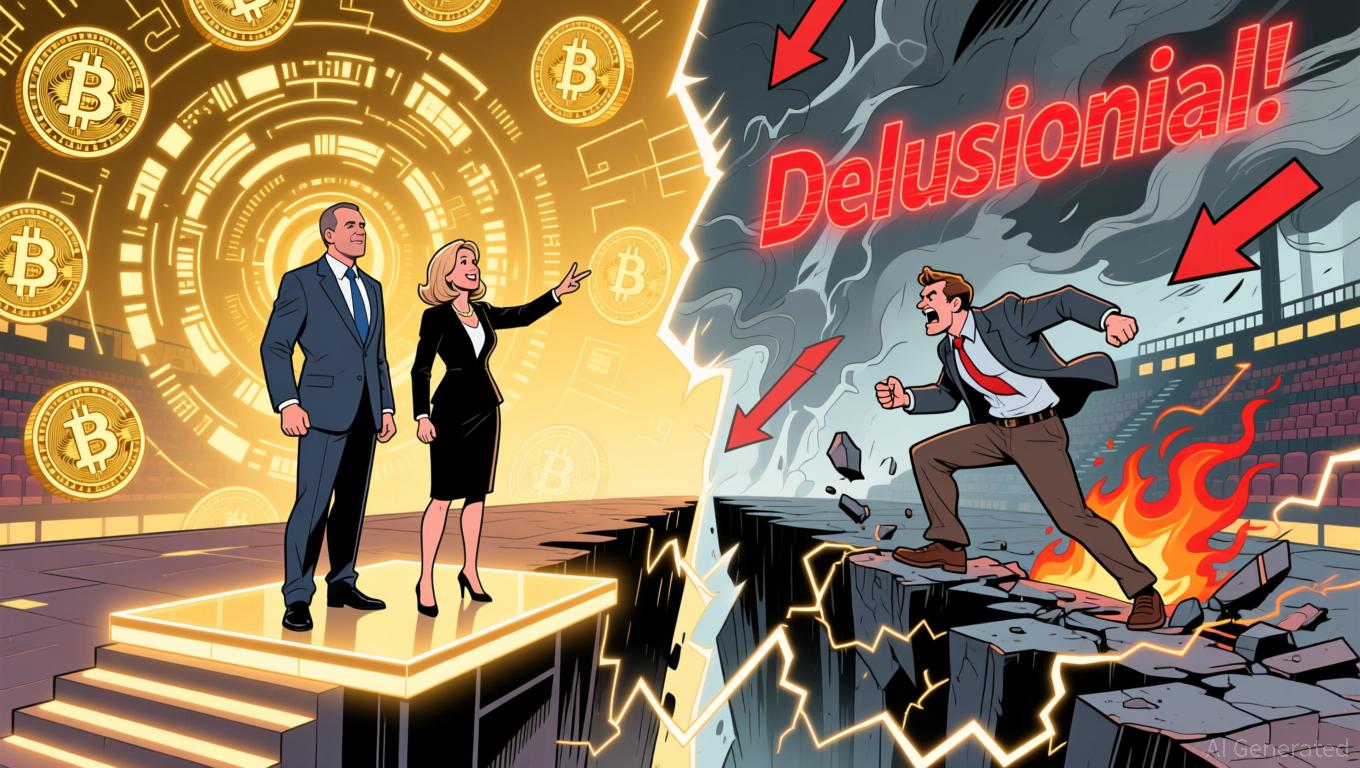

Bitcoin Updates: Crypto Enthusiasts and Conventional Experts Debate $1 Million Bitcoin Projection

Jim Cramer, who has long been critical of Bitcoin's lofty price targets, has intensified his doubts, ridiculing optimistic forecasts that claim the cryptocurrency could be valued at $1 million per coin by 2030. The CNBC anchor singled out Michael Saylor, the CEO of MicroStrategy, whose persistent support for Bitcoin's future has made him a central figure in crypto discussions. "The usual crypto bulls are gearing up for another round of hype, throwing out numbers like $1 million per

Saylor, a prominent Bitcoin advocate, has stuck to his viewpoint despite recent market swings. At the Money20/20 event in October,

This ongoing debate highlights the growing divide between staunch crypto supporters and traditional finance experts. Saylor and his supporters point to Bitcoin’s limited supply and increasing institutional interest as positive factors, while skeptics like Cramer argue that such predictions overlook broader economic challenges. "They always have to justify their stance," Cramer remarked,

At the same time, blockchain data shows Bitcoin’s lasting impact. A strategy linked to the asset

As the discussion continues, the $1 million Bitcoin prediction remains unverified—a goal that,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin's Recent Decline: Can Institutional Investors Help Steady the Market or Intensify the Slump?

- Bitcoin's price drop below $85,000 has intensified debates as long-term holders offload over 400,000 BTC, per economist Peter Schiff's warning about "weak hands" deepening selloffs. - High-profile exits like Owen Gunden's $1.3B BTC liquidation highlight profit-taking by OGs, while institutions via ETFs have absorbed 2.39M BTC since 2024, per Ark Invest. - Market fragility worsens as gamma exposure forces dealers to sell near $85,000 support, but institutional demand could stabilize prices if buying conti

YFI Value Drops 4.78% Over the Past Week as Market Fluctuations Continue

- YFI rose 0.1% in 24 hours but fell 4.78% in seven days, with 14.2% monthly and 50% annual declines. - Price movements reflect broader market instability, not project-specific updates or governance changes in Yearn.finance. - Analysts predict YFI remains sensitive to macroeconomic trends and global investor sentiment in the near term. - Token consolidation continues without fundamental shifts, urging investors to monitor on-chain metrics and protocol updates.

Bitcoin News Today: Bitcoin Drops to $90K—Is This a Prime Buying Chance or the Start of a Deeper Downturn?

- Bitcoin fell below $90,000, pushing 70% of active capital into losses and erasing $120B in market value. - Short-term holders face >30% drawdowns, with fear metrics hitting 2-year lows as $1.9B in leveraged positions liquidated. - Analysts cite historical rebounds after extreme fear, but MicroStrategy's leveraged holdings risk further selling if prices drop. - Institutional actions and Fed policy uncertainty remain key factors, though oversold indicators suggest potential 40% near-term rebound.

Coast Guard Strengthens Prohibition of Hate Symbols to Combat Antisemitism and Extremist Activity

- U.S. Coast Guard reversed a policy to reclassify hate symbols like swastikas and nooses from "potentially divisive" to prohibited, following backlash from lawmakers and advocacy groups over antisemitism risks. - The reversal came after a leaked draft proposal aligned with Trump-era Pentagon directives, which critics argued weakened harassment definitions and accountability for hate incidents. - Coast Guard reaffirmed strict prohibitions on divisive symbols, emphasizing severe punishment for violations, b