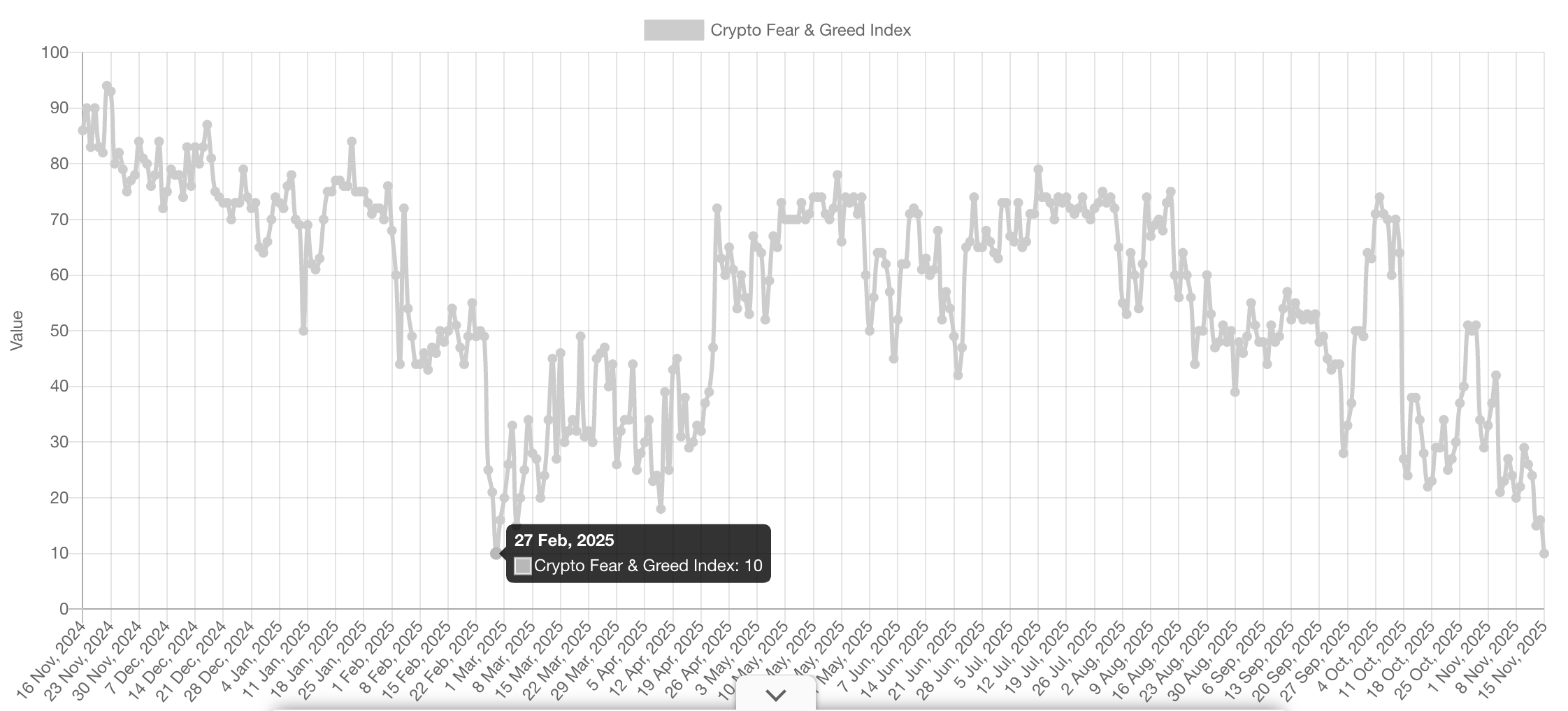

Crypto sentiment index sinks to lowest score since February

Crypto sentiment has dropped to its most fearful level in over eight months, as ongoing macroeconomic uncertainty continues to rattle market participants.

However, crypto analysts are anticipating the bearish mood to be short-lived.

The Crypto Fear & Greed Index, which measures overall market sentiment, posted an “Extreme Fear” score of 10 in its Saturday update, the lowest score it has seen since Feb. 27, as Bitcoin (BTC) fell below $95,000 on Friday and has yet to reclaim above $96,000 at the time of publication, according to CoinMarketCap.

The February low came just days after spot Bitcoin ETFs saw their worst-ever single-day outflows of $1.14 billion, as Bitcoin fell from $102,000 at the start of the month to $84,000.

Indicators suggests market is less bearish than previous downturns

Crypto market participants use sentiment indexes to gauge the broader market’s sentiment toward the sector and inform their decisions on whether conditions favor buying or selling.

However, Bitwise’s European head of research, Andre Dragosh, argued the situation isn’t as bleak as it may appear when compared with past downturns.

“Sentiment index is bearish but less so than during previous corrections despite lower prices,” Dragosh said in an X post on Friday, pointing to Bitwise’s crypto sentiment index showing signs of reversal.

“Our Cryptoasset Sentiment Index also continues to show a positive divergence,” Dragosh said.

While US President Donald Trump recently signed a bill ending the longest government shutdown in US history, an event some crypto market participants had blamed for recent volatility, uncertainty persists around the US Federal Reserve’s interest-rate cut decision, which is often linked to the crypto market.

Bitcoin chart signaling “potentially positive” move ahead

Meanwhile, NorthmanTrader founder Sven Henrich told his 503,400 X followers on Friday that Bitcoin’s price chart is showing “something potentially positive” for Bitcoin bulls. “Falling wedge, positive divergence,” Henrich said.

A Messari research manager, known online as “DRXL,” said that in his eight years working in the crypto industry, he has never seen “such dissonance between the headlines and the sentiment.”

Related: ‘We are buying’: Michael Saylor denies reports of Strategy dumping BTC

“Everything we once dreamed of is happening, yet it somehow feels… over,” he said.

Some analysts see the lack of a year-end surge as a healthy sign. Bitwise chief investment officer Matt Hougan recently told Cointelegraph that “The biggest risk was [if] we ripped into the end of 2025 and then we got a pullback.”

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin’s Latest Support for ZK Technology and What It Means for the Cryptocurrency Industry

- Vitalik Buterin promotes ZK technologies as Ethereum's scalability and privacy solution, accelerating institutional adoption through technical upgrades and partnerships. - ZKsync's 15,000 TPS Atlas upgrade and Polygon's AggLayer framework highlight ZK's role in cross-chain efficiency, with ZKsync's token surging 120% in 2025. - Institutional investments in Succinct Labs ($55M) and Aztec Network ($100M) underscore growing confidence in ZK's ability to solve blockchain's scalability-privacy trilemma. - ZK

Bitcoin News Update: Institutional Confidence Grows with Structured Crypto Products and Tokenized Assets as ETFs See $524M Inflows

- 55% of institutional investors expect short-term crypto price rebounds, driving RockToken and Binance to offer structured investment solutions for Bitcoin/Ethereum exposure. - U.S. Bitcoin ETFs saw $524M inflows via BlackRock/Fidelity, contrasting Ethereum ETF outflows due to staking model uncertainties, as Bitcoin's "macro hedge" narrative gains traction. - Binance's BlackRock BUIDL integration and U.S.-Swiss trade pact (securing $200B investments) highlight growing institutional confidence in tokenized

Mastercard's Move Toward Stablecoins May Accelerate ONDO's Expansion in Asset Tokenization

- Institutional investors boost Mastercard holdings , signaling risk-on sentiment that could indirectly benefit crypto assets like ONDO. - Mastercard-Thunes stablecoin integration advances digital asset adoption, potentially supporting tokenization platforms such as Ondo. - Oil price volatility and NZD/USD fluctuations highlight macroeconomic risks that may temper ONDO's short-term gains. - Financial sector resilience and institutional demand for tokenized assets align with ONDO's long-term growth potentia

Czech National Bank buys USD 1 million in Bitcoin & crypto assets