Has Bitcoin Stepped Into a Bear Market? Analysts Split

Bitcoin has been below its 365-day moving average at $102,000 since last Friday, igniting debate among analysts about a possible bear market. The Fear & Greed Index has tumbled to 10, matching panic levels last seen in early and mid-2022. By Thursday, over $700 billion had vanished from the market in the past month. Despite

Bitcoin has been below its 365-day moving average at $102,000 since last Friday, igniting debate among analysts about a possible bear market. The Fear & Greed Index has tumbled to 10, matching panic levels last seen in early and mid-2022.

By Thursday, over $700 billion had vanished from the market in the past month. Despite heightened fear and key technical breakdowns, mixed signals from macro trends and whale activity keep experts split on crypto’s immediate direction.

Technical Breakdown Raises Bear Market Fears

Bitcoin’s second drop below $100,000 in one week triggered alarms. It now trades under the 365-day moving average, a level that marked regime changes in the 2018 and 2021 bear markets. Detailed analysis shows this indicator effectively separates bullish and bearish phases across cycles.

The decline is not limited to price. On-chain data shows Bitcoin below the realized price for coins held 6–12 months at $94,600. This is the cost basis for so-called “bull-cycle conviction buyers.” If the price stays below this level, many investors will incur losses, which can increase selling pressure.

Bitcoin perpetual futures saw their largest weekly jump in open interest since April, surging over $3.3 billion. Many traders had set limit orders to buy the dip as Bitcoin fell below $98,000. However, prices continued dropping, triggering these orders and creating leveraged exposure in a declining market.

Veteran trader Peter Brandt has heightened concern with his technical analysis. Brandt highlighted a sweeping reversal on November 11, followed by eight days of lower highs and a broadening top pattern. His downside projections are $81,000 and $58,000.

Does a sweeping reversal ((Nov 11) followed by 8 days of lower highs and the completion of a massive broadening top qualify as a bear market?Targets implied are 81k and 58kThose who now claim they will be big buyers at $58K will be pukers by the time BTC reaches $60k pic.twitter.com/Z01KKDSGmV

— Peter Brandt (@PeterLBrandt) November 19, 2025

Yet, some experts say these conditions do not confirm a full-scale bear market. They call the current phase a “mid-cycle breakdown,” a risky period that needs more signals to confirm a trend. Three triggers would confirm a bear market:

- Bitcoin remaining below the 365-day MA for four to six weeks,

- long-term holders selling over 1 million BTC within 60 days,

- a negative market-wide MACD.

Whale Accumulation Challenges Bearish Signals

Though fear metrics signal capitulation, on-chain data shows a rise in Bitcoin whale accumulation. Addresses holding 1,000 or more BTC have increased, even as prices drop. This suggests institutional and major investors see the downturn as a buying opportunity, not the start of a prolonged bear market.

This is a fascinating chart:While fear and panic had afflicted many investors, the number of BTC Whales has spiked up of late. Large holders are keeping a level head and buying at discount prices from panic sellers. Stay strong. pic.twitter.com/z1yWE4U0Ms

— Bradley Duke (@BradleyDukeBTC) November 19, 2025

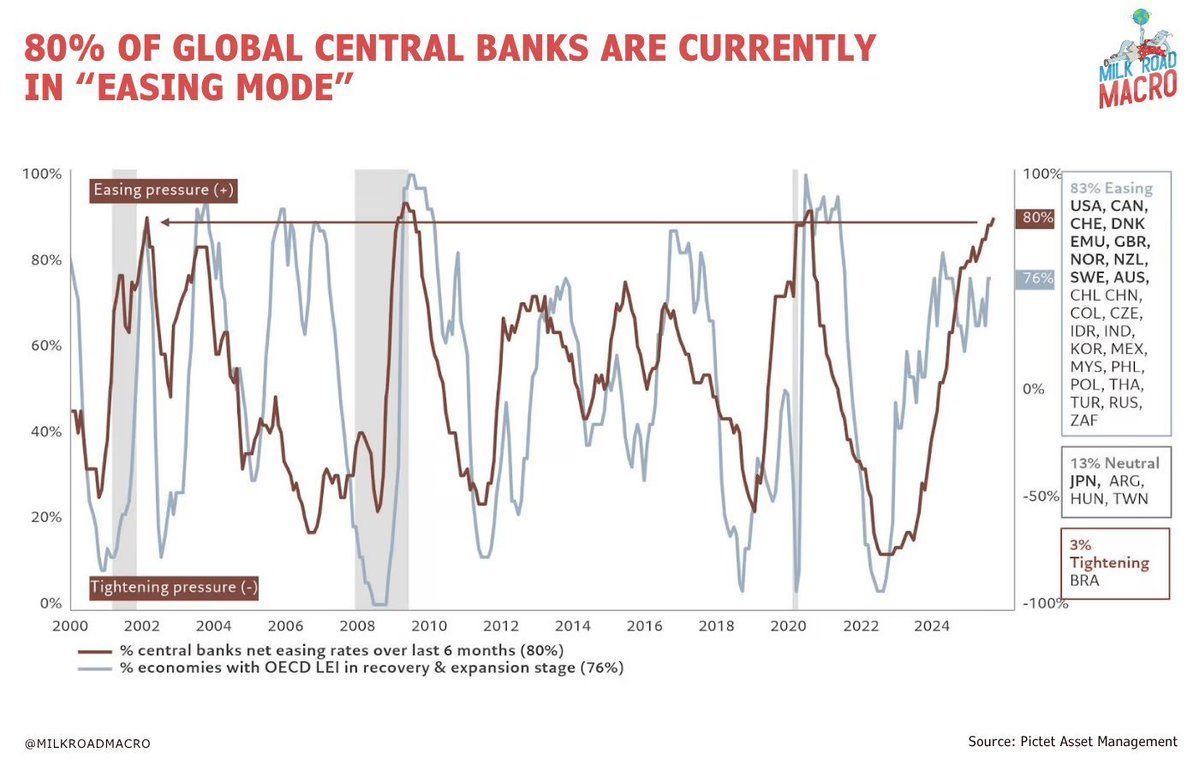

The strongest claim against a bear market comes from macro fundamentals. Global liquidity stands at a record high, with over 80% of central banks easing policy. This broad monetary loosening has historically benefited risk assets, with cryptocurrencies susceptible to liquidity waves.

Macro analysts highlight that central banks are cutting rates and adding liquidity. Data from the Bank for International Settlements confirms the trend: US dollar credit grew by 6%, and euro credit by 13% year-over-year through Q2 2025. Expanding credit often fuels asset price gains.

Over 80% of global central banks are in easing mode as of 2024, creating favorable liquidity conditions for risk assets. Source: MilkRoadMacro

Over 80% of global central banks are in easing mode as of 2024, creating favorable liquidity conditions for risk assets. Source: MilkRoadMacro

Historical data support this thesis. When liquidity rises, risk assets often rally. Cryptocurrencies can benefit most from being frontier assets. The current setting recalls pre-bull markets, when brief corrections happened as the money supply expanded. Unless this liquidity trend reverses—which central banks do not suggest—crypto remains structurally supported.

Still, the IMF’s April 2025 Global Financial Stability Report flagged stretched valuations in technology assets. The OECD forecasts global GDP growth to slow to 2.9% next year from 3.3% in 2024. These could limit how much liquidity can boost prices. As a result, analysts weigh abundant liquidity against economic headwinds in today’s market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Drops 30%: Market Correction or On the Brink of a Crash?

- Bitcoin fell 30% from October's peak to $86,000, driven by regulatory uncertainty, macroeconomic risks, and institutional caution. - The U.S. government's Bitcoin for America Act proposal adds volatility by enabling BTC payments for federal obligations. - ETF outflows, whale liquidations, and bearish options signal market distress, though industry leaders call the correction "healthy." - A potential "death cross" and oversold conditions suggest further declines to $30,000 remain possible amid Fed policy

Bitcoin Updates: Bulls Encounter Major Challenge: Will Bitcoin Recover Important Levels After a 30% Decline?

- Bitcoin fell below $87,000 in Nov 2025, triggering $914M liquidations and pushing its unrealized loss ratio to 8.5%, signaling bearish sentiment. - ETF outflows hit $903M in one day, with BlackRock's IBIT losing $355.5M, attributed to institutional profit-taking and year-end risk-off moves. - Japan's $135B stimulus and Fed rate-cut uncertainty deepened selling, while Ark Invest added $39.6M in crypto firms amid price declines. - On-chain data shows $66.4M in losses from whale liquidations, but miners' ac

Bitcoin News Today: Bitcoin’s Sharp Decline: Gauging the World’s Appetite for Risk

- Bitcoin fell below $86,000, sparking stability concerns due to macroeconomic pressures, institutional caution, and shifting investor sentiment. - ETF outflows and $2B in exchange deposits, plus BlackRock's $523M redemption, intensified bearish fears as net unrealized profit hit 2025 lows. - New projects like Bitcoin Munari aim to leverage market fragmentation, but success depends on uncertain broader stability and regulatory progress. - Institutions show mixed signals: Strategy Inc. reported $2.8B gains

Fed Policy Changes and the Increasing Link with Solana (SOL)

- Fed's 2025-2026 shift from QT to QE injects liquidity, impacting Solana's volatile market dynamics. - Japan's rising JGB yields influence U.S. Treasury dynamics, while Solana's price drops 32.5% amid ETF inflows. - Solana's DApp revenue rises but active wallets plummet, while ETFs drive $342M inflows despite price declines. - Derivatives show reduced leveraged bets ($7.2B OI) but positive funding rates signal institutional bullishness on Solana's long-term potential. - Macroeconomic volatility and Solana