SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

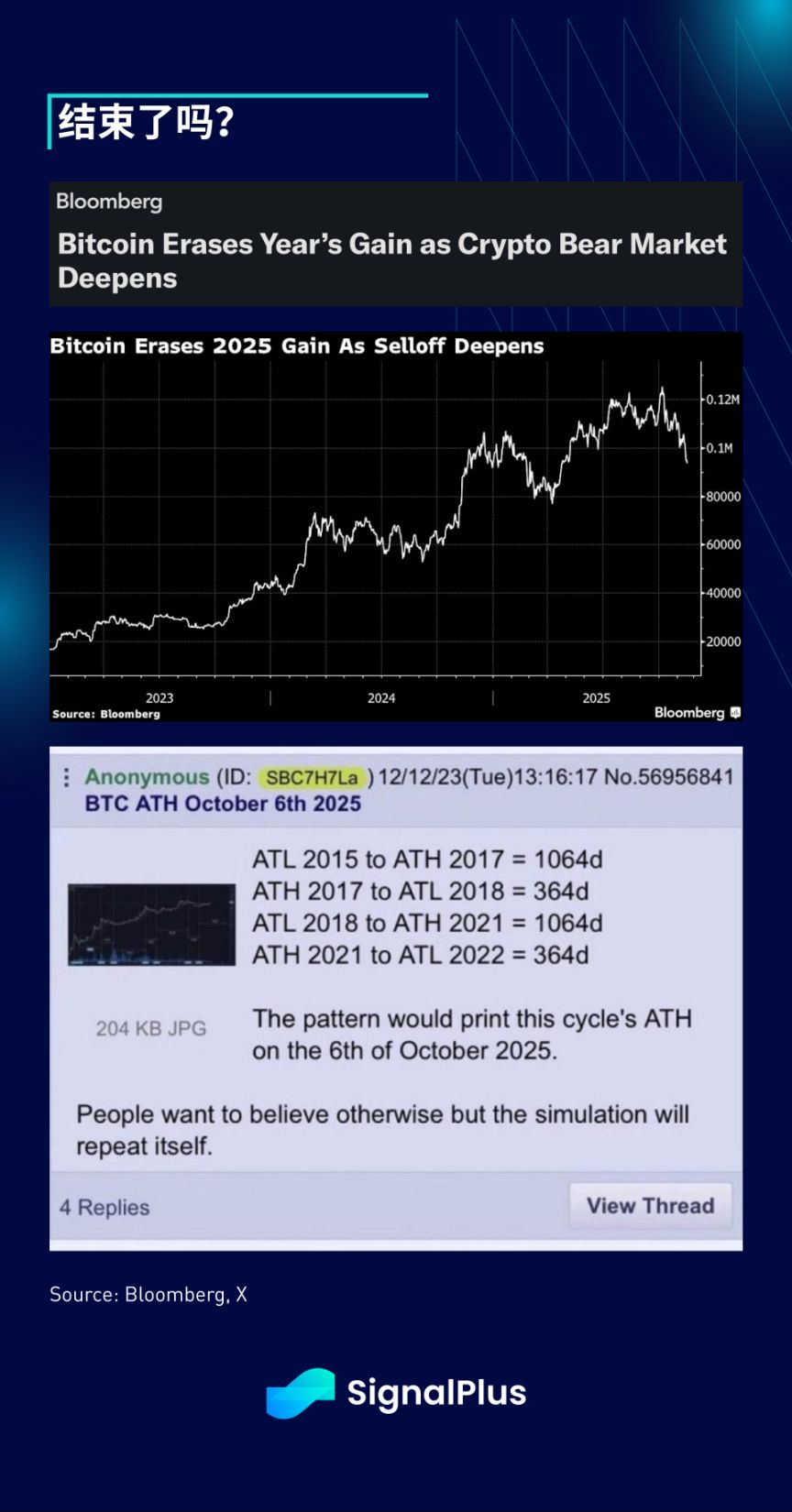

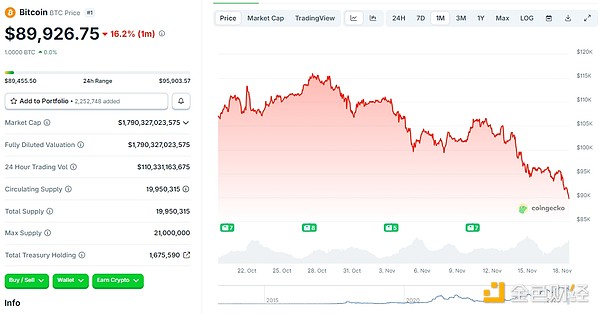

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...

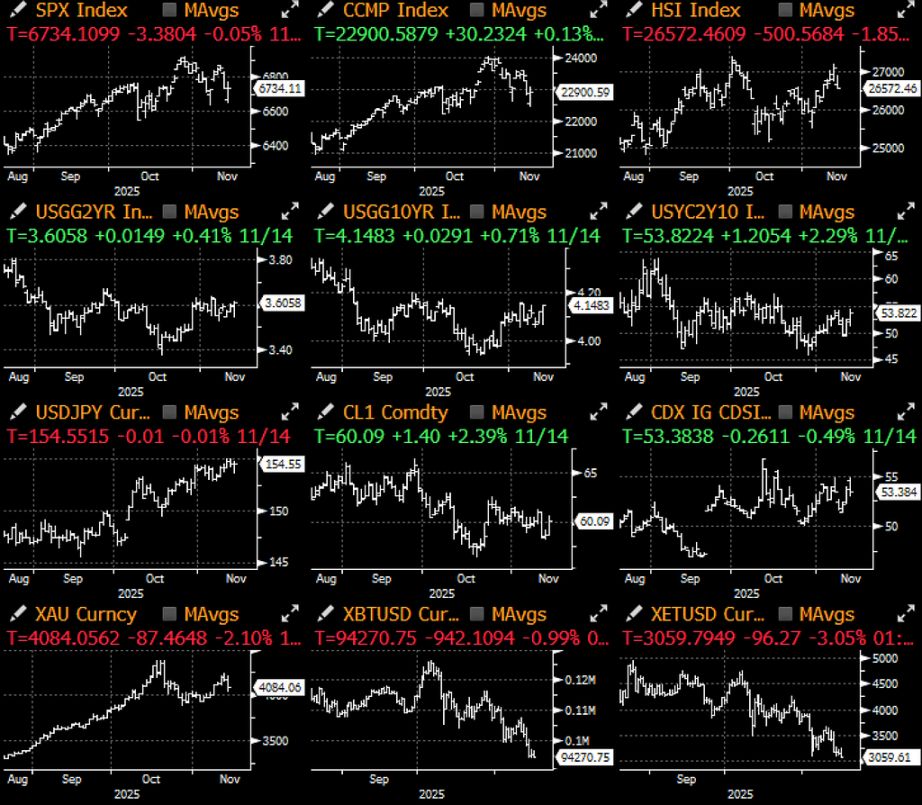

Over the past week, cryptocurrency prices have fallen again. BTC pulled back after reaching $94,000 on Monday due to light selling pressure, and major cryptocurrencies dropped another 10–20% week-on-week. Market sentiment has become more pessimistic than ever, even surpassing previous bear markets. While macro headwinds can explain part of the sell-off, the performance of cryptocurrencies has indeed lagged behind most other asset classes, including leveraged tech stocks, which are most closely correlated with crypto.

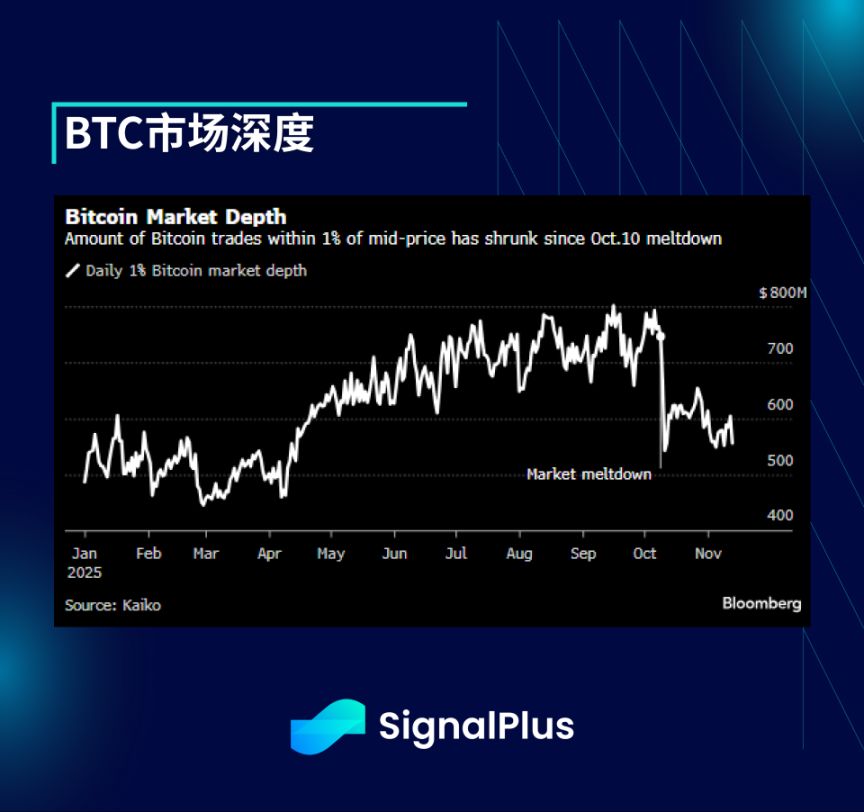

Additionally, following the market crash in October, persistent rumors of significant losses among market makers have led to a notable decline in order book liquidity, exacerbating market volatility, especially on the downside.

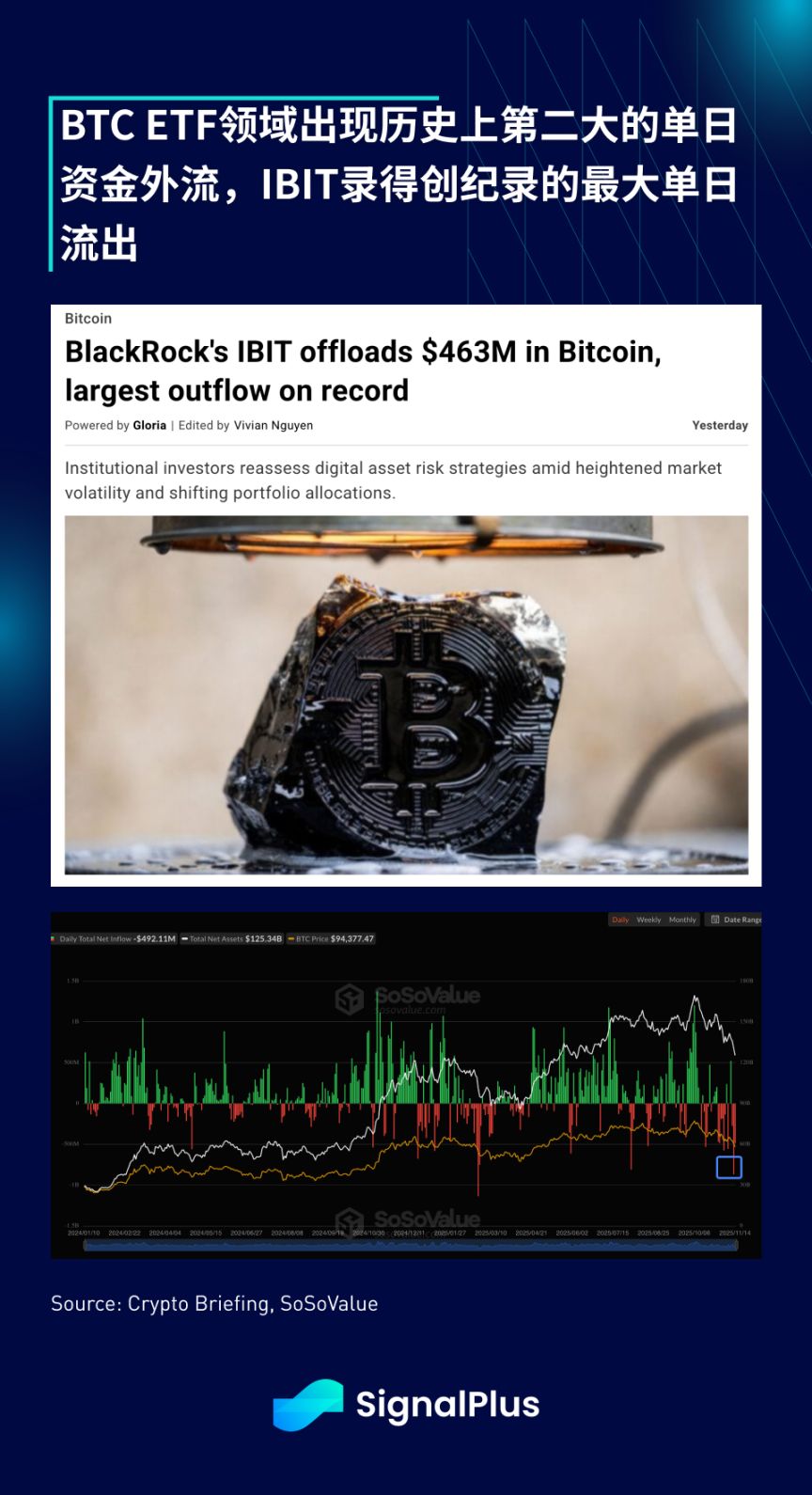

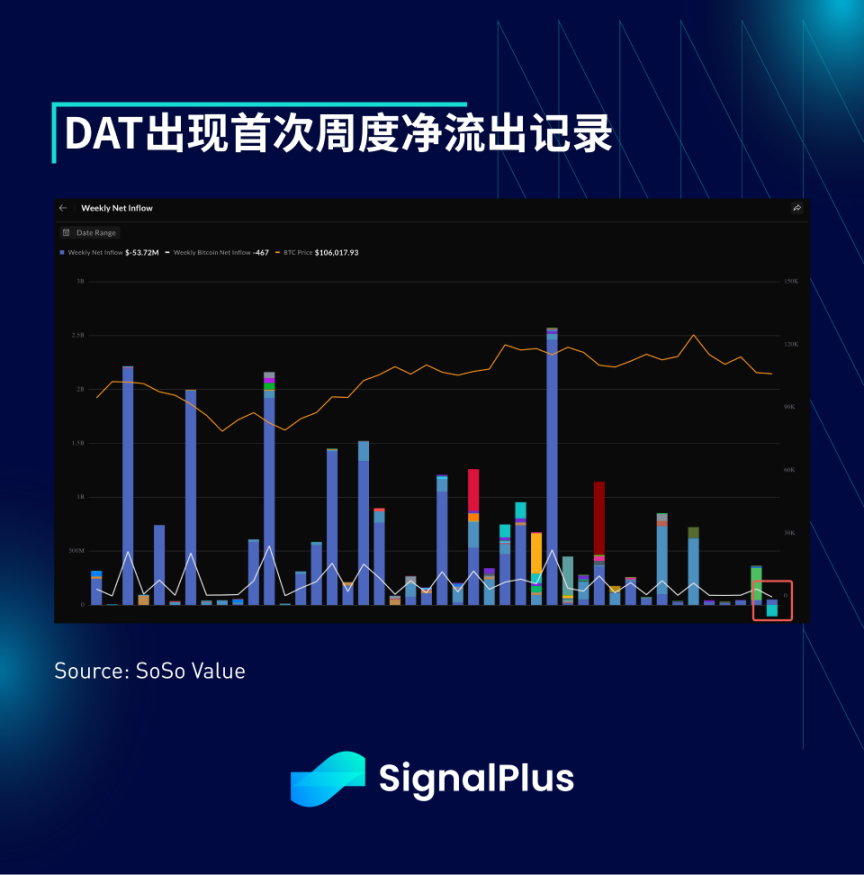

Unsurprisingly, we have seen rapid deleveraging and actual capital outflows across the crypto space. After large-scale liquidations in centralized exchange futures, ETF outflows and DAT sales have also hit new highs for the year. BlackRock's IBIT recorded its largest single-day outflow in history at $463 million, and DAT saw its first weekly net outflow since launch.

Ongoing selling has caused the DAT premium to collapse into negative territory, sparking market concerns that companies may sell assets to support falling stock market capitalizations, leading to fears of treasury sales. MSTR is clearly the elephant in the room. Although Saylor quickly and publicly denied any selling tricks, the final conclusion may still be pending.

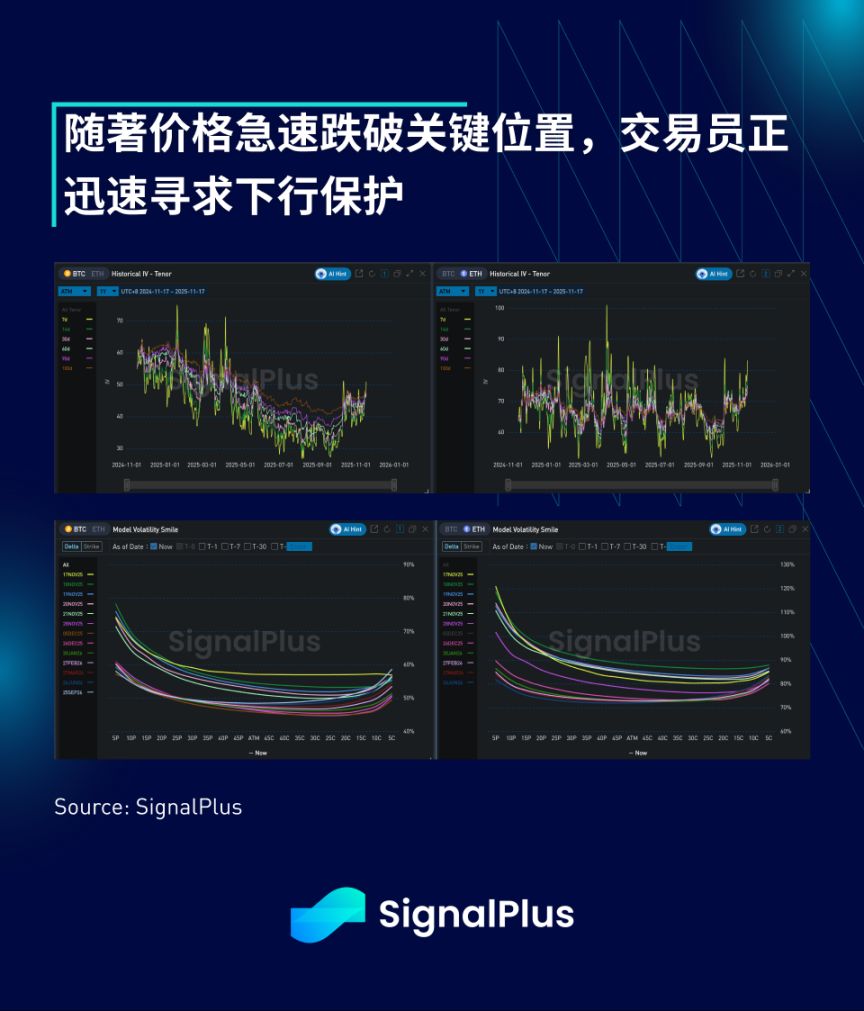

After a long period of calm, realized and implied volatility have both rebounded as prices fell below the bull market cycle range. In particular, there is still demand for put option skew, especially for ETH, which has less actual capital support than BTC, raising concerns about a more severe downturn.

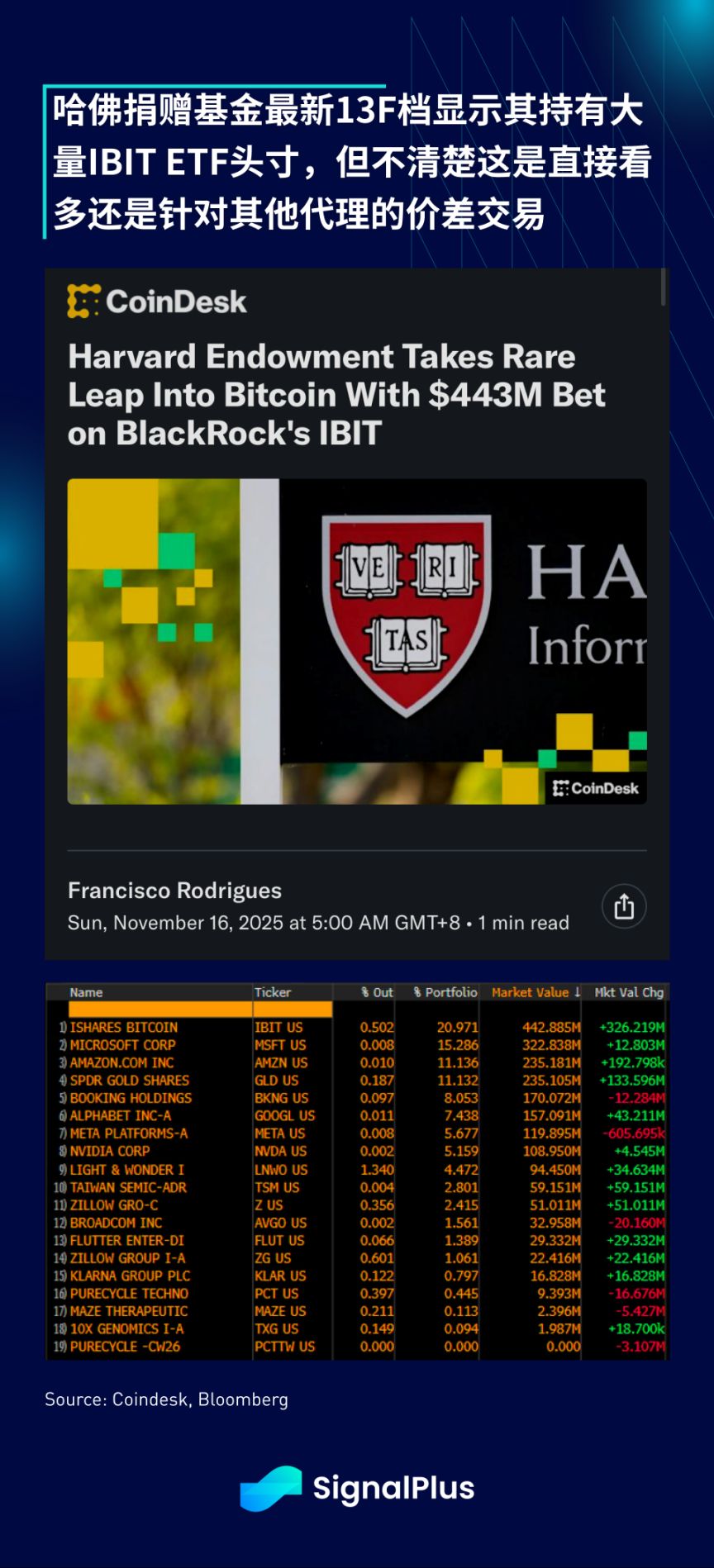

Amidst all the pessimism and gloom, is there any good news in the sector recently? Aside from Square's recent announcement that its merchants have started accepting bitcoin payments, the latest 13F filings also show that the Harvard University endowment fund (with $57 billion under management) now holds a $443 million IBIT position, making it the largest single stock holding in its portfolio. But before everyone gets too excited, it is unclear whether this position is a pure long or a spread/arbitrage trade against DAT or other crypto proxies. We tend to believe the latter, but even if it is not a pure long exposure, it is still positive to see that real money accounts from traditional finance are at least becoming more active participants in the sector.

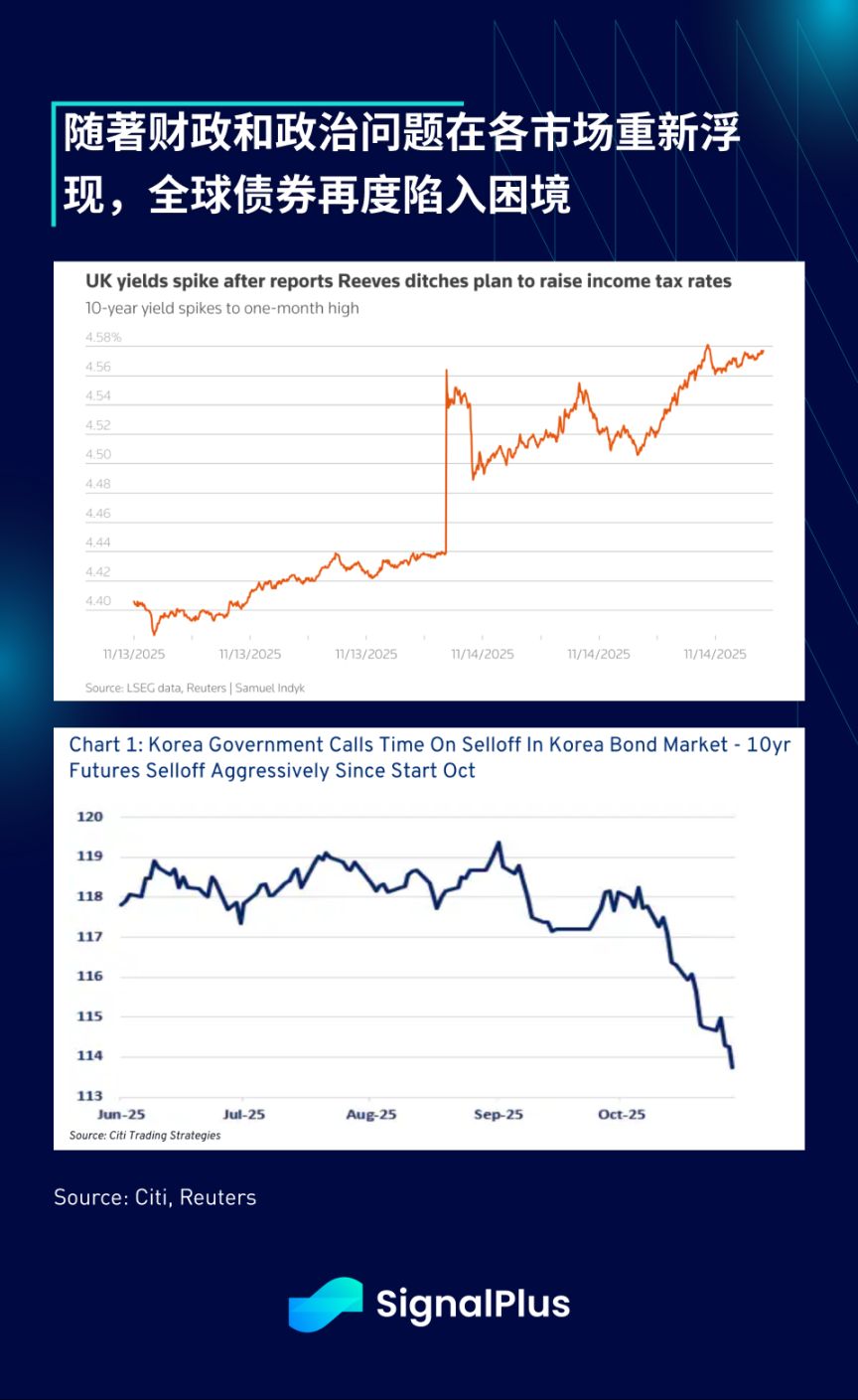

Back to the macro side, despite the KOSPI falling 3.8% and the Nasdaq plunging 2% at the open, U.S. stocks shook off a turbulent start, closing higher and holding above the 55-day moving average support. The fixed income market also faced pressure, with Japanese, Korean, and UK bonds all under strain due to brewing fiscal/political concerns, and U.S. Treasuries facing similar headwinds as yields reversed higher.

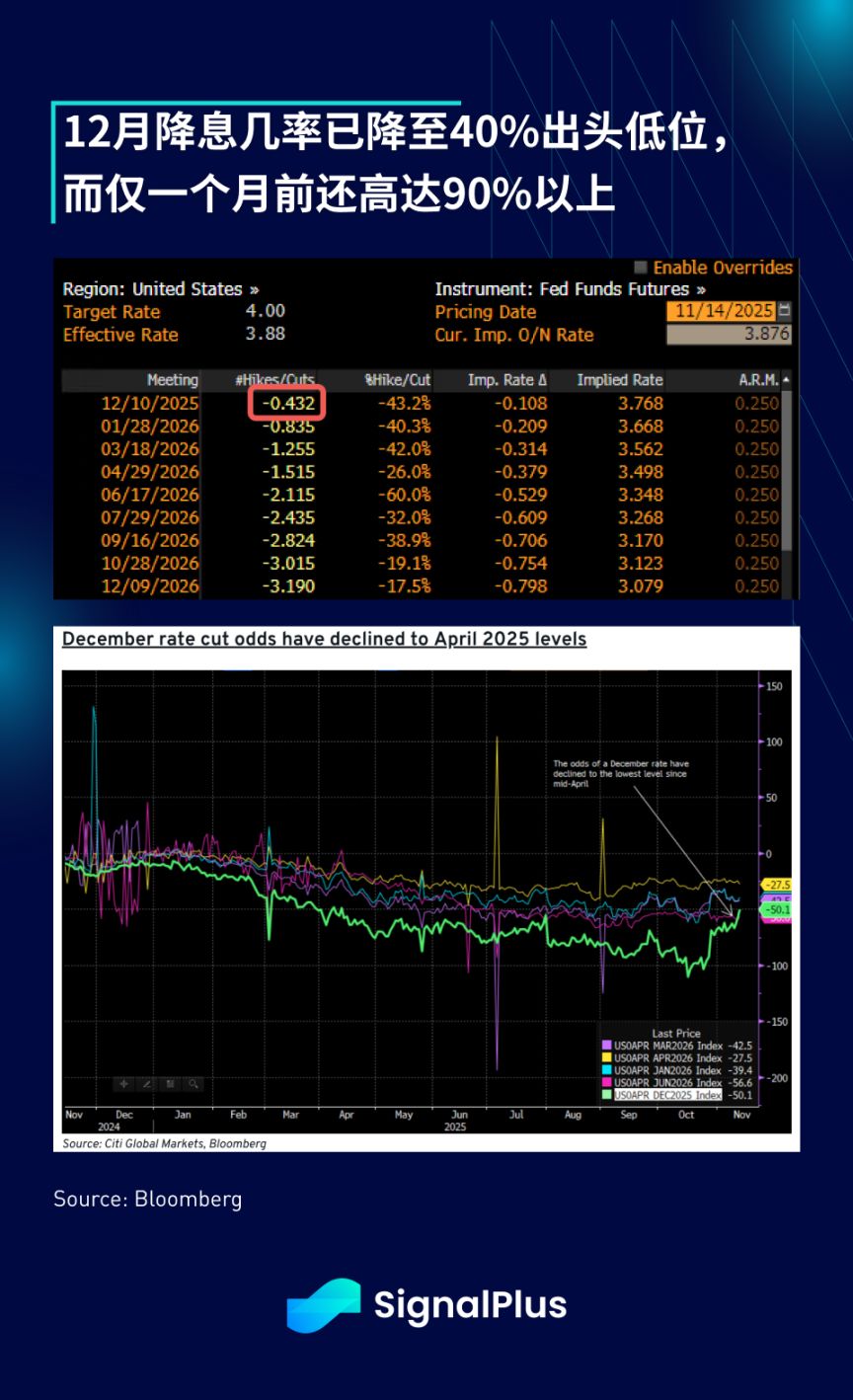

In the U.S., the probability of a rate cut in December has dropped to around 40%, as Federal Reserve officials have come out to dampen easing expectations. Despite some concerns in the labor market, the U.S. economy remains broadly stable. The biggest worry remains inflation. Former Treasury Secretary and Fed Chair Yellen declared that the U.S. is "at risk of becoming a banana republic," while President Trump recently suffered a major setback in the polls due to high inflation and rising living costs.

Fed officials have made it clear they want to manage and lower easing expectations, with former Chair Yellen warning that the U.S. faces the risk of becoming a "banana republic."

"At present, it is clear that monetary policy should not do more," — Cleveland Fed President Mester

"For the December meeting, I think unless we get compelling evidence that inflation is falling faster than I expect, or we see a more severe cooling in the labor market than we currently observe, it will be hard to support another rate cut." — Dallas Fed President Logan

"I don't think further rate cuts will help patch any cracks in the labor market—these pressures are likely due to structural changes in technology and immigration policy," — Kansas City Fed President Schmid

Looking ahead, we will be closely monitoring the following:

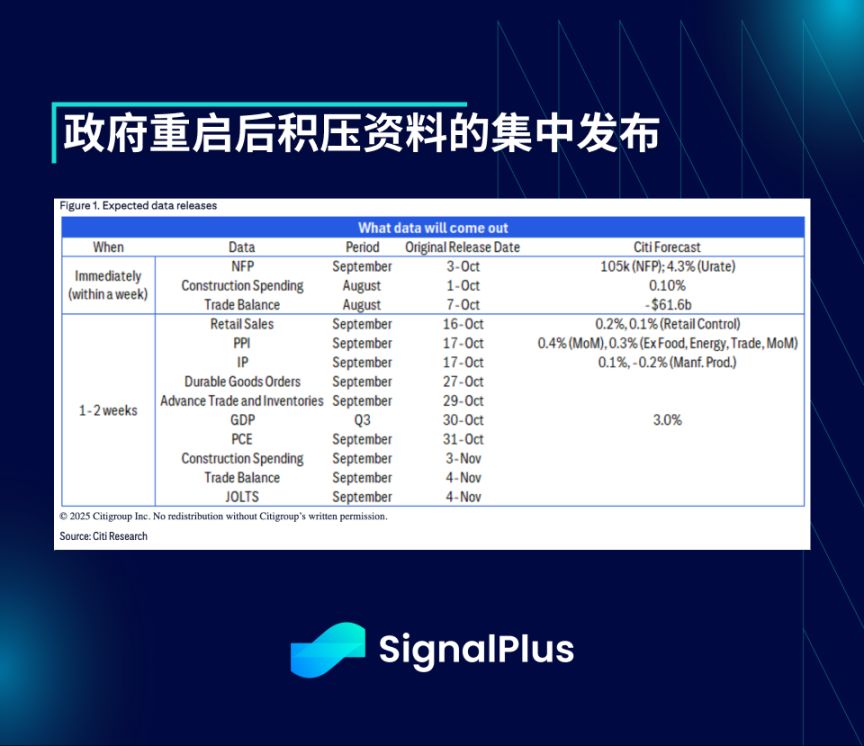

1. Concentrated release of backlogged data after the government reopens

- We expect that in the coming weeks, as analysts begin to sift through the backlog of economic data, rate cut expectations will fluctuate.

2. Macro factors return to drive short-term asset movements as asset volatility rises

- As investors refocus on economic growth, early signs of a slowdown in the labor market, and stubborn inflation, cross-asset volatility has increased.

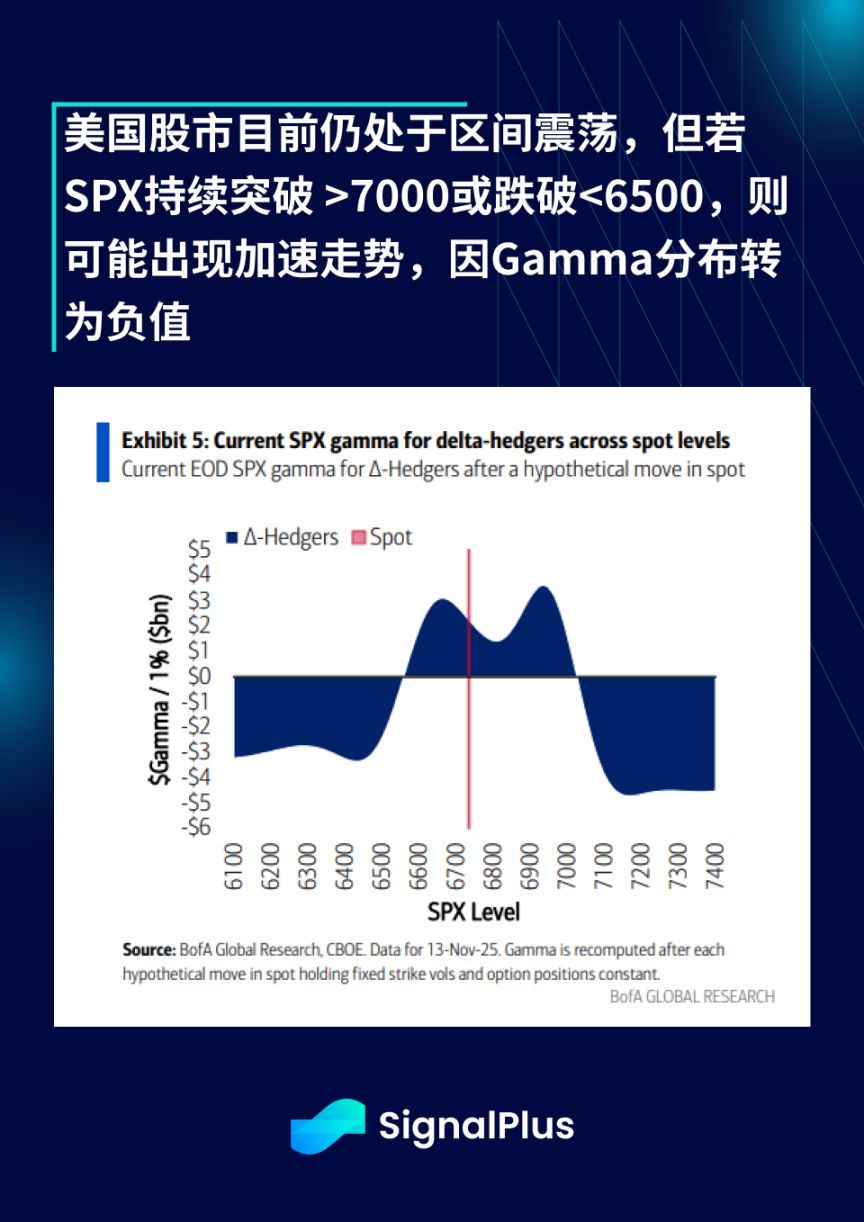

3. U.S. equities remain range-bound for now, but if SPX continues to break above 7000 or below 6500, an accelerated move may occur as Gamma distribution turns negative

4. We remain cautiously optimistic on U.S. equities as earnings growth continues to rise and retail demand remains strong

- Despite expensive valuations, U.S. corporate earnings growth remains at one of the highest levels in recent years.

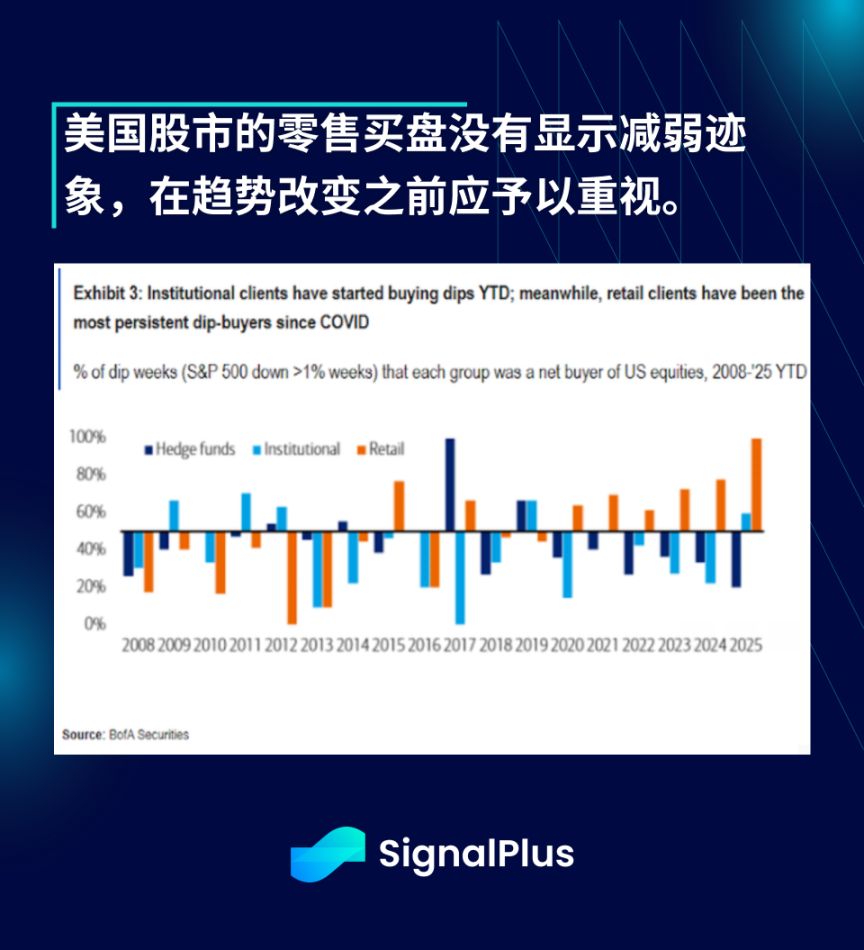

- Retail buying in U.S. equities shows no signs of weakening and should be respected until the trend changes.

5. The technical outlook for cryptocurrencies is not very optimistic, but may offer attractive long-term entry points

- We continue to expect the aftermath of the October crash to persist, as more victims emerge, more protocols shut down, and more native participants exit due to shattered illusions.

- The sale of DAT is a real risk and will significantly suppress market sentiment until further notice.

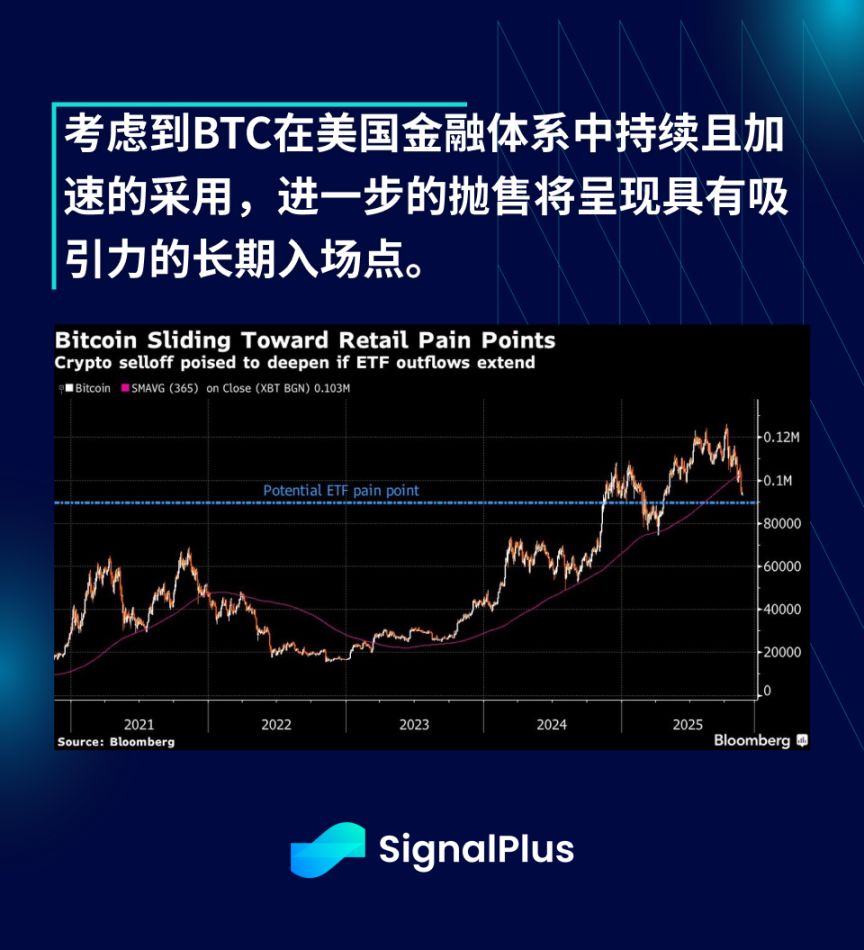

- Given the continued and accelerated adoption of BTC in the U.S. financial system, further sell-offs will present attractive long-term entry points.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

Is the crypto market bearish? See what industry insiders have to say

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave