Bitcoin News Update: Investors Exit Cryptocurrency Market Amid Fed’s Reluctance to Lower Rates

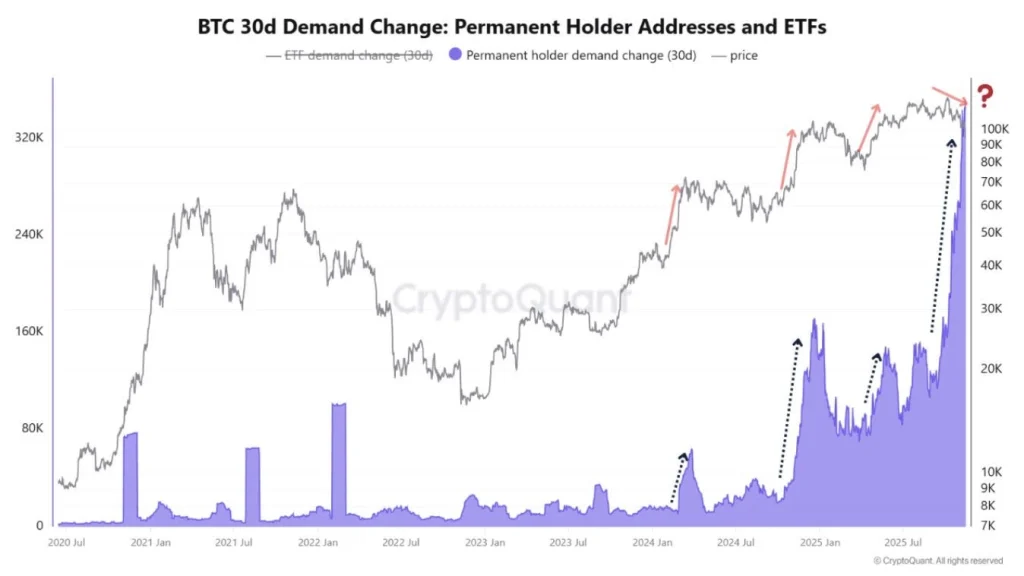

- Fed officials including Lorie Logan and Neel Kashkari oppose rate cuts, citing persistent inflation and weak economic data, dampening December easing expectations. - Tightening liquidity and shifting Fed policy triggered Bitcoin's six-month low at $93,000 and record $866M ETF outflows amid heightened defensive positioning in crypto derivatives. - Market pricing for a 25-basis-point December cut dropped to 52% from 94%, driving capital reallocation to cash, bonds, and gold as macro uncertainty persists. -

The Federal Reserve's careful approach to interest rate reductions has dampened hopes for monetary easing in December, as officials stress the necessity for clearer signs of inflation improvement before adjusting policy. Dallas Fed President Lorie Logan reaffirmed her stance against a rate cut in October and

The tightening of liquidity, made worse by the U.S. government shutdown and delays in economic reporting, has further reduced risk appetite in

Currently, traders are factoring in a

In corporate news, Paysafe Limited announced a return to revenue growth for Q3 2025, with U.S. dollar revenue up 2% year-over-year. Despite softer free cash flow and lower adjusted EBITDA margins, the payment company sustained a strong free cash flow yield of 9.3% relative to enterprise value, supporting its Buy recommendation

On the global stage, the Reserve Bank of India extended credit terms for exporters in response to escalating U.S.-India trade friction

As the Federal Reserve approaches its December meeting, attention will stay fixed on economic data and central bank statements. With liquidity tightening and inflation remaining persistent, the outlook for crypto assets is still unclear. Nevertheless, analysts such as Edward Carroll from MHC Digital Group

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights

Why Analysts Say Warren Buffett’s Japan Strategy May Indirectly Boost Ripple and XRP

XRP News Today: Despite Record Inflows into XRP ETF, Token Experiences 4.3% Decline

- XRP fell 4.3% to $2.22 despite Canary Capital's XRPC ETF securing $245M inflows, outperforming 2025 ETF peers. - Analysts cite delayed ETF settlement mechanics , macroeconomic pressures, and $28M in XRP liquidations as key price drivers. - XRPC's success contrasted with $866M Bitcoin ETF outflows, highlighting shifting institutional crypto preferences. - Experts predict gradual XRPC-driven demand but warn XRP remains vulnerable below critical $2.30 support level.

Ethereum Updates: As Bitcoin Faces Greater Market Challenges, Corporate Treasuries Shift Focus to Ethereum

- BitMine Immersion appoints Chi Tsang as CEO, now holding 3.5M ETH ($12.4B) as it shifts focus to Ethereum financial services. - Strategy's stock plummets below Bitcoin treasury value (mNAV 1.24), reflecting waning investor confidence despite Saylor's bullish stance. - Ethereum drops 5.46% amid $259M ETF outflows, while Bitcoin falls below $95K after $1.4B liquidation event. - Corporate treasuries expand beyond BTC/ETH, with Forward Industries (Solana) and Cypherpunk (Zcash) adopting new crypto strategies