Bitcoin Faces Deepest Pullback of the Bull Cycle as Analysts Remain Split on the Future

Bitcoin’s sharp retreat and record-long Extreme Fear streak have split analysts on whether the market has entered a new bear phase or is close to bottoming. While some see structural breakdowns, others say the conditions match past local bottoms.

Bitcoin’s (BTC) current retreat now stands as the deepest correction of this market cycle, based on observations from an on-chain analyst.

At the same time, sentiment has tanked. Analysts disagree on whether the market is entering a prolonged downturn or if a bottom will form soon.

Bitcoin Faces Deepest Correction of the Cycle as Fear Dominates Market

Bitcoin has continued to shed its gains in the past months. Yesterday, the coin dropped below $90,000, marking a 7-month low. However, a modest recovery followed.

BeInCrypto Markets data showed that it was trading at $91,460 at the time of writing. This represented a 0.109% increase over the past 24 hours.

Bitcoin Price Performance. Source:

Bitcoin Price Performance. Source:

On-chain analyst Maartunn highlighted the magnitude of the pullback in a recent X (formerly Twitter) post. He pointed out that the depth of the correction is now the largest seen so far in the current cycle.

The current pullback is the largest of this bull market cycle 📉

— Maartunn (@JA_Maartun)

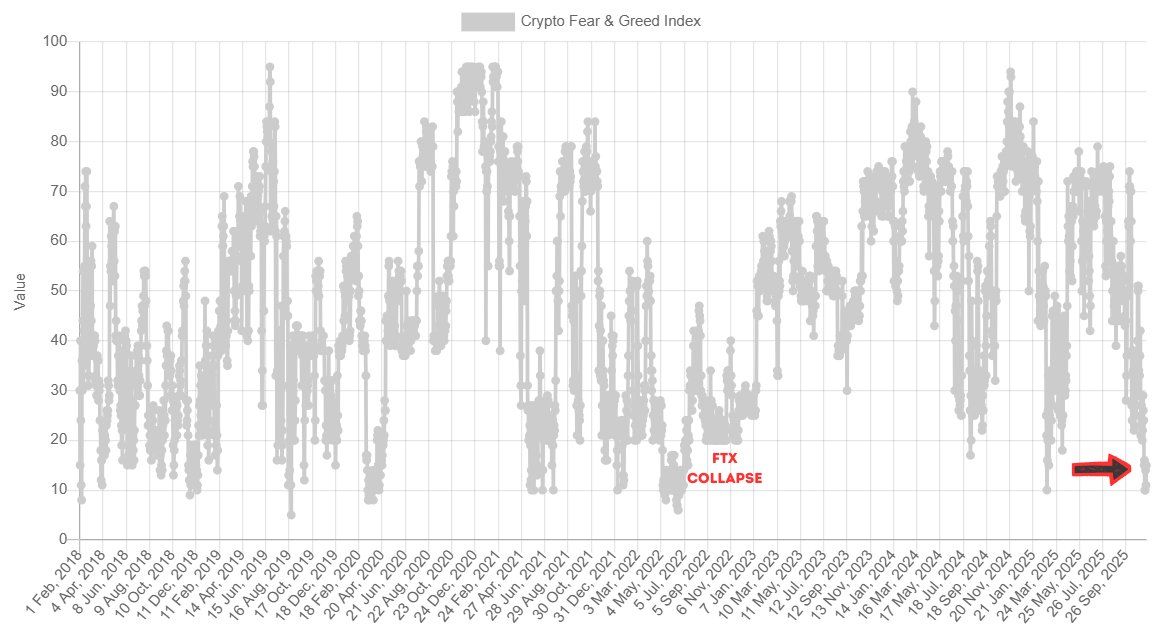

The decline has also shaken market sentiment. The Crypto Fear & Greed Index has remained locked in Extreme Fear for eight consecutive days as of November 19.

Such a long streak signals that traders remain deeply cautious, with risk appetite at one of its lowest levels of the year.

“This is now the longest Extreme Fear streak since the FTX collapse,” Coin Bureau wrote.

The Crypto Fear & Greed Index. Source:

The Crypto Fear & Greed Index. Source:

Analysts Divided on Bitcoin: Bear Market or Local Bottom?

Alphractal stated that extremely negative sentiment can mean two things. It can signal an upcoming local bottom during a bull market. However, in a bear market, such sentiment typically indicates continued downside. Notably, this is where analysts remain split.

Some argue that a bear market has started according to the 4-year cycle. In a detailed thread, Mister Crypto also outlined several arguments for why the bull market is over. He highlighted technical signals and cycle timing models that align with previous cycle peaks.

On-chain and behavioral signals support his view. He noted that old Bitcoin whales are selling, a Wyckoff distribution pattern has completed, and Bitcoin is beginning to lose strength versus the S&P 500, just as it did at the start of the last bear market.

Investor and trader Philakone even forecasted that BTC could drop as low as $35,000 by the end of next year. This stands in sharp contrast to the numerous bullish BTC forecasts analysts have been issuing all year.

“It’s wild that people think this is impossible. That bitcoin can’t hit $35K to $40K before Dec 2026. All bear markets have lasted roughly 365 days exactly from the top to the very bottom in 2014, 2018, and 2022. All bear markets dropped 78% to 86%. So how’s this not possible?,” he posted.

However, other analysts argue the opposite. They contend that this is not how bull markets typically end and believe Bitcoin may instead be carving out a bottom.

Altcoins are sitting at a 4-year bottom.I’ve been in the crypto since 2016, and this is not how the bull market ends.

— Ash Crypto (@AshCrypto)

Institutional figures Tom Lee and Matt Hougan also suggest that Bitcoin may be forming a bottom, potentially as early as this week.

“Not saying we’ll shoot straight to new highs from here, but if history repeats, the local bottom should be in, and a recovery pump might be just around the corner,” Hougan said.

With opinions sharply divided, it remains unclear whether Bitcoin’s pullback marks the start of a deeper downturn or simply a short-term bottom. Only the coming time will reveal which side is right.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Federal Reserve's Mixed Signals Spark Bitcoin's Surge Back to $85K

Why Did Memecoins Collapse in 2025? The Shift Toward Utility-Based Cryptocurrencies

- The memecoin market plummeted in November 2025, with top tokens like SPX and DOGE losing over 14% amid a broader crypto slump. - Total crypto market cap dropped to $2.96 trillion, as investors shifted to utility-driven tokens like DeFi projects. - Analysts attribute the crash to macroeconomic sensitivity and retail-driven hype, with Bitcoin and Ethereum also falling 14-16%. - Despite the downturn, cautious optimism remains for a rebound if market conditions stabilize or new trends emerge.

Bitcoin News Update: "2025 Downturn Triggers Crypto Outflow: Savvy Investors Focus on Practical Use, Move Away from Hype"

- Bitcoin fell below its 50-week moving average on Nov 21, 2025, confirming a bear market with a 23% monthly loss and $2B in liquidations. - Crypto market cap dropped below $2.8T in 24 hours as Bitcoin ETFs saw $903M outflows and open interest fell 35% from October peaks. - Institutional investors shifted toward utility-driven projects like Digitap ($TAP), which raised $2M via presale with 124% APR staking rewards. - Digitap's hybrid crypto-fiat model combines blockchain with SWIFT/SEPA, targeting $250T pa

Solana News Update: Institutions Invest $2 Billion in Solana ETFs While GeeFi Presale Marks a New Era for Altcoins

- Solana (SOL) dropped 30% to $125 in late 2025 amid market volatility and a $352.8M Q3 net loss despite revenue growth. - Six new U.S. Solana ETFs drove $26.2M in inflows on Nov 18, with total assets exceeding $2B, reflecting institutional confidence in its infrastructure. - GeeFi (GEE) emerged as an altcoin contender, selling 50% of its Phase One tokens in 24 hours, leveraging Avalanche's 99.9% fee cuts and staking rewards. - Analysts highlight Solana's bearish technical indicators but note ETF inflows c