Aster Price Dips 8% But This Secret Ingredient Is Keeping Its Uptrend Alive

Aster has slipped 8% in the past 24 hours, yet the altcoin continues to maintain a broader uptrend that has held firm for nearly three weeks. Despite bearish pressure from the wider crypto market, Aster is benefiting from unique structural advantages that are helping it resist deeper declines. Aster Has The Key To A Safe

Aster has slipped 8% in the past 24 hours, yet the altcoin continues to maintain a broader uptrend that has held firm for nearly three weeks.

Despite bearish pressure from the wider crypto market, Aster is benefiting from unique structural advantages that are helping it resist deeper declines.

Aster Has The Key To A Safe Rally

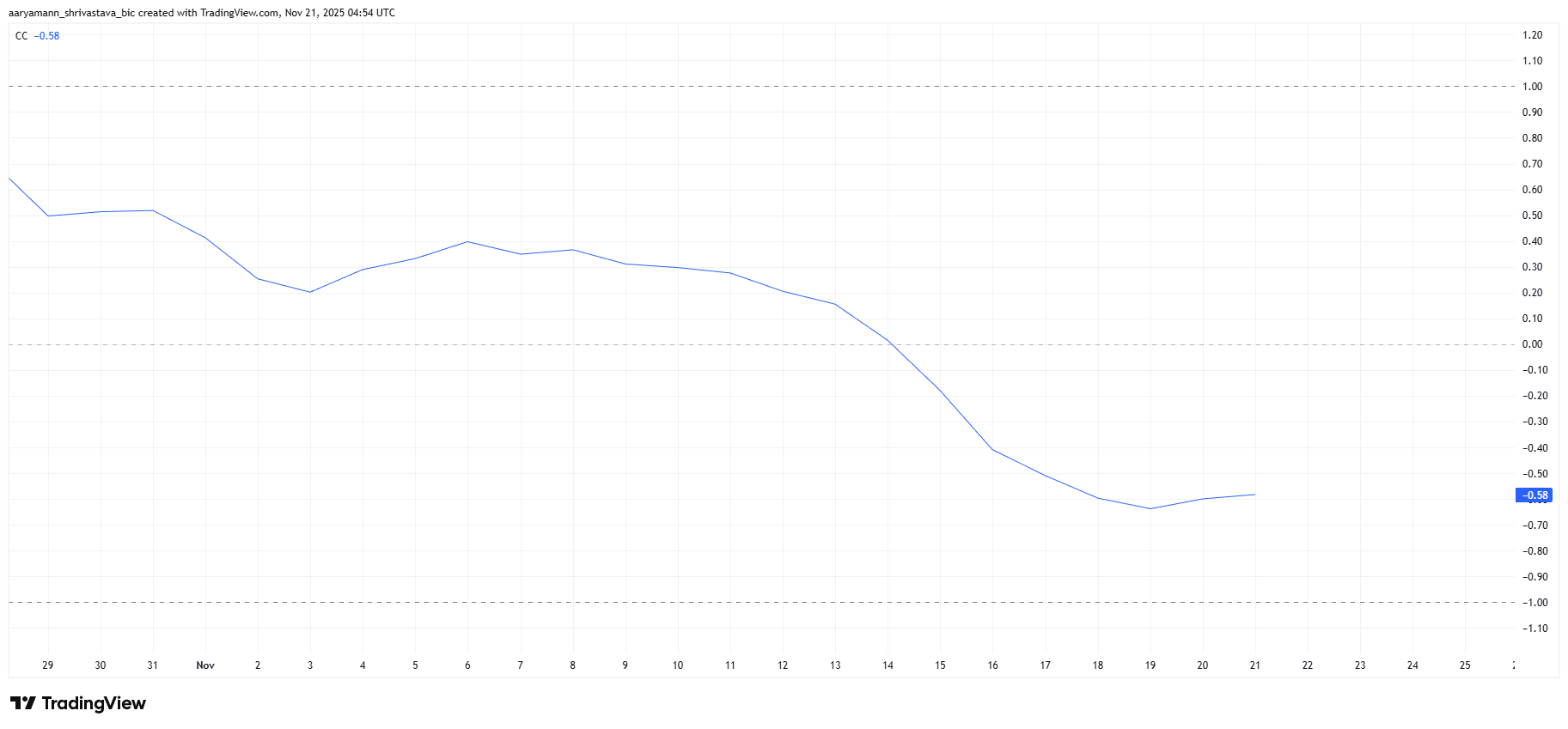

Aster’s negative correlation with Bitcoin is strengthening its position. At the time of writing, the correlation coefficient between Aster and BTC sits at -0.58, indicating that the two assets are moving in opposite directions. With Bitcoin continuing to decline on the daily chart, this negative relationship gives Aster room to rise even as the market weakens.

This dynamic has turned into one of Aster’s biggest advantages. As Bitcoin retreats, Aster’s price structure gains support from its divergence, allowing buyers to step in without the usual pressure tied to BTC’s volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ASTER Correlation To Bitcoin. Source:

ASTER Correlation To Bitcoin. Source:

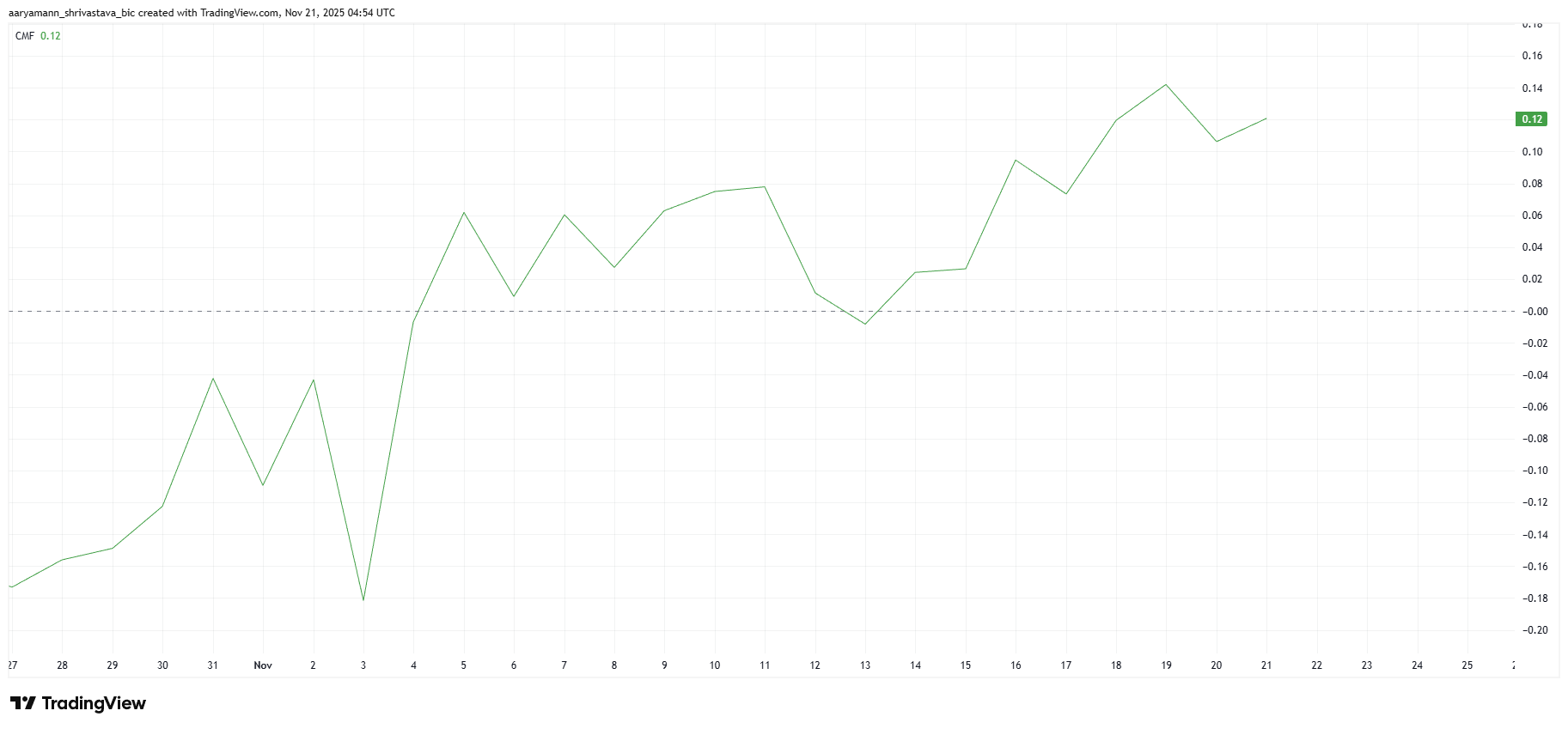

Macro momentum indicators are also pointing toward strengthening inflows. The Chaikin Money Flow is showing a sharp uptick, signaling rising capital entering the asset. Sustained positive CMF readings often indicate renewed investor confidence and provide essential backing for continued rallies.

Investor support plays a crucial role in maintaining price momentum, and Aster is benefiting from consistent accumulation. If these inflows continue, the altcoin could gain enough strength to push toward the $1.50 mark.

ASTER CMF. Source:

ASTER CMF. Source:

ASTER Price Will Continue Its Rise

Aster trades at $1.25 while holding above the key $1.20 support level, sitting just below the $1.28 resistance. Its current position suggests that the altcoin may continue rising as long as broader momentum and negative correlation with Bitcoin remain supportive.

Based on the current indicators, Aster’s nearly three-week-long uptrend appears likely to extend further. Even with the recent 8% drop, bullish conditions could drive the price toward $1.39. A breakout above that level would open the path to $1.50, reinforcing the strength of the ongoing rally.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if investors decide to lock in profits, Aster could lose its $1.20 support. A breakdown below that threshold may push the price to $1.07. This would invalidate the bullish thesis and signal a shift in sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: BitMine Targets '5% Alchemy' While Ethereum Treasury Exceeds $11.2 Billion

- BitMine (BMNR) holds 3.63M ETH (3.0% supply), becoming the world's largest Ethereum treasury with $11.2B in crypto/cash assets. - Recent 69,822 ETH purchase and institutional backing from ARK, Kraken, and Galaxy support its "Alchemy of 5%" goal to acquire 5% ETH supply. - Despite 40% ETH price drop causing $4B unrealized losses, BitMine plans 2026 staking infrastructure launch amid evolving crypto regulations. - As second-largest crypto treasury after MicroStrategy, BitMine's rapid ETH accumulation and l

COAI Token Fraud Aftermath and Safeguarding Investors in Cryptocurrency: Addressing Compliance Preparedness and Strategies for Reducing Risks

- COAI token's 2025 collapse erased $116.8M for C3.ai, exposing DeFi's systemic risks from algorithmic stablecoin failures and centralized control. - U.S. regulators modernized crypto oversight via SEC no-action letters and CFTC policy shifts, but fragmented frameworks persist between agencies. - Retail investors now rely on blockchain analytics tools and real-time fraud detection platforms to combat scams, as EU's MiCA regulation sets global benchmarks. - Post-COAI reforms emphasize balancing innovation w

XRP News Today: Institutional ETFs Drive XRP Closer to Widespread Acceptance

- XRP surged to $3.66 in July 2025 after years below $1, driven by ETF launches and regulatory optimism. - Eight U.S. XRP ETFs, including Grayscale’s fee-waived GXRP , attracted $423M in assets, signaling institutional validation. - Analysts project $5.05 by 2025 and $26.50 by 2030, but warn of risks like whale concentration and market manipulation. - Emerging projects like $APEING Whitelist highlight crypto’s cyclical nature, with ETFs creating new entry points for risk-tolerant investors.

Ethereum News Update: Miners Invest $200 Million in Ethereum DeFi, Anticipating a Supercycle

- Bitcoin miner BitMine adds $200M in Ethereum to reserves, citing confidence in its DeFi and smart contract potential. - L2 Capital's Tom Lee predicts a crypto "supercycle" by mid-2024, driven by ETF approvals and stablecoin regulations. - Institutional Ethereum holdings rise as firms like Argo and Hut 8 diversify portfolios, with crypto fund assets hitting $18B. - Analysts debate Ethereum's $10K 2025 target, noting Dencun upgrades' scalability benefits but cautioning regulatory risks from China/EU.