Dogecoin Price Looks Set For Another Leg — Up Isn’t The Likely Direction

Dogecoin’s trend still points down despite brief rebounds. Momentum shows a hidden bearish divergence, and long-term holders have increased their selling by nearly 280% in ten days. Unless DOGE reclaims $0.163, the downtrend stays active with risks toward $0.150 and lower. The chart remains bearish until buyers step back in convincingly.

Dogecoin (DOGE) is trading near $0.156, down almost 19% over the past month and 11% in the past week. While a few large-cap coins are trying to build early recovery signs, the Dogecoin price is doing the opposite. The trend still tilts lower, and the signals forming on the chart and on-chain point to weakness rather than relief.

The short-term structure shows why the Dogecoin (DOGE) price weakness may continue before any meaningful upside can develop.

Momentum Weakens As Hidden Bearish Divergence Forms

The clearest problem sits in the momentum data. Between Nov. 15 and Nov. 18, the Dogecoin price made a lower high, but the RSI made a higher high. RSI, or Relative Strength Index, measures whether buying or selling pressure is strong. When RSI climbs while the price makes a lower high, it forms a hidden bearish divergence.

Traders treat this as a continuation warning, meaning the existing downtrend still has room.

DOGE Prints A Bearish Divergence:

TradingView

DOGE Prints A Bearish Divergence:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

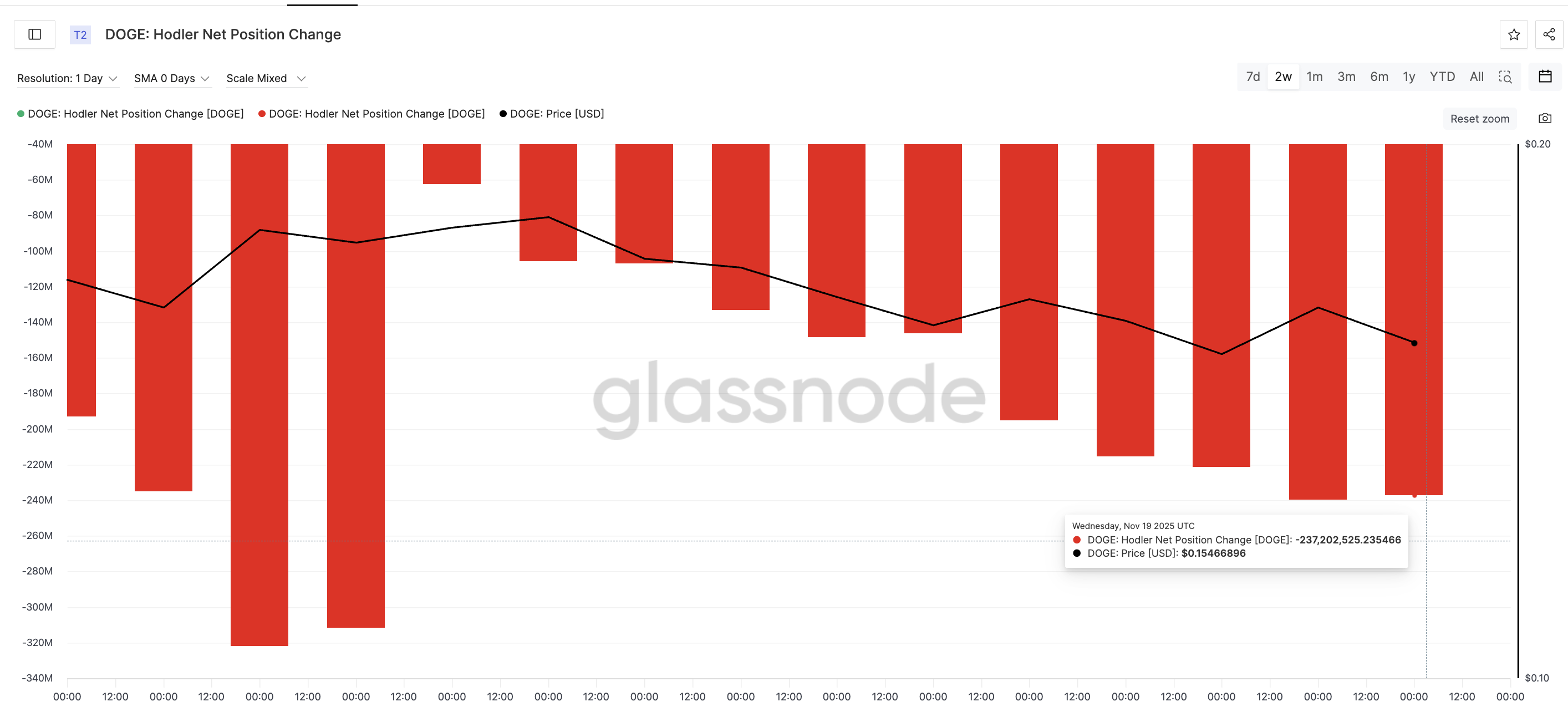

This weakness becomes more convincing when you look at long-term DOGE holders. Glassnode’s Hodler Net Position Change shows how many coins held for more than 155 days are moving. These wallets usually sell only when conviction collapses.

On Nov. 9, long-term holders were distributing about 62.35 million DOGE. By Nov. 19, that figure had grown to 237.20 million DOGE. That is a sharp increase of nearly 175 million DOGE in ten days, a 280% jump. This reflects a clear rise in long-term selling pressure.

HODLers Keep Dumping:

Glassnode

HODLers Keep Dumping:

Glassnode

Taken together, momentum is weakening, and holders with strong hands are stepping back. That combination makes short-term rebounds easy to fade. All while exposing downside risks.

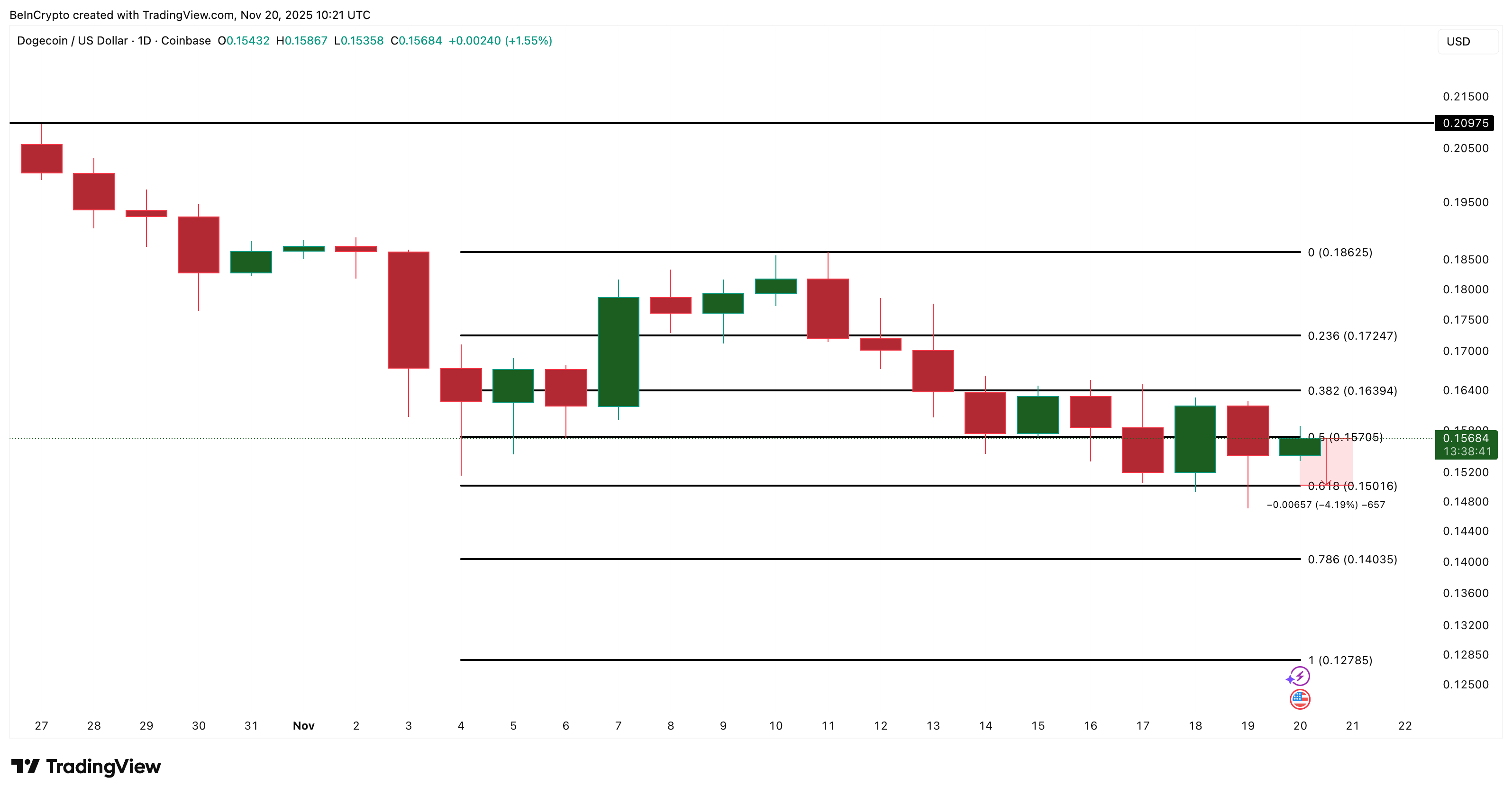

Dogecoin Price Faces More Downside Unless Key Levels Break

The Dogecoin price continues to lean lower along its trend structure, so the next supports come from the trend-based projection levels. The first important level sits at $0.150, which has repeatedly acted as a short-term floor. Losing this support could push the price toward $0.140 and even $0.127 if broader market sentiment softens.

On the upside, the Dogecoin price needs to reclaim $0.163 to pause the bearish pattern. A clean move above $0.163 would shift momentum enough to target $0.186, the next major resistance on the chart. Until that happens, the downtrend remains intact, and every bounce carries the risk of fading.

Dogecoin Price Analysis:

TradingView

Dogecoin Price Analysis:

TradingView

For now, the overall picture stays simple. The trend is negative, the momentum favors sellers, and long-term holders are still distributing. Unless Dogecoin starts reclaiming key levels, the DOGE price trend is likely to continue — just not in the direction Long traders are hoping for.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: The Dangers of Leverage: Crypto Whale Suffers $26 Million Loss Amid Market Decline

- A crypto whale lost $26.348M by partially liquidating 15x leveraged BTC and 3x leveraged ETH positions amid declining prices. - The whale's $250M portfolio faces $3.734M unrealized losses if liquidated, with a $65,436 WBTC liquidation threshold. - Broader market trends show $260.66M ETH ETF outflows and ETH/BTC prices below $2,800 and $87,000, worsening leveraged traders' risks. - A HyperLiquid user lost $4.07M from a 6x ETH long position, reflecting systemic leverage challenges as macroeconomic factors

Bitcoin Updates: U.S. Market Pessimism Contrasts with Asian Confidence as Bitcoin Drops Near $85,000

- Bitcoin's price fell to $85,000 in Nov 2025, down 7% in 24 hours and 20% monthly, driven by dormant wallet sales and bearish derivatives bets. - Surging sell pressure from inactive wallets and rebalanced derivatives toward puts highlight deteriorating market structure and liquidity. - Fed rate-cut uncertainty and regional divergences—U.S. bearishness vs. Asian buying—exacerbate volatility amid $565M in liquidations. - Analysts split on recovery: some see consolidation near $85K-$100K, others warn of a po

Aave News Today: Aave’s High-Return Application Offers a Solution to Inflation’s Impact on Savings

- Aave , a top DeFi lending protocol, launched a consumer savings app offering up to 9% APY, competing with traditional banks and fintech platforms. - The app targets mainstream users with zero minimum deposits, real-time compounding, and $1M balance protection, aiming to simplify DeFi accessibility. - While outperforming traditional savings rates, Aave's insurance transparency and security history raise concerns amid crypto's volatile trust landscape. - This move reflects DeFi's neobank trend, with high-y

The PENGU USDT Sell Alert: Is This a Red Flag or Simply a Market Adjustment?

- PENGU USDT's sell signal highlights concerns over structural risks in stablecoin-backed crypto strategies amid volatility and regulatory shifts. - The token's 28.5% decline since October 27, coupled with weak technical indicators, reflects broader fragility in algorithmic stablecoins and leveraged positions. - Growing institutional adoption of asset-backed alternatives like USDC contrasts with PENGU's speculative NFT-driven model, which lacks robust collateral or compliance. - While Fed policy easing may