ZEC drops 10.72% over 24 hours as significant short positions are liquidated and trading volume increases

- ZEC fell 10.72% in 24 hours but surged 23.62% in 7 days, driven by massive short liquidations and rising trading volume. - High-profile short positions lost $3.28M (Roobet/Stake.com) and $21.75M (Hyperliquid), as ZEC's price broke $700 and hit $11.3B market cap. - Institutional confidence grows with BitMEX's Arthur Hayes holding ZEC as second-largest asset, while analysts warn of overbought conditions and potential pullbacks.

As of NOV 17 2025,

ZEC Short Sellers Take Heavy Losses as Price Spikes

Zcash (ZEC) remains a focal point in the cryptocurrency sector as its price swings have led to substantial losses for those betting against it. On November 17, ZEC surpassed $700, resulting in partial liquidations of major short positions. A prominent trader and gambler, linked to Roobet and Stake.com, incurred losses exceeding $3.28 million due to the price rally.

LookOnChain’s on-chain data shows that the address (0x7B7...734E) currently possesses 73 BTC worth $122.5 million, with a liquidation threshold at $95,764. The same address also holds 34 ZEC valued at $16.75 million, along with 5.6 million

Hyperliquid’s Largest ZEC Short Sees Over $21 Million in Unrealized Losses

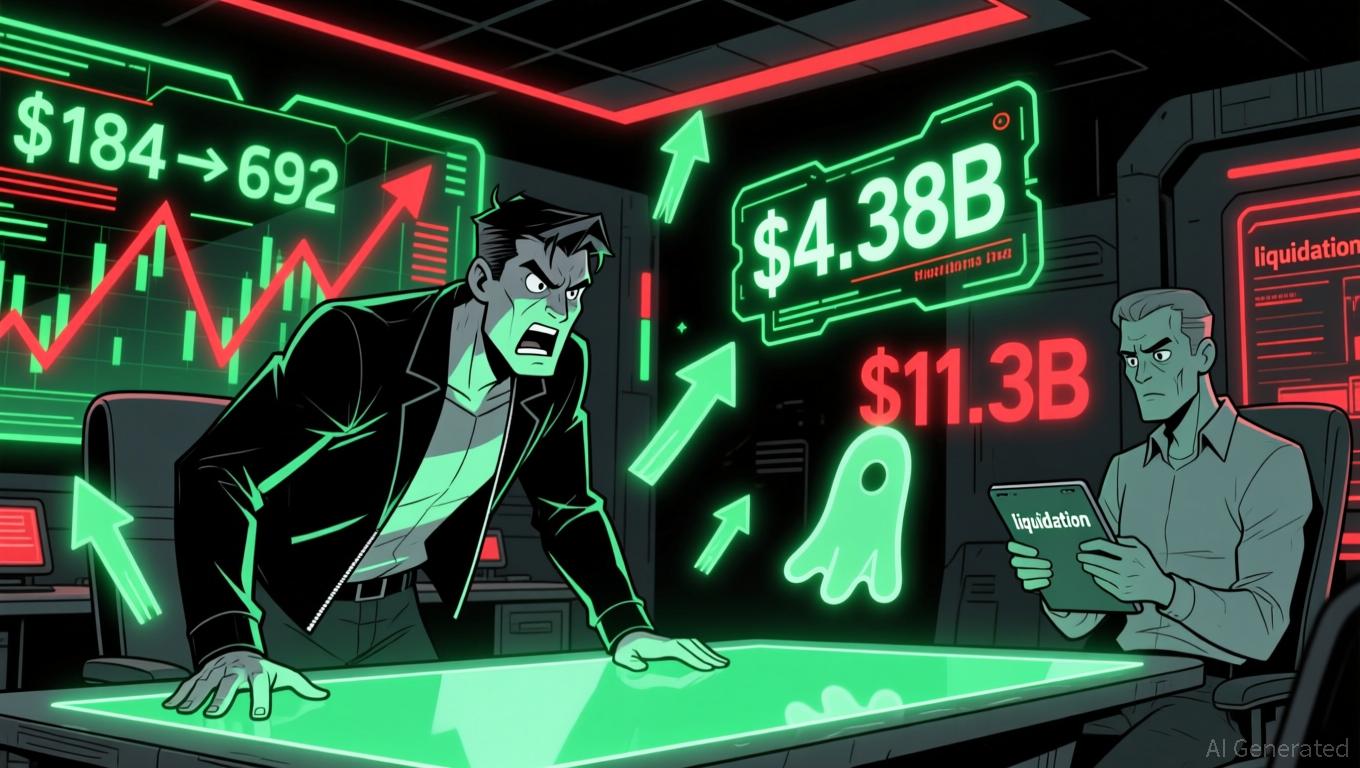

The biggest ZEC short on Hyperliquid is also under significant stress. The short, tied to address (0xd47), has accumulated an unrealized loss of $21.75 million, equating to a 245% loss from its original position. The position has expanded from $29.26 million to $43.20 million, with floating losses rising by about $7 million in just one week.

This trade began on October 10 at roughly $184 and has been increased several times since. The average entry price now stands at $360, with a liquidation point at $1111. The account’s total notional value is $74.35 million, and on-chain observers are closely tracking this address for any further changes or forced liquidations.

ZEC Becomes Third-Largest Altcoin by Trading Volume

Zcash’s trading activity has surged, making it one of the top three altcoins by volume. On November 17, ZEC posted a 24-hour trading volume of $4.38 billion, ranking behind only

The heightened attention toward ZEC is largely due to increasing demand for privacy-oriented cryptocurrencies. Experts point to Zcash’s use of shielded transactions and zero-knowledge proofs as key factors behind its adoption. According to Delphi Digital, ZEC has led growth in the privacy coin segment, outpacing rivals such as TORN.

Institutional and Retail Investors Back ZEC’s Future

Both large-scale and individual investors are showing optimism about ZEC’s prospects. Arthur Hayes, co-founder of BitMEX, has made ZEC the second-largest liquid asset in his portfolio after

Furthermore, Zcash’s recent breakout from a long-term wedge formation has caught the eye of technical analysts. Eric Van Tassel noted that ZEC has surged 555% since this breakout, experiencing several pullbacks of 20–43% over the past 36 days.

ZEC’s Rally Raises Concerns of Overbought Market and Potential Correction

Despite the strong

The debate between ZEC enthusiasts and Bitcoin supporters has grown more heated, with some speculating that the rally is orchestrated due to its speed and volatility. On the other hand,

With the upcoming Zcash halving and more wallet integrations on the way, market participants are watching closely to see if the current uptrend can be sustained.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: Crypto Whale Maintains $145M ETH Position After $4.9M Loss, Anticipates Surge to $3,860

- Hyperliquid's whale 0x9ee holds $145M ETH long with $4.9M loss, targeting $3,860 rebound despite market volatility. - Portfolio includes $52.2M XRP long and $44M ASTER short, highlighting leveraged crypto trading's mixed gains/losses. - Platform faces $5M liquidity loss from Popcat manipulation and 38% HYPE futures decline, signaling ecosystem instability. - High-leverage risks exposed by $168M liquidation and $100M BTC loss parallels, underscoring market fragility. - ASTER short turning to long position

Crypto Privacy Era Concludes as IRS Integrates into International Tax System

- The White House proposes IRS access to offshore crypto transactions via OECD's CARF framework to combat tax evasion and align with global standards. - CARF, supported by 72 countries including major economies, will enable cross-border data sharing while exempting DeFi transactions from new reporting rules. - U.S. crypto exchanges will report detailed transactions to IRS from 2026, marking a shift toward transparency as markets react with price volatility. - Critics raise privacy concerns over expanded IR

TRX News Today: JUST DAO Links USDJ with TRX to Address Market Fluctuations and Regulatory Challenges

- JUST DAO suspends USDJ operations, pegging it to TRX at 1:1.5532 to stabilize amid crypto volatility and regulatory scrutiny. - USDJ surged 187.82% pre-announcement, outperforming Bitcoin’s 0.77% drop as TRON-based assets show resilience. - Market cap fell to $3.21T as USDJ’s TRX peg aims to reduce fiat reliance and align with DeFi’s blockchain-native trends. - Mixed reactions highlight risks of TRX volatility undermining the peg, while analysts foresee TRX’s DeFi integration boosting its 2025 appeal.

TWT's Updated Tokenomics Framework: Transforming DeFi Governance and Enhancing Investor Yields

- Trust Wallet's TWT token redefines DeFi governance through utility-driven value creation, deflationary supply, and community governance in 2025. - Permanent burning of 88.9 billion tokens creates scarcity, while gas discounts, collateral capabilities, and governance rights align utility with platform adoption. - Hybrid investor returns combine scarcity-driven appreciation, staking yields, and fee-burn mechanisms, but depend on Solana ecosystem performance and utility adoption. - Challenges include fragme