NEAR Intents Hits Record Transaction Volume, Raising Hopes That a Price Recovery is “NEAR”

In November, NEAR Intents’ daily fee revenue reached an all-time high. At the same time, its daily trading volume increased tenfold compared to the previous quarter. However, NEAR’s price continued to show weak performance and remained stuck in its 2025 accumulation range. These positive metrics sparked expectations that investors may secure strong entry positions before

In November, NEAR Intents’ daily fee revenue reached an all-time high. At the same time, its daily trading volume increased tenfold compared to the previous quarter. However, NEAR’s price continued to show weak performance and remained stuck in its 2025 accumulation range.

These positive metrics sparked expectations that investors may secure strong entry positions before overall market fear fades and fundamentals begin to take effect.

How NEAR Intents Became a Late-2025 Catalyst for NEAR’s Price

NEAR Intents is a multichain trading protocol built on NEAR Protocol, a blockchain platform focused on AI and chain abstraction.

The protocol removes the need for users to perform complex manual actions. These include bridging tokens, managing gas fees across multiple networks, or handling intermediate steps. NEAR Intents allows users—or AI agents—to express an “intent” for the desired outcome. The protocol then automates the entire process, delivering a smooth and efficient experience.

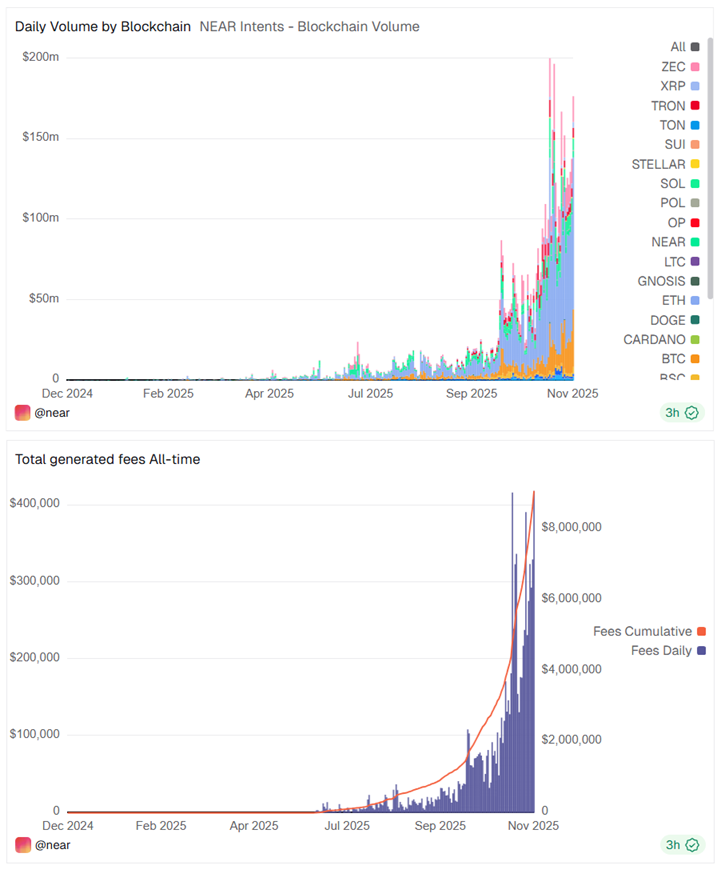

According to Dune Analytics, NEAR Intents’ daily fee revenue reached a record level of more than $400,000. This pushed total cumulative fees above $10 million. Meanwhile, daily trading volume consistently remained above $150 million, representing a tenfold increase from the previous quarter.

Daily Volume & Fee on NEAR Intents. Source: Dune.

Daily Volume & Fee on NEAR Intents. Source: Dune.

NEAR Protocol also reported that its 30-day cumulative trading volume recently surpassed $3 billion.

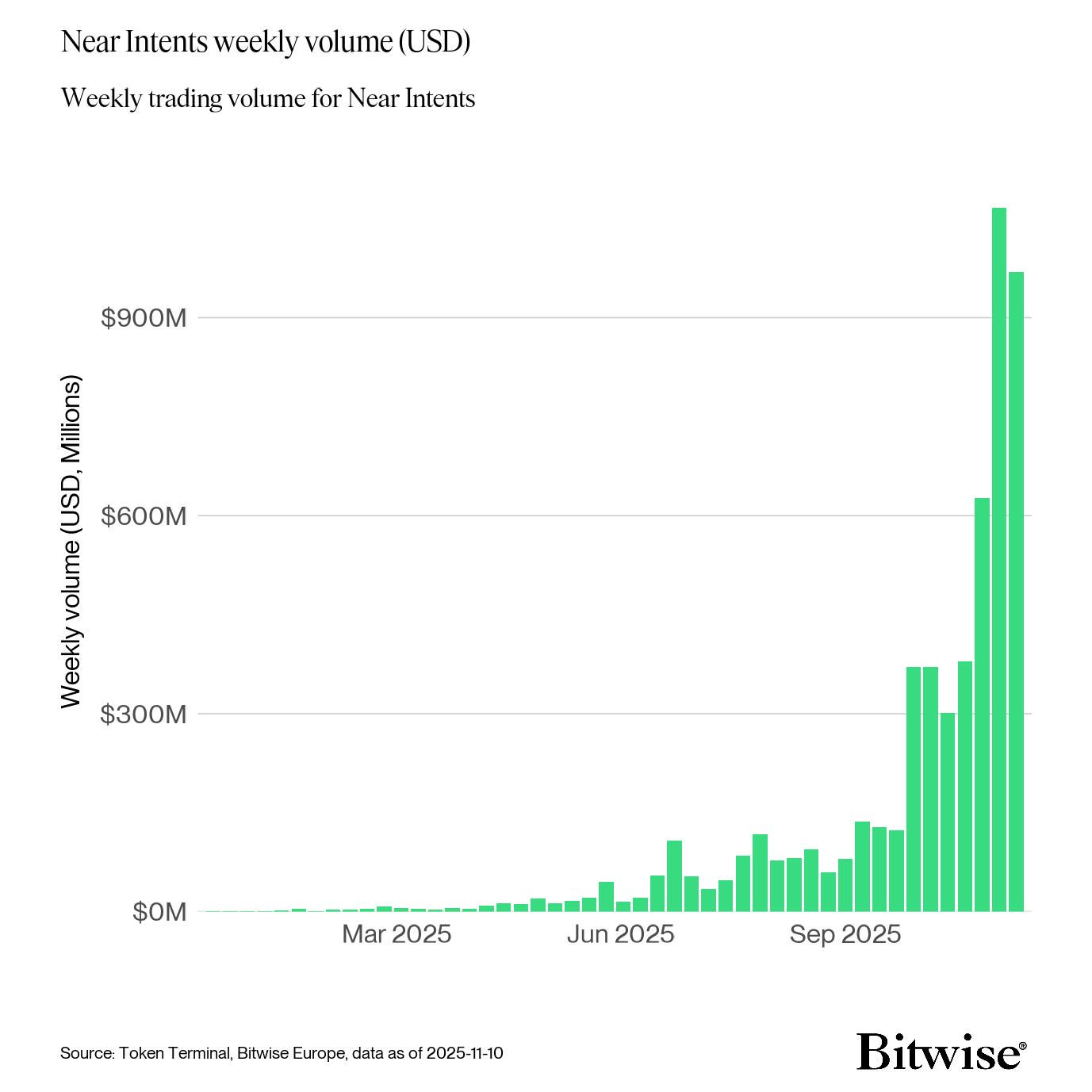

Additionally, a Bitwise report noted that NEAR Intents recorded $969 million in trading volume for the week beginning November 10, 2025. Bitwise predicted that NEAR Intents will expand weekly trading volume more than tenfold and reach $10 billion by June 2026.

Near Intents Weekly Volume. Source:

Bitwise

Near Intents Weekly Volume. Source:

Bitwise

This growth will naturally have a positive impact on the NEAR token.

“NEAR’s token model is designed to capture value from AI-native activity. This includes intent-routing fees, infrastructure services, and model execution, extending beyond traditional blockspace monetisation,” Bitwise stated.

What Drives This Surge in Volume?

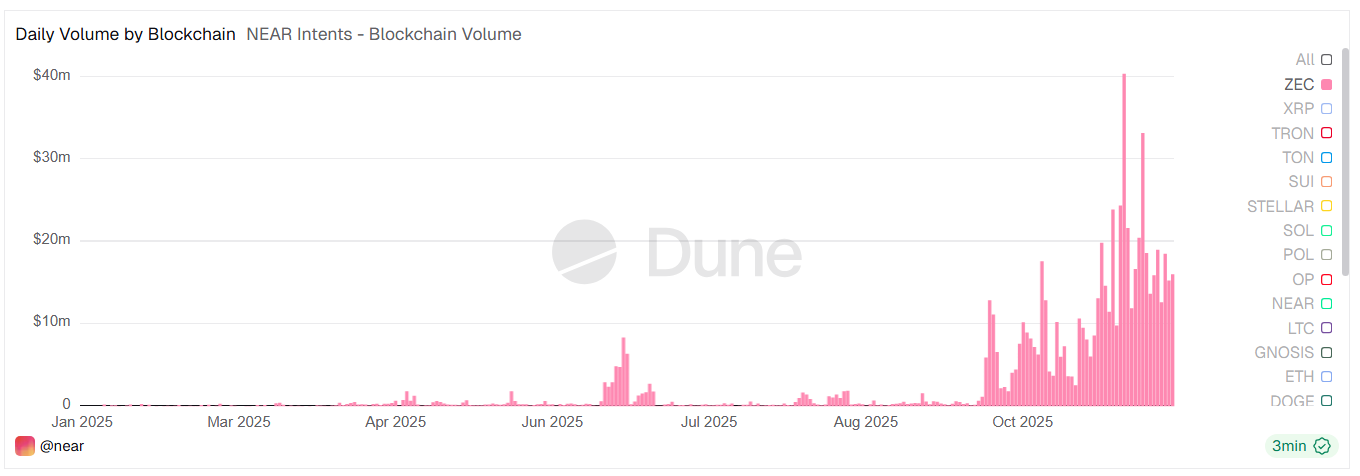

A CoinMetrics report highlighted the role of the Zashi wallet. This wallet integrates with NEAR Intents, enabling seamless multichain swaps into shielded ZEC. Meanwhile, the amount of ZEC held in shield pools reached new highs as demand for privacy accelerated.

ZEC Volume on NEAR Intents. Source:

Dune

ZEC Volume on NEAR Intents. Source:

Dune

As a result, investors have increasingly turned to NEAR Intents. Trading in ZEC now accounts for about 10% of the protocol’s daily volume, averaging $15 million per day.

NEAR’s Price Remains Stuck in the 2025 Accumulation Range

Despite these developments, NEAR’s price remains trapped in its 2025 accumulation zone. TradingView data shows NEAR moving between $1.90 and $3.10 since the beginning of the year.

NEAR Price Performance. Source:

TradingView.

NEAR Price Performance. Source:

TradingView.

Analyst Vespamatic attributed this stagnation to Bitcoin’s price decline. This pressure could cause altcoins to drop even further, even when their fundamentals remain strong.

“NEAR has a risk of falling to $0.6, especially if Bitcoin falls to $84,000. In a bear market, almost 99% of altcoins can be destroyed, even though they have strong fundamentals,” Vespamatic predicted.

However, analysts also noted that NEAR’s current price near $1.9 aligns with the year’s strongest support. Combined with recent positive catalysts, this level may set the stage for a potential price rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Latest Remarks on ZK and Their Impact on Ethereum's Prospects: Key Investment Prospects in Zero-Knowledge Technology

- Vitalik Buterin positions zero-knowledge (ZK) technology as Ethereum's foundational pillar for privacy, scalability, and security in 2025. - His three ZK pillars include private account abstraction, cryptographic synergy (MPC/FHE/TEE integration), and modexp replacement to reduce computational overhead. - ZK infrastructure now holds $28B TVL, with projects like zkSync, StarkNet, and ZKP leading adoption through EVM compatibility and hybrid on-chain/off-chain models. - Investors gain opportunities in ZK p

No More Concealed Allocations: ZKP Auctions Transform Fairness in Crypto

- ZKP's crypto presale uses daily on-chain auctions to distribute 35% of its 257 billion tokens, rejecting private allocations and hidden vesting schedules. - The 24-hour auction model allocates 200 million tokens proportionally based on pooled contributions, ensuring equal access without early-mover advantages. - Transparent on-chain visibility and $50,000 daily contribution caps prevent whale dominance, aligning with trustless system trends in crypto distribution. - This structure creates organic price d

Zcash (ZEC) Price Rally and the Revival of Privacy Coins: Regulatory Changes and Growing Institutional Interest Usher in a New Chapter

- Zcash (ZEC) surges over 7% in 24 hours, hitting $700+ amid 2025's privacy coin revival driven by regulatory clarity and institutional adoption. - U.S. Clarity/Genius Acts enable selective transparency for privacy coins, with Zcash's hybrid model outpacing Monero's mandatory anonymity in institutional appeal. - Cypherpunk's $100M Zcash treasury and Grayscale's ZCSH trust validate ZEC as a compliance-ready privacy asset, complementing Bitcoin's store-of-value role. - Zashi Cross Pay and Sapling upgrades en

Bitcoin News Update: Pakistan's Foreign Exchange Outflow Accelerates Amid Economic Instability and Lax Crypto Oversight

- Pakistan reports $600M forex loss via illicit crypto transactions, draining 23% of dollar inflows through unregulated channels. - ECAP reveals cash withdrawals from licensed firms fund crypto investments, straining reserves amid trade deficits and political instability. - SBP tightens forex controls but experts warn crypto outflows persist, mirroring global crypto losses and compounding weak enforcement. - Geopolitical shifts, including Trump's India-Pakistan ceasefire claims and U.S.-Pakistan military c