U.S. Technology Leaders Pursue Saudi AI Partnerships as Policy Discussions Continue at Home

- Nvidia's Nov. 19 earnings report, projected to show 56.4% revenue growth to $54.9B, will gauge the AI sector's health amid valuation concerns and market volatility. - Nasdaq-100 futures rose 0.6% as investors anticipate results that could either boost AI-driven stocks or trigger a sell-off, compounded by delayed data and Fed policy uncertainty. - Repeated mentions of Saudi Arabia's Humain AI partnership highlight Nvidia's strategic alignment with sovereign AI initiatives, reflecting global competition fo

Nvidia Corp. (NVDA) is preparing to announce a crucial earnings report on Nov. 19, drawing intense attention from both investors and analysts as the AI chip giant navigates a turbulent market environment. The upcoming report,

There is a sense of anticipation in the U.S. stock market, with futures ticking upward ahead of the earnings release. Nasdaq-100 futures

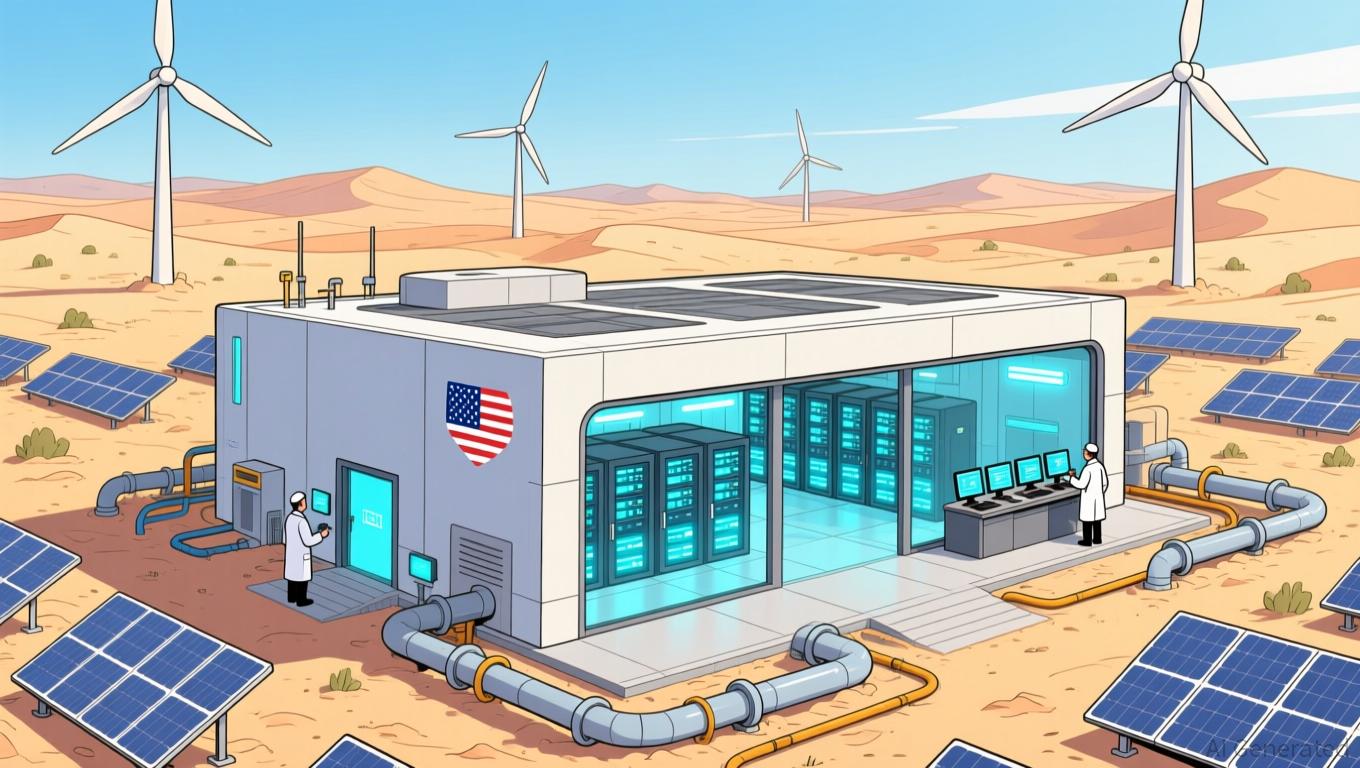

The geopolitical implications are significant. As the U.S. works to regulate the distribution of advanced AI technologies, Saudi Arabia’s Humain, backed by the country’s sovereign wealth fund, is emerging as a major contender in the global AI landscape.

As Nvidia’s earnings approach, the dynamic between business strategy, regulatory developments, and international AI rivalry is set to influence the sector’s direction. Strong results may bolster faith in the AI surge, while disappointing numbers could prompt a move toward more defensive industries. For now, attention is firmly fixed on the San Jose, California-based firm, whose ability to steer through these complex challenges will be a true test of its leadership in a rapidly evolving tech world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin just hit a critical point: analysts split between $85K crash and $250K surge

Dogecoin Price Forecast: DOGE could retest $0.14

Hyperliquid News Today: Crypto Giants Clash in Bear vs. Bull Battle, Triggering FTX-Like Turmoil as $1.1B Disappears

- Late November 2025 saw $1.1B crypto liquidations, with HyperLiquid's 0x35d1 whale holding $64.57M in SOL/ETH shorts amid market panic. - Bitcoin's drop below $90K triggered cascading liquidations, erasing $973M in long positions and echoing FTX-era volatility on decentralized platforms. - HyperLiquid's HYPE token rose 6.7% despite turmoil, driven by speculative "Adam and Eve" patterns and 2.0+ long-short ratio imbalances. - Influencer Andrew Tate lost entire HyperLiquid account via BTC liquidations, high

Bitcoin Updates: Concerns Over Monetary Policy and Large-Scale Investor Sell-Offs Lead to Unprecedented Crypto ETF Withdrawals

- BlackRock's IBIT Bitcoin ETF lost $463M in a single day on Nov. 14, its worst outflow amid broader crypto fund exodus. - U.S. crypto ETPs saw $2B in outflows last week, driving AUM down 27% to $191B as Bitcoin ETFs bore the brunt. - Market analysis attributes the selloff to macroeconomic uncertainty, crypto whale selling, and cautious Fed policy. - While Bitcoin and Ethereum ETFs declined, Solana and XRP ETFs attracted $255M in inflows, bucking the trend. - Analysts debate a potential "mini bear market,"