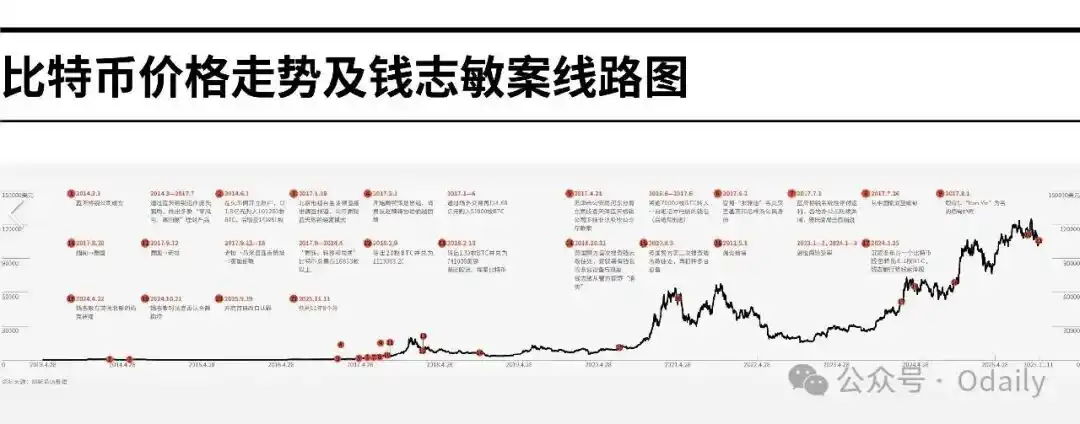

ZEC Price Surge Truth: Chen Zhi and Qian Zhimin Flee BTC, Making This Place a New Safe Haven

Bitcoin is insurance against fiat currency; Zcash (ZEC) is insurance against Bitcoin.

Original Article Title: "The Secret Narrative Behind ZEC's Soaring: The Safe Haven Migration of 'Chen Zhi and Qian Zhimin'"

Original Article Author: Wenser, Odaily Planet Daily

The highly anticipated end of the U.S. government shutdown did not lead to a market recovery in sentiment.

The cryptocurrency market not only did not see the expected "sell-off exhaustion" rebound, but continued to be dominated by a bearish sentiment: BTC once fell below the $90,000 mark, ETH briefly dropped below $2,900, and a nearly universal decline became the current market's footnote. Only the privacy track represented by ZEC bucked the trend and displayed a remarkably eye-catching independent market trend.

At the same time, two industry-shaking "big cases" were unfolding in parallel: the "Prince Group" figurehead Chen Zhi, holding 127,000 BTC, had his assets seized by the U.S. government; and the mastermind behind the "Blue Sky Geli" non-fungible token (NFT) project, Qian Zhimin, who raised over 40 billion RMB, was arrested after 7 years on the run, with his over 60,000 BTC assets likewise in limbo.

Behind these two events, a domino effect was triggered—the censorship resistance and anonymity of Bitcoin are facing unprecedented scrutiny from technophiles, purists, and even mysterious gray-market whales.

When the authoritarian forces of the real world collide head-on with decentralized technology ideals, the outcome is not romantic, forcing even idealists to contemplate: From the perspective of BTC asset final ownership, the nation-state machinery is ultimately the winner.

This has also forced the cryptocurrency industry to revisit an age-old question: If BTC is also finding it difficult to assume the role of a "censorship-resistant currency," then who will be the next generation symbol of privacy and on-chain asset storage? The market's answer may already be emerging—ZEC, which is bucking the trend and showing strong upward momentum at this time, is becoming the suitable "version answer."

ZEC's significant surge may not be a result of market manipulation by whales, but rather a genuine long-term market demand. This conclusion is supported by multiple narratives and data dimensions.

When the iron fist of authoritarian governments crushes the fantasy bubble of a "censorship-resistant currency": BTC is no longer the noble "safe haven" asset

One of the direct reasons for the resurgence of ZEC's "privacy token" belief is the hidden information revealed by 2 recent "BTC large asset cases": BTC's censorship resistance and anonymity are facing a severe test.

Let's start with the case of Chen Zhi, a key figure involved in the "Prince Group" case with assets totaling $15 billion.

The judiciary and intelligence agencies demonstrated a comprehensive process for handling on-chain assets: On-chain tracing → Financial freeze → Judicial takeover. This was a practical closed-loop integration of "on-chain tracking capability" with "traditional judicial power":

Step One: On-chain Tracing — Locking the "Funds Container." The anonymity of Bitcoin is often misunderstood. In fact, its blockchain is a public ledger, with each transaction leaving a trace. The Chen Zhi group attempted to launder money using the classic "spray-funnel" model: dispersing funds from the main wallet to a large number of intermediate addresses like watering a garden with a watering can, then, after a brief pause, aggregating back to a few core addresses like streams flowing into a river. This operation may seem complex, but from an on-chain analysis perspective, frequent "dispersion-convergence" behavior actually forms a unique pattern. Investigative agencies (such as TRM Labs, Chainalysis) use clustering algorithms to accurately map the "funds flowback," ultimately confirming that these seemingly dispersed addresses all point to the same controlling entity — the Prince Group.

Step Two: Financial Sanctions — Cutting off the "Cash-out Channel." After locking the on-chain assets, U.S. authorities subsequently initiated dual financial sanctions: Office of Foreign Assets Control (OFAC) sanctions: listing Chen Zhi and related entities, prohibiting any U.S.-regulated institution from transacting with them. Financial Crimes Enforcement Network (FinCEN) §311 provision: designating key entities as "primary money laundering concerns," completely cutting off their access to the U.S. dollar clearing system. At this point, although these bitcoins can still be controlled by private keys on-chain, their most important value attribute — the "ability to be exchanged for dollars" — has been frozen.

Step Three: Judicial Takeover — Completing the "Ownership Transfer." The final seizure was not based on forcibly cracking the private key but rather law enforcement directly taking over the asset's "signing authority" through legal procedures (such as a court order). This means that law enforcement officers successfully obtained the mnemonic phrase, private key, or controlled the hardware wallet, allowing them to initiate a valid transfer transaction like the asset's original owner, transferring the bitcoins to a government-controlled address. However, in the Chen Zhi case, the specific method by which the U.S. government obtained the private key has not been officially disclosed in full detail, leading to speculation within the community based on the previous security vulnerability of Lubian.com that law enforcement utilized this vulnerability to crack the private key. At the moment this transaction is confirmed by the blockchain network, the "legal ownership" and "on-chain control" are unified.

In both a technical and legal sense, ownership of these 127,271 BTC has formally transferred from Chen Zhi to the U.S. government. This coordinated approach clearly demonstrates: in the face of state power, "unseizing on-chain assets" is not absolute.

$15 Billion BTC Asset Transfer Process

This matter was later elaborately explained in the "LuBian Mining Pool Hacking Incident Large-Scale Bitcoin Theft Event Technical Traceability Analysis Report" released by the National Computer Virus Emergency Response Center. This incident of "the largest virtual asset seizure in history" was actually a "typical state-level hacker organization orchestrated 'hack-on-hack' event." In the cryptic world resembling a dark forest, not only does the Lazarus Group exist as the "North Korean national team," but the "American team" as the "on-chain special forces" also lurks silently in the shadows.

Compared to Chen Zhi, the figurehead of the "Prince Group" advancing step by step in Southeast Asia, the experience of Qian Zhimin, the central figure in the 60,000 BTC money laundering case, is even more legendary and tortuous.

According to Caixin, she first learned about Bitcoin as early as 2012, with "the ambition to one day hold 210,000 BTC, accounting for 1% of the total Bitcoin supply." She nearly reached this goal: from June 2014 to June 2017, within three years, Qian Zhimin instructed her "frontmen" to successively purchase 194,951 BTC at an average purchase price of only ¥2,815 per BTC (statistical criteria unknown). By the day of her sentencing in the UK in November this year, the price of Bitcoin had inflated by 266 times to ¥750,000 per BTC.

A diary written by Qian Zhimin between May and July 2018 reveals that she had formulated a "six-year plan" from 2018 to 2023, with the core objectives of "retirement at 45" and "rebuilding a digital empire." She demanded of herself to "retain at least three identities," including St. Kitts and Nevis and "two European countries (at least one undisclosed but allowing for free travel in Europe)," while also setting up two long-term leased "havens" in Europe.

To support the above arrangements, she anchored almost all large expenditures on Bitcoin. The diary states that in 2018, based on an estimated price of "approximately $6,800 per BTC," she planned to sell at least 4,000 BTC for immigration, real estate purchases, and team-building; in 2019, assuming the price rose to "$8,200," she would sell no more than 1,500 BTC; by 2020, she further raised the budgeted price to "$9,500," reserving about 1,750 BTC for investment in trading platforms and managing various "relationships." In her diary, she wagered that after entering 2021, the price would remain at $40,000 to $55,000 per BTC in the long term, planning grand projects such as a "digital bank," "family fund," and self-built kingdom based on this premise.

Qian Zhimin Case Node Description Chart

From the second half of 2016 to 2017, Qian Zhimin deposited over 70,000 bitcoins into a laptop's wallet. (Note by Odaily Planet Daily: In addition, information on over 120,000 BTC has not been further disclosed. According to a diary seized by the UK police, Qian Zhimin once wrote, "Lost 20,008 BTC."). Combining this with information indicating that the total bitcoin turnover, transfer, and exchange during his time in the UK was over 18,833 BTC, the final amount of BTC seized by the UK police was around 61,000, along with BTC and XRP tokens worth 67 million pounds.

The key to Qian Zhimin's ultimate arrest was the suspicious wallet addresses monitored by the UK police during a money laundering investigation and information revealed through Binance's KYC data about Qian Zhimin's associate "Seng Hok Ling" and their on-chain and off-chain behavioral patterns. In April 2024, Qian Zhimin was arrested while sleeping in an Airbnb apartment in Yorkshire, UK.

This once again demonstrates that assets can exist in the digital world of blockchain, but humans ultimately cannot escape the physical world's constraints, and the off-chain space is currently under the jurisdiction of authoritarian governments.

Imagination vs. Reality

These two cases involving a total of over 180,000 BTC have prompted the market to reassess Bitcoin's boundaries in narratives such as "censorship resistance" and "anonymity." Of course, in reality, with the establishment of BTC ETFs, deep involvement of institutional funds, and the regulatory system's increasing demands for transparency in crypto assets, Bitcoin's early narrative based on anonymity and censorship resistance has gradually faded from the mainstream stage.

Meanwhile, ZEC, which proudly carries the flag of "POW Privacy Coin," has become the "new promised land" in the minds of many Bitcoin OGs, Bitcoin maximalists, and tech enthusiasts.

The Privacy of BTC is Dead, Long Live the Privacy Coin ZEC: Market Repricing of "New Safe Haven Assets"

If the "second revival" of ZEC relied on endorsements from crypto bigwigs such as Naval, 0xmert, Arthur Hayes, Ansem, during its initial surge from $60 to over $100, after surpassing the milestones of $200, $400, $700, its market buying pressure has already shifted from short-term hype-driven capital to the group of Bitcoin OG whales, Bitcoin purists, and other holders with genuine privacy needs.

ZEC Price Trend in the Past Month

Specifically, ZEC focusing on the concept of "privacy coin" has the following advantages:

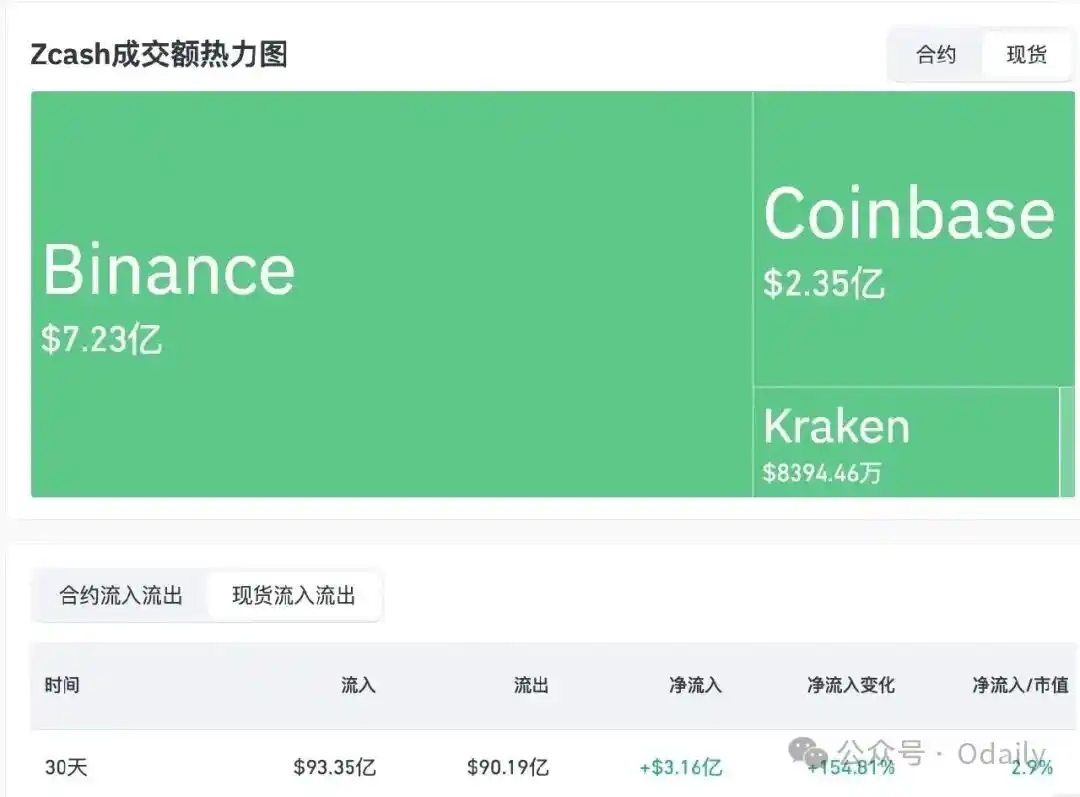

Firstly, it benefits from ample liquidity based on mainstream CEX. According to information from Coingecko, at the time of writing, ZEC had a trading volume of over $2.26 billion in the past 24 hours, with Binance and Coinbase ranking in the top 2 for 24-hour trading volume, with the former accounting for over 33% and the latter nearly 11%. In the current market of liquidity crunch, such a unique "CEX ecosystem position" has provided ZEC with a significant stage to attract funds and achieve a counter-trend rally.

Secondly, it is based on the genuine market demand for its differentiated "privacy anonymity pool" (Shielded pool). Data shows that the Shielded Supply of Zcash (ZEC) once approached nearly 5 million tokens on November 3, and at the time of writing, this data still remains above 4.82 million, accounting for about 30% of the circulating supply; with over 26,000 on-chain transactions within 24 hours and over 2,200 shielded transactions in the last 24 hours. This indicates that ZEC's real adoption data is stable and active.

Thirdly, it has a relatively stable token circulation and a smaller market cap compared to other mainstream tokens. According to Coingecko data, ZEC has a total circulation of nearly 16.4 million tokens, with a market capitalization of around $11 billion, ranking 16th in the cryptocurrency market cap rankings; after excluding stablecoins such as USDT, USDC, stETH, wstETH, WBTC, the market cap ranks 11th, indicating greater upside potential compared to other mainstream coins with market caps ranging in the hundreds of billions or even trillions of dollars.

Fourthly, its compliance is more complete, and it faces less regulatory pressure. Different from privacy coins such as XMR and DASH, which have been highly controversial and involved in lawsuits, as a mainstream privacy POW coin, ZEC's ecosystem does not directly conflict with regulatory bodies, and its POW mechanism to a certain extent ensures its stronger resistance to censorship. Considering the roadmap for the fourth quarter of 2025 released by ZEC's development organization, Electric Coin Co. (ECC), ZEC possesses certain technological advantages. Furthermore, compared to XMR, ZEC's optional privacy mode provides institutions with space to maintain compliance and reporting, making ZEC an asset acceptable to regulatory bodies.

Fifthly, ZEC benefits from its longstanding ecosystem, geeky nature, and a community with a strong technical atmosphere. As the birthplace of ZK-Rollup technology, the ZEC community includes numerous tech giants, crypto OGs, well-known angel investors, and even highly active crypto influencer Cobie, who claims to have held ZEC since 2016, and Gemini co-founder Tyler Winklevoss, who in 2021 stated in a post that ZEC is the "most underrated cryptocurrency."

Considering the above five major advantages, ZEC naturally has become the preferred target for many BTC whales, purists, and anti-censorship asset enthusiasts for "sensitive asset migration." This point is also supported by multiple data points.

Analysis of ZEC Market Performance from Transaction Perspective: From Real Adoption-Driven to Market Mainstream Focus

In a previous article, "Buying ZEC to Slam BTC? The 4 Industry Truths Behind the Surge in Privacy Coins," we conducted a detailed analysis of the possible reasons for the resurgence of privacy coins. The data performance of ZEC during this month's price increase once again proves that its main driving force is the combined effect of market sentiment and real adoption, rather than pump-and-dump schemes by manipulative actors.

ZEC Becomes a Contract Concentration Holding Target: 24-Hour Trading Volume Only Second to BTC and ETH

According to Coinglass data, in the past 24 hours, the total amount of liquidations in the ZEC network has exceeded $72.88 million, with short liquidations exceeding $69.30 million, making it the third-highest liquidation volume in the past 24 hours after ETH and BTC.

ZEC Ranks Second in 'Contract Liquidation Leaderboard'

In addition, recently ZEC contract trading volume and open interest have remained at high levels: as of the time of writing, the 24-hour trading volume exceeds $6.6 billion; the 24-hour open interest exceeds $1.2 billion.

ZEC Contract Data Leads by a Wide Margin

On the spot side, ZEC's trading on major CEXs has also remained in a net inflow state: from October 1 to the present, within 50 days, ZEC spot had a net outflow on only 15 days; within 30 days, ZEC spot net inflow is around $316 million; within 50 days, ZEC spot net inflow is around $419 million. In the last 24 hours, ZEC's spot trading volume on Binance exceeded $720 million, with a 24-hour increase of over 21%; on Coinbase, spot trading volume exceeded $230 million, with a 24-hour increase of over 17%.

ZEC Spot Inflow-Outflow Data Chart

ZEC Spot Trading Heatmap and 30-Day Trading Data

Behind ZEC's Price Changes: From BTC Trading Volume to Market Frenzy

Aside from the overall trading volume perspective, from the BTC trading pair volume level, we can also see two major phases ZEC has gone through:

First, before November 7, there was a gradual increase in BTC trading volume, and after ZEC's price broke through the annual high of 700 on that day, the BTC trading pair volume once exceeded 110 coins. At this point in ZEC's overall buying interest, there were still many trades where BTC was used to buy or sell ZEC;

Secondly, after November 7th, ZEC became one of the few hot topics in a bear market. This, combined with the previous "Chen Zhi case," "Qian Zhimin case," and BTC ETF outflows, shifted market attention to the stage that everyone was pursuing.

ZEC/BTC Trading Pair Candlestick Chart

Looking back, after experiencing a slow rise in October, as time entered November, ZEC's upward curve undoubtedly became steeper. This was influenced both by the overall market and highlighted ZEC's objective advantages, such as real-world use cases and significant funding capacity.

Especially after the first week of November, following a series of concentrated news exposures, BTC's privacy and anti-censorship properties were further questioned by the market. In contrast, ZEC's "privacy coin attributes" once again received high recognition from the crypto market.

In the second week of November, discussions on X platform about "BTC no longer private" escalated. On November 14th, a lengthy article by Delphi Digital team member Simon concluded that "ZEC is taking over from BTC as a value store of privacy and sovereignty," definitively settling the matter.

Thus, after more than a month of development and amidst an industry downturn, ZEC officially became the mainstream narrative in the current industry. Many traders who had previously liquidated ZEC at $300 or $400 once again bought in large quantities, leading to the first wave of "consensus buying." The key features of the market at this time were:

• ZEC's daily average price increase remained at 20–30% multiple times, entering the top ranks of CEX price gainers;

• Several crypto OGs explicitly stated that "BTC's privacy is dead, ZEC is where the privacy token lineage lies," including BitMEX co-founder Arthur Hayes. On November 7th, he made a high-profile statement that ZEC had become the second-largest liquid holding in his family office fund, the Maelstrom Fund, just behind BTC. On November 16th, he even started a "meme-making community activity" to further highlight ZEC's ecosystem vitality, stating that the "most desired Christmas gift is ZEC."

• Privacy-focused tokens in the XMR, DASH, etc., category saw a slight synchronous uptick;

• Centralized Exchange (CEX) order books such as Binance, Coinbase, and OKX experienced a series of natural buy orders.

Even the search volume for "Zcash" and "ZEC" on Google Trends experienced a sudden surge of 200%–300%; more importantly, the market demand, sentiment hype, and active trading of ZEC also attracted high attention from the capital markets. Gemini co-founder Tyler Winklevoss, mentioned earlier, even contributed a significant amount of buying pressure with real money.

ZEC Treasury Company Established: Aiming to Acquire at Least 5% of the Token

On November 12, Nasdaq-listed company Leap Therapeutics announced the purchase of 203,775.27 ZEC tokens at an average price of $245 per token and declared a transformation into a ZEC treasury company now renamed Cypherpunk Technologies Inc. In addition, the company also announced a $58.88 million private placement led by Winklevoss Capital.

On November 18, Cypherpunk Technologies Inc. (Nasdaq: CYPH) announced that the company once again invested $18 million to acquire 29,869.29 ZEC (Zcash) at an average purchase price of $602.63. With the previous purchase of ZEC for $50 million, Cypherpunk's total ZEC holdings have reached 233,644.56 tokens, with an average holding cost of $291.04.

This acquisition has brought the company's total ownership proportion in the Zcash network to 1.43%. Cypherpunk focuses on privacy and self-sovereignty, believing that Zcash is a "digital privacy asset" and a hedge against Bitcoin's transparency and its financial infrastructure, especially in an AI-enriched future. Previously, the company had just appointed Will McEvoy, Head of Winklevoss Capital, as Chief Investment Officer (CIO) and board member. Winklevoss Capital had previously led the company's $58.88 million private placement. The company's goal is to eventually hold at least 5% of the total ZEC supply, continuing to advance its Zcash-centric digital asset treasury strategy.

Can ZEC become another crypto asset that receives strong buying interest from Wall Street institutions and crypto funds following BTC? As ZEC's value continues to be discovered, it may attract widespread attention.

Conclusion: Is ZEC "BTC Privacy Insurance"? Perhaps More Than That

Of course, we are not encouraging investors to chase after ZEC at high prices. What we present is an objective analysis based on public data, market structure, and demand—looking at a longer time horizon, ZEC's long-term trend performance may still have room to continue.

In the article "Why Naval Says: Zcash Is Privacy Insurance for Bitcoin?" Max Wong of IOSG Ventures provided a detailed explanation of the rise of ZEC and the underlying technical principles and mechanisms. His core point echoes what Silicon Valley notable investor Naval said for the first time in support of ZEC: "Bitcoin is insurance against fiat currency; Zcash (ZEC) is insurance against Bitcoin."

Today, apart from being exchangeable with BTC and filling its privacy gap, ZEC is gradually taking on a new narrative expectation in the eyes of some market participants—to become the "successor to Bitcoin as the anti-censorship asset."

As we approach a quarter mark of the 21st century, the notion of free value may no longer be solely referenceable by BTC, which is being driven by compliance and deep institutional involvement. Instead, it may be redefined by those technology solutions that continue to focus on privacy and sovereignty. From this perspective, ZEC's resurgence seems to be a "sovereignty signal" reigniting market discussions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dalio interprets "When Will the Bubble Burst": Stock Market Bubble + Huge Wealth Gap = Enormous Danger

Dalio stated that the US stock market is currently in a bubble. A bubble does not burst simply because valuations are too high; historically, what truly triggers a crash is a liquidity crisis.

Bitcoin implodes as volatility from Big Tech, AI bubble fears, spreads to crypto

How does the leading player in perpetual DEX view the future trend of HYPE?

If you believe that the trading volume of perpetual DEXs will continue to grow, then HYPE is one of the purest and most leveraged ways to capitalize on this trend.

Privacy Meets Social Trust: How UXLINK and ZEC Are Building the Next Generation of Web3 Infrastructure

As ZEC advances compliant privacy and UXLINK builds real-world social infrastructure, the industry is moving towards a safer, more inclusive, and more scalable future.