Date: Tue, Nov 18, 2025 | 05:50 AM GMT

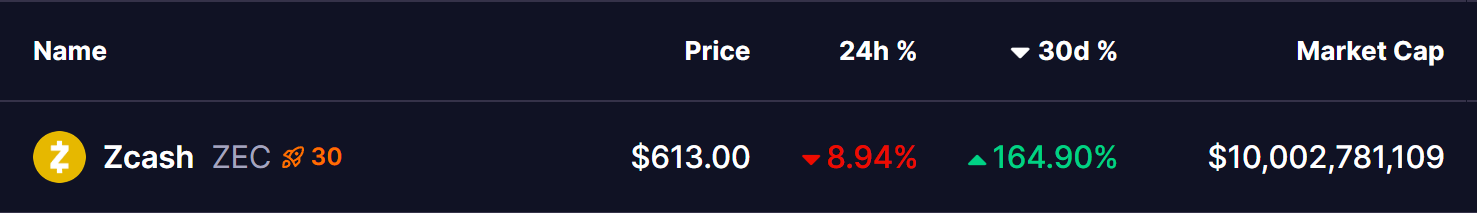

The privacy-narrative tokens have recently become a major spotlight in the crypto market — especially Zcash (ZEC), which has shown a remarkable rally. Despite a 8% dip today, ZEC is still up more than 164% over the past 30 days.

Beyond the headline numbers, the chart is revealing something even more interesting — an emerging fractal setup that may be signaling further upside ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at Upside

On the 4-hour chart, ZEC appears to be replicating a familiar bullish structure from late October, one that previously triggered a massive breakout.

A month ago, ZEC formed a clean ascending triangle pattern — a bullish continuation formation. During that phase, the price made multiple higher lows along the triangle’s rising support trendline, each time bouncing precisely from the 100-MA zone. These repeated retests strengthened buyer confidence and eventually resulted in a decisive breakout above horizontal resistance. That breakout fueled an explosive 145% rally within weeks.

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Now, ZEC seems to be following the same blueprint.

The chart shows a new ascending triangle forming, with ZEC once again testing its rising lower boundary — a level that aligns perfectly with the 100-MA support around $547. This confluence triggered a strong reaction, pushing the price back above $600 and signalling early resilience from buyers.

What’s Next for ZEC?

If this fractal continues to play out, and if buyers successfully keep ZEC above both the 100-MA and the rising trendline of the triangle, the next major hurdle sits at the horizontal resistance zone near $744. A breakout above this region would confirm the bullish structure and could open the doors for another strong rally — potentially extending toward the $1,500 area based on the previous measured move projection.

However, as with any fractal pattern, repetition is not guaranteed. A breakdown below the rising support and the 100-MA would invalidate this setup and increase the risk of deeper corrective movement.

For now, the emerging structure suggests ZEC may still have room to push higher if key support continues to hold.