BigBear.ai Holdings (NYSE:BBAI) soared by 19% in premarket activity on November 11, 2025,

after posting third-quarter results that surpassed expectations

and announcing a $250 million purchase of Ask Sage, a generative AI company focused on defense and national security. The sharp rise in shares reflected investor enthusiasm for BigBear.ai’s shift toward higher-margin AI offerings, even as the broader crypto and tech markets remained volatile.

The company reported a reduced GAAP loss of $0.03 per share

and revenue totaling $33.1 million, both beating Wall Street forecasts. The Ask Sage acquisition,

expected to contribute $25 million in recurring annual revenue by 2025

, is set to strengthen BigBear.ai’s capabilities in secure AI solutions for both government and private sector clients.

Rocket Lab USA (NASDAQ:RKLB) also captured attention as its shares climbed 9.6%

following a third-quarter performance that exceeded projections

. The space launch company reported a 48% year-over-year increase in revenue, reaching $155 million, and

Stifel analysts boosted their price target to $75

. Rocket Lab’s non-GAAP gross margin improved to 41.9%, attributed to higher launch pricing and greater operational efficiency

as noted in analyst commentary

. However, the timeline for the Neutron rocket launch was pushed back,

now scheduled for Q1 2026

, leading to some investor caution, with the stock trading 15% below its October peak.

Elsewhere,

GameSquare’s third-quarter report revealed a strategic move

toward integrating Web3, including a digital asset treasury approach centered on Ethereum yields and acquiring culturally relevant NFTs. Collaborations with crypto-focused partners such as Rollbit and

Anime

Coin highlighted growing trust in blockchain-based revenue models.

In a separate development, American Bitcoin, a company linked to the Trump family

, posted a quarterly profit and doubled its revenue, signaling ongoing strength in crypto infrastructure despite market challenges.

The cryptocurrency sector itself presented mixed trends.

Canary’s XRP ETF launched with $58 million

in trading volume, positioning it as a strong contender compared to newer Solana ETFs. On the other hand,

Ethereum

(ETH) slipped below $3,100 as ETF outflows and increased selling by long-term holders intensified,

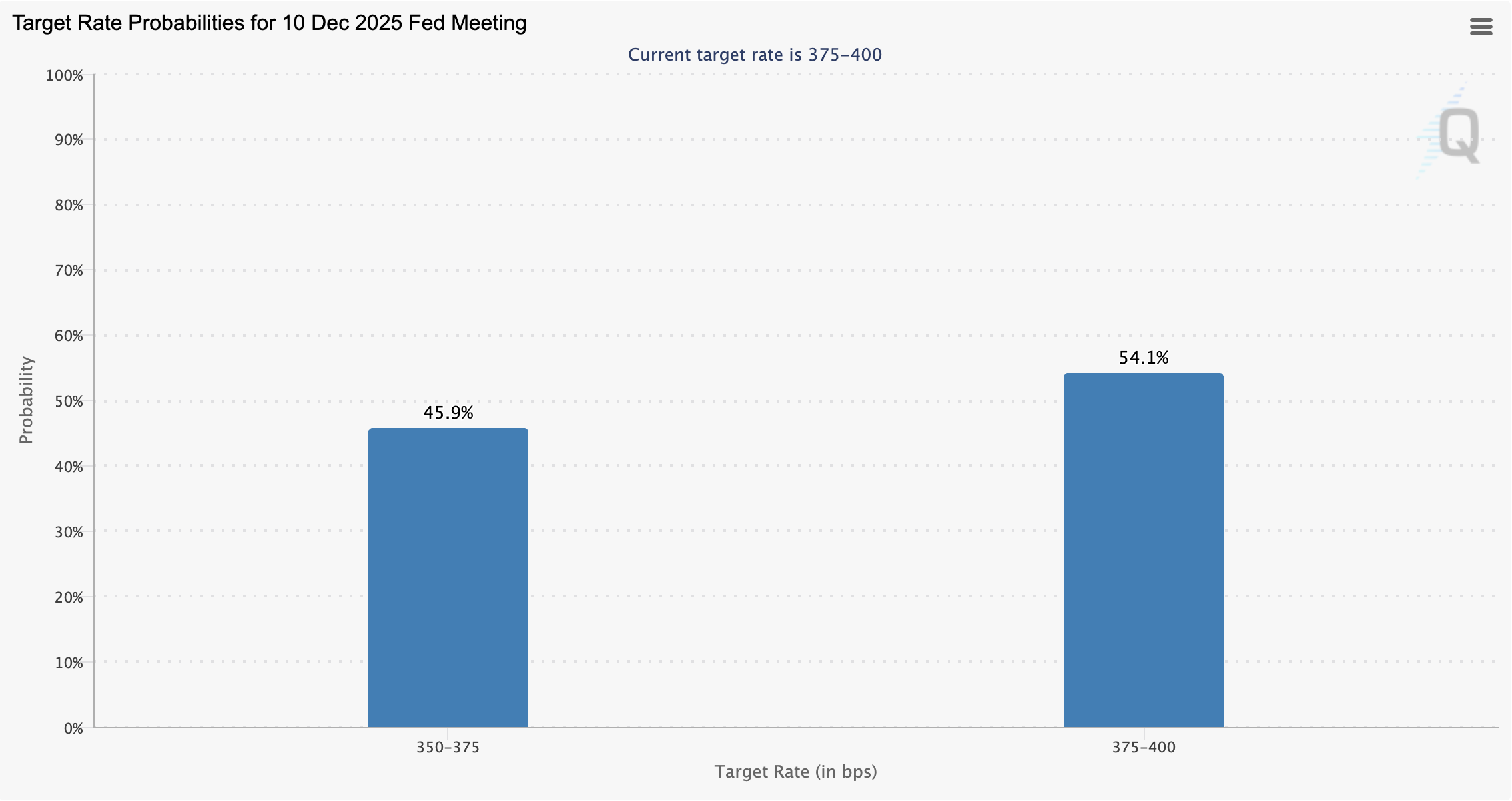

further pressured by the Federal Reserve’s hawkish policies

.

EnviroGold eliminated $10.2 million in debt in 2025

reaffirming its commitment to advancing the NVRO Process™ commercially

, though forward-looking statements warned of risks associated with scaling new technologies. In the traditional finance space,

Goldman Sachs increased Banco de Chile’s price target to $35

even though the bank missed third-quarter earnings expectations.

The interconnected developments across AI, space, crypto, and conventional equities highlight a market balancing growth prospects with regulatory uncertainty. As companies like

BigBear

.ai and

Rocket Lab

pursue strategic deals and operational achievements, investors continue to monitor sector-specific drivers and broader economic challenges.