US Govt and Mt. Gox Shift Millions in Hidden Crypto Transfers

New blockchain movements from the US government and Mt. Gox are drawing trader scrutiny, with delayed creditor payouts helping calm market fears.

Blockchain tool Arkham detected small but impactful moves that could have lasting effects for months.

The US government and Mt. Gox, the defunct Japanese exchange, made significant transfers that have traders watching closely.

US Government Moves Seized Crypto

Blockchain intelligence firm Arkham revealed that the US government recently moved $23,000 worth of WIN tokens on Tron. These assets were seized from Alameda Research nearly two years ago.

ARKHAM ALERT: US GOVERNMENT MOVING FUNDSThe US Government moved $23K of WIN on Tron seized from Alameda Research 2 years ago. pic.twitter.com/98goLfxUrd

— Arkham (@arkham) November 18, 2025

While small in dollar terms, the move signals that authorities are still actively managing high-profile crypto seizures.

Such transfers can precede auctions, compliance actions, or other administrative steps, with minor movements, just like major ones, capable of influencing market sentiment for linked tokens.

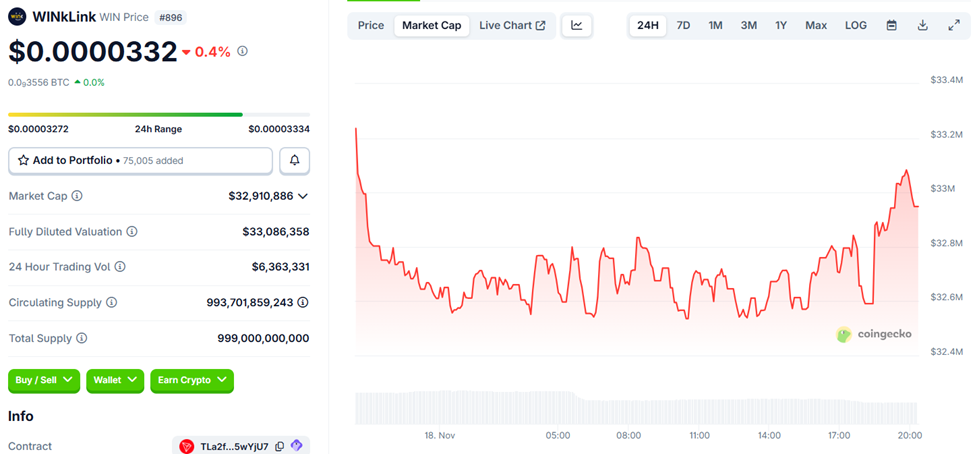

WINkLink (WIN) Price Performance. Source:

WINkLink (WIN) Price Performance. Source:

Data on CoinGecko shows the WINkLink token on Tron was trading for $0.0000332 as of this writing, down by 0.4% in the last 24 hours.

Mt. Gox Transfers $16.8 Million in Bitcoin

More attention is focused on Mt. Gox, which transferred 185 BTC, valued at approximately $16.8 million, to the following a test transaction. An additional $936 million in Bitcoin was shifted to another Mt. Gox wallet, according to Arkham.

MT GOX JUST TRANSFERRED $16.8M OF $BTC TO KRAKENMt Gox just transferred 185 BTC ($16.8M) to Kraken after a test transaction. $936M of change BTC has been moved to another Mt. Gox wallet.Mt. Gox made their last major movement 8 months ago, depositing $77.4M worth of Bitcoin to… pic.twitter.com/5YQYJqqxBw

— Arkham (@arkham) November 18, 2025

This follows the exchange’s last major transfer, eight months ago, when $77.4 million in Bitcoin was sent to Kraken for creditor distributions.

On October 27, Mt. Gox announced that Bitcoin repayments will now occur by October 31, 2026. This locks 34,689 BTC, approximately $4 billion, and temporarily removes a significant source of potential selling pressure.

“It has become desirable to make the repayments to such rehabilitation creditors to the extent reasonably practicable,” rehabilitation trustee Nobuaki Kobayashi stated in the letter, citing court approval for the one-year extension.

Analysts say the delay calms Mt. Gox FUD and provides near-term market clarity. By pushing the next major liquidity event out by a year, investors gain stability and confidence amid delayed selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bears Make Progress While Whales Continue to Gather PEPE During Market Decline

- PEPE faces potential 18% decline as technical indicators and whale activity signal bearish momentum, with price below all major moving averages. - Whale accumulation (65% long-term supply) contrasts with $21M short-seller profits, deepening market uncertainty amid fragile price dynamics. - Broader memecoin sector weakens (-19.35% weekly PEPE drop), though UK/Japan regulatory easing offers faint hope for 15-20% ETH-based token liquidity by Q1 2026. - Price projections remain polarized (bulls: $0.0000147 b

Bitcoin Updates Today: The Mystery of Bitcoin Persists: Dorsey's Approach Sparks New Theories About Satoshi

- Jack Dorsey's Bitcoin integration at Block and strategic announcements fuel speculation he may be Satoshi Nakamoto, though no proof exists. - Bitcoin's 30% price drop reduced Nakamoto's estimated paper wealth to $95B, now ranking 18th globally amid market volatility. - Ark Invest boosted crypto stock exposure including Block and Circle, signaling sector resilience despite short-term downturns. - Experts caution Dorsey-Nakamoto links remain circumstantial, emphasizing lack of cryptographic evidence or dir

Bitcoin Latest Update: Fed's Mixed Signals Drive Bitcoin Past $84,000

- Bitcoin surged above $84,000 on Nov. 21, 2025, driven by New York Fed President John Williams' hints at a potential December rate cut, pushing market odds of easing above 70%. - The rebound followed weeks of 30% declines from record highs amid hawkish policies, contrasting with Cleveland Fed President Beth Hammack's downplayed labor risks. - Analysts highlight critical support at $74,500–$83,800 for Bitcoin's recovery, with a successful defense potentially triggering a rebound toward $94,000–$100,000. -

Bitcoin News Today: JPMorgan's Bitcoin Report: Using Leverage Increases Both Profits and Risks

- JPMorgan launches a leveraged Bitcoin structured note tied to the iShares Bitcoin Trust ETF , offering amplified gains or losses over a two-year horizon. - The product guarantees $160 per $1,000 investment if BTC/ETF hits a price target by 2026, or 1.5x returns if extended to 2028, amid Bitcoin's 30% two-month decline. - The $3.5B November ETF outflows and XRP's $587M inflows highlight shifting crypto dynamics, with low-cost institutional ETFs driving adoption. - JPMorgan's offering mirrors traditional l