Cloudflare Outage Exposes Web3’s Centralization Problem

Cloudflare’s global outage knocked major crypto platforms offline, highlighting a gap between decentralization rhetoric and real-world dependencies. The disruption may spark a push toward more resilient, crypto-native infrastructure.

The latest Cloudflare outage caused widespread disruption across crypto applications, demonstrating the sector’s heavy reliance on centralized internet infrastructure. As Cloudflare’s worst service disruption since 2019, the incident exposed a major contradiction within the crypto industry’s claims of decentralization and resilience.

This outage raised difficult questions: Can genuine decentralization exist if a single provider can take down large swaths of the industry?

Scale and Cause of the Cloudflare Outage

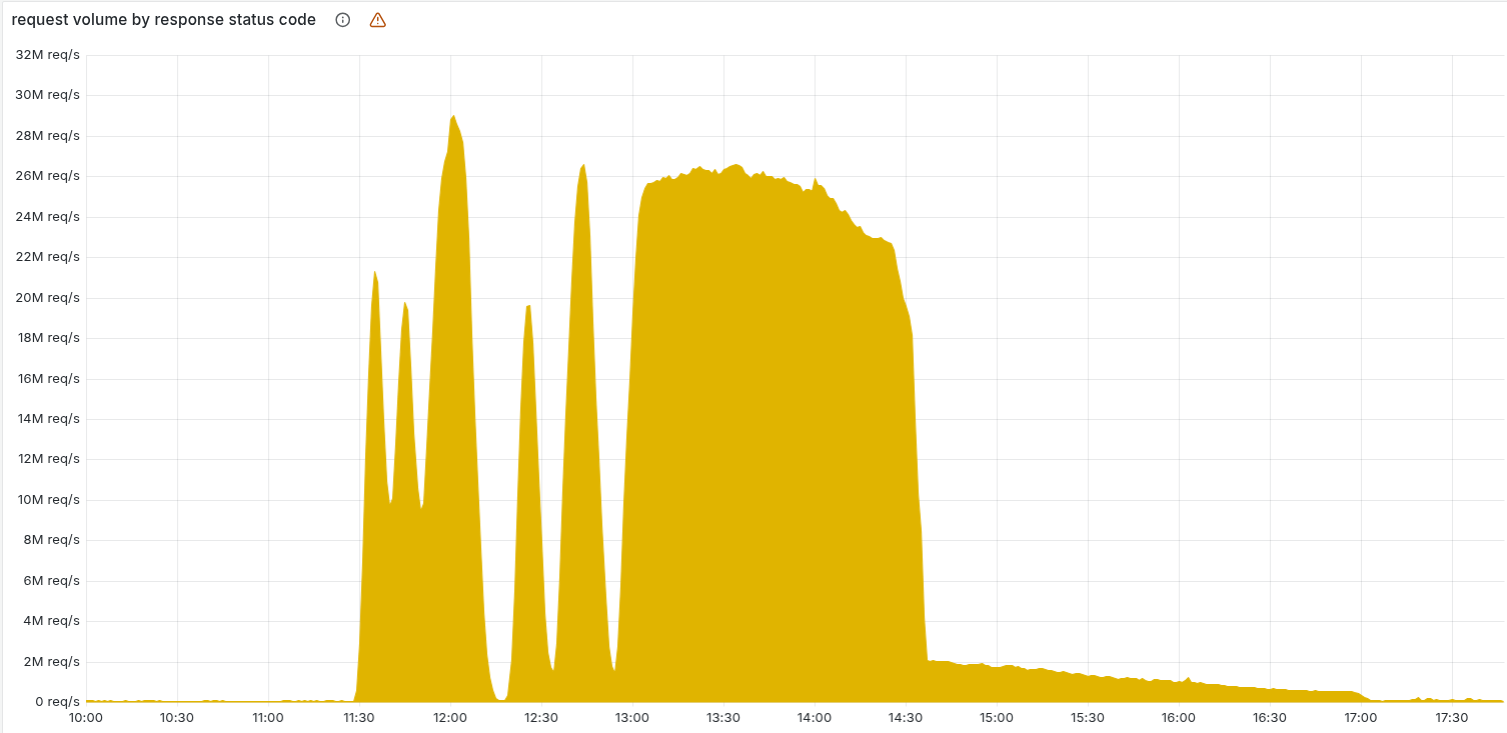

The outage began at 11:20 UTC on November 18, following a database permissions change that triggered a failure in Cloudflare’s network. In its official incident report, Cloudflare explained that a bot management feature file had doubled in size, exceeding memory limits and resulting in widespread HTTP 5xx errors.

Core Cloudflare services—including CDN, security, Workers KV, Access authentication, and Dashboard logins—experienced major disruption between roughly 11:20 and 14:30 UTC, with some services partially mitigated from 13:05 and residual issues continuing into the afternoon. All services were fully restored by 17:06 UTC.

The team confirmed that no cyberattack was responsible for the incident. Instead, it stemmed from a configuration change and query behaviour that propagated rapidly through the system.

“Today was Cloudflare’s worst outage since 2019. We’ve had outages that have made our dashboard unavailable. Some that have caused newer features to not be available for a period of time. But in the last 6+ years we’ve not had another outage that has caused the majority of core traffic to stop flowing through our network….On behalf of the entire team at Cloudflare, I would like to apologize for the pain we caused the Internet today,” Matthew Prince, CEO of Cloudflare wrote.

HTTP 5xx Error Spike During the Cloudflare Outage. Source:

Cloudflare

HTTP 5xx Error Spike During the Cloudflare Outage. Source:

Cloudflare

Cloudflare plays a significant role in directing global internet traffic, with its infrastructure supporting a wide range of online services. In its “Browser Market Share Report for 2025 Q3,” the company noted that more than 10% of all websites connect through its reverse-proxy system.

Moreover, nearly 25 million online properties depend on Cloudflare’s network to reach their audiences. Because many online platforms rely heavily on their systems, outages or disruptions can have far-reaching consequences.

Crypto’s Decentralization Paradox Exposed

Notably, when Cloudflare faltered, major exchanges and DeFi protocols simultaneously went offline.

The incident drew swift criticism from industry analysts. They pointed out the gulf between cryptocurrency’s rhetoric of decentralization and its operational reality.

Nader Dabit, Director of Developer Relations at Eigen Labs, illustrated the irony in a post on X, highlighting the failure of “unstoppable” apps when Cloudflare went offline.

Your favorite DeFi protocol went down with the AWS outage. Now your favorite DeFi protocol is down with the Cloudflare outage. And all Oracles weight Binance as the first Gospel in the crypto Bible. Not as decentralized as we’ve been told, is it?” The White Whale added.

The outage revealed that many crypto applications rely on centralized networks for essential services. Although blockchains themselves can operate independently, users access them through Web2 infrastructure, creating weaknesses.

The event also revealed gaps in DeFi risk management. If users cannot access their accounts or transact during crucial moments—even while on-chain protocols continue to operate—the practical reality of permissionless finance becomes shaky.

Nonetheless, not all experts viewed the incident as an existential threat to Web3. Helius Labs’ CEO, Mert, put the outage in perspective by noting Cloudflare’s immense scale relative to blockchain throughput.

“cloudflare processes 85 trillion more requests per second than all chains ever have combined for in their lifetime. sit this one out. like a toddler bragging about flying a toy plane to a pilot,” Mert noted.

This perspective illustrates the engineering challenge ahead. While the blockchain industry values uptime, few projects handle traffic at a scale comparable to Cloudflare’s.

Building decentralized systems with similar capacity is unresolved. For now, Web3 projects commonly rely on established, centralized infrastructure due to practical considerations.

Yet, some analysts said the disruption could foster innovation. Blockchain data expert Alex Svanevik noted that the outage might boost alternative crypto infrastructure solutions.

Whether the crypto sector will diversify or continue relying on convenience over ideology is a question industry leaders must confront as they weigh security and resilience.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin ETFs See $1.3B Outflow While Institutional Investors Enter the Market

- Bitcoin fell below $90K after erasing 2025 gains, with U.S. spot ETFs recording $1.32B in outflows as BlackRock's IBIT lost $532M. - Institutional buyers like El Salvador and MicroStrategy added $100M+ in BTC, contrasting with ETF redemptions and bearish options activity. - Regulatory uncertainty and technical indicators suggest prolonged volatility, with key support levels at $89.4K and $82.4K under pressure. - Binance's Teng called the 21% November drop part of healthy consolidation, while Dimensional

Bitcoin News Update: Typical Bitcoin Holder Now Sees 13% Decline as Price Drops Under $84k

- Bitcoin fell below $84,000 on Nov 20, 2025, a 32% drop from its October peak of $126,300, marking its largest correction since late April. - Macroeconomic pressures including stubborn inflation, weak jobs data, and ETF outflows exacerbated selloffs, with leveraged liquidations exceeding $1.3B. - Technical indicators show broken key support levels and a "death cross," while institutional buyers like Strategy added $835M BTC to stabilize prices. - The $83,500–$85,000 range is critical for near-term directi

Bitcoin News Update: Bitcoin's Drop Intensifies as Major Holder's Deposit Unable to Halt Crypto Market Downturn

- Bitcoin plunged 4.53% on Nov 21 as a 665.9 BTC whale deposit into Binance failed to halt a $120B crypto market crash. - Prices fell to $81,629 amid weak U.S. jobs data, fading macro optimism, and $3.9B in leveraged position liquidations across 24 hours. - Bitcoin ETFs saw $903M outflows while perpetual futures open interest dropped 35%, signaling institutional retreat from crypto. - Analysts warn of forced selling from leveraged holders like MicroStrategy as Bitcoin's $75K support level appears increasin

Bitcoin News Today: Crypto at a Turning Point: ETF Withdrawals and Federal Reserve Announcements Trigger Bitcoin's Sharpest Drop Since 2022

- Bitcoin fell to $95,000 in Nov 2025, its worst monthly drop since 2022, driven by ETF outflows, shifting Fed signals, and waning investor sentiment. - $1.32B in Bitcoin ETF outflows and $728M Ethereum losses reflect profit-taking after October's rally, with institutional players like MicroStrategy seeing share declines. - Fed officials remain divided on rate cuts, with liquidity risks highlighted by Bank of America as Bitcoin's 35% peak-to-trough drop signals market distress. - Crypto Fear & Greed Index