Tether Dominance Hits 6% in November – Why This Is a Worrying Signal

In November 2025, the Tether Dominance index (USDT.D) — the share of USDT’s market cap relative to the total crypto market cap — officially surpassed 6%. It also broke above a descending trendline that had remained intact since 2022. Analysts have expressed concern as USDT.D breaks a long-term resistance level. The move often signals the

In November 2025, the Tether Dominance index (USDT.D) — the share of USDT’s market cap relative to the total crypto market cap — officially surpassed 6%. It also broke above a descending trendline that had remained intact since 2022.

Analysts have expressed concern as USDT.D breaks a long-term resistance level. The move often signals the beginning of a major correction or even an extended bear market for the entire crypto market.

How Significant Is the Rise of USDT.D in the Market Context of November?

TradingView data shows that USDT.D reached 6.1% on November 18 before pulling back to 5.9%.

Earlier in the month, this metric sat below 5%. The increase reflects heightened caution among investors. Many have rotated capital into the most liquid stablecoin instead of deploying funds to buy deeply discounted altcoins.

USDT.D vs. Total Market Cap. Source:

TradingView

USDT.D vs. Total Market Cap. Source:

TradingView

Historical data indicate a strong inverse correlation between USDT.D and total market capitalization. Therefore, USDT.D breaking above a trendline that has held for nearly four years may signal deeper market-wide declines ahead.

Several analysts expect USDT.D to climb toward 8% by the end of the year, implicitly suggesting that a bear market may be forming in November. This projection has merit because fear continues to grow and shows no signs of easing.

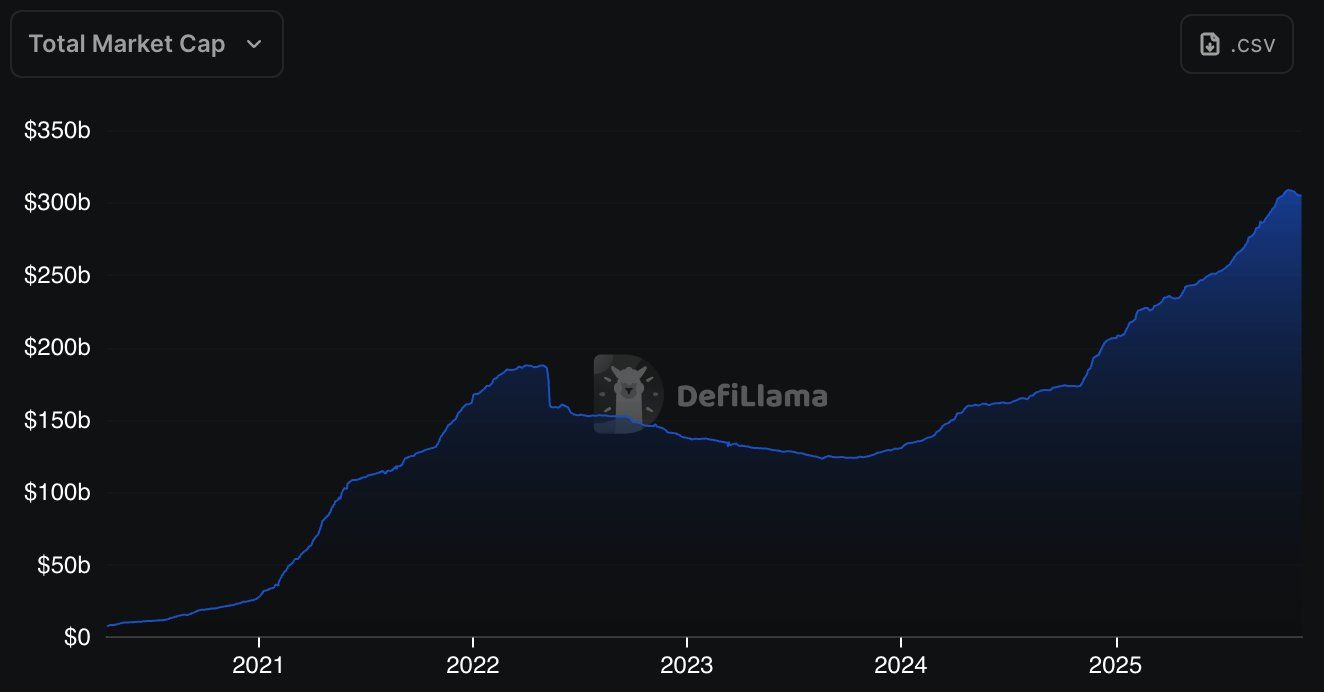

In addition, the well-known analyst Milk Road highlights a notable shift in the stablecoin market. DefiLlama data shows that the total stablecoin market cap fell from $309 billion at the end of October to $303.5 billion in November.

Stablecoin Market Cap. Source:

DefiLlama

Stablecoin Market Cap. Source:

DefiLlama

The stablecoin market has shed approximately $5.5 billion in less than a month. This marks the first significant decline since the 2022 bear market. The DefiLlama chart reveals that, after four years of continuous growth, the curve has flattened and is starting to turn downward.

The combination of a shrinking stablecoin market cap and a rising USDT.D suggests a broader trend. Investors appear not only to be selling altcoins into stablecoins but also withdrawing stablecoins from the market entirely.

“Expanding supply means fresh liquidity entering the system. When it flattens or reverses, it signals that the inflows powering the rally have cooled,” Milk Road said.

However, Milk Road still sees a glimmer of optimism in the current landscape. He argues that the situation does not necessarily indicate a crisis. Instead, the market is operating with less “fuel” for the first time in years, and such shifts often precede price changes.

Furthermore, a recent BeInCrypto report notes a contrasting trend. Despite the declining market cap, the amount of stablecoins held on exchanges has increased in November. This suggests that some investors view the downturn as an opportunity to position themselves for the end of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: "Crypto ETFs See $3 Billion Outflow While Energy Storage Surges in Contrasting Markets"

- U.S. Bitcoin ETFs lost $903M in net outflows on Nov 20, with IBIT and GBTC leading the exodus. - Ethereum ETFs faced $262M in eight-day outflows as institutional investors locked in year-end profits. - Bitcoin dropped 9% to $83,884 amid technical breakdowns and miner economics, despite major holders continuing accumulation. - Smaller crypto ETFs like Solana and XRP saw inflows, contrasting with Canadian Solar's $1.858G storage contract and 167.7% stock surge. - Divergent market trends highlight crypto vo

Ethereum Updates Today: Major Ethereum Investor Makes $1.34B Move Amid Crypto Market Slump

- Chordate board proposes voluntary liquidation and delisting due to insufficient capital, with process starting December 2025. - Ethereum whale '66kETHBorrow' accumulates $134M in ETH amid market selloff, signaling long-term bullish conviction. - Crypto markets face $3,000 ETH support test as $170M+ liquidations highlight fragility, contrasting whale's accumulation strategy. - Canaan Inc. reports $1.3B mining revenue and BTC/ETH treasury growth, showcasing resilience amid industry downturn.

Bitcoin Updates: The 2026 Transformation in Crypto—Infrastructure Surpasses Speculation

- Crypto market anticipates 2026 growth driven by infrastructure upgrades and structured tokenomics, contrasting volatile meme coins like PEPE and BONK . - Bitcoin Munari (BTCM) advances with Solana integration and $0.01 presale model, targeting 2027 Layer-1 launch with EVM compatibility and privacy tools. - Bullish's Q3 2025 resilience during market crashes highlights its AMM liquidity advantages, while tokenization services gain traction amid institutional demand growth. - Institutional-grade infrastruct

Bitcoin News Update: Bitcoin ETFs See $1.9B Outflow While Competing Altcoins Draw $420M in Just 16 Days

- U.S. Bitcoin ETFs saw $1.9B in 4-day outflows as prices fell below $90,000 amid macroeconomic uncertainty. - BlackRock's IBIT lost $1.43B in 5 days, reflecting institutional risk aversion ahead of potential Fed policy shifts. - Altcoin ETFs attracted $420M in 16 days, with XRP and Solana funds gaining traction through staking yields and regulatory clarity. - Analysts warn sustained outflows could push Bitcoin toward $85,000, highlighting diverging investor priorities between blue-chip and emerging crypto