POPCAT Flash Crash on Hyperliquid Sparks $4.9 Million Manipulation Allegations

Popcat’s $30M crash on Hyperliquid wiped $4.9M from the liquidity provider. Was it a stress test or a manipulative attack? Full breakdown inside.

An anonymous trader burned through $3 million in minutes on Hyperliquid after faking a $20 million buy wall on POPCAT.

The move triggered a cascade of liquidations, resulting in a $4.9 million loss for the platform’s liquidity provider. Analysts now suspect a coordinated “stress test” of Hyperliquid’s system.

$30 Million Long Positions Create Chaos

The incident began when an unknown trader withdrew $3 million USDC from the OKX exchange, splitting it across 19 separate wallets before depositing it into Hyperliquid DEX.

Using these accounts, the trader opened massive long positions on POPCAT, leveraging them approximately 5x. Total exposure reached around $26–30 million, briefly making POPCAT one of the most actively traded tokens on the platform.

According to blockchain intelligence firm Arkham, the trader’s positions were quickly liquidated, resulting in the loss of almost all collateral.

“Someone just passed $5 million of bad debt on POPCAT to Hyperliquid’s Hyperliquidity Provider (HLP)…These 19 accounts were liquidated for a combined $25.5 million of POPCAT, losing $2.98 million in collateral,” Arkham reported.

The on-chain tracker also revealed that HLP lost $4.95 million, a move that effectively closed out remaining positions.

The remaining long positions were passed to the Hyperliquidity Provider (HLP) to liquidate.HLP appears to have lost $4.95M closing out the positions.

— Arkham (@arkham) November 12, 2025

Fake Buy Wall Sparks Mass Liquidations

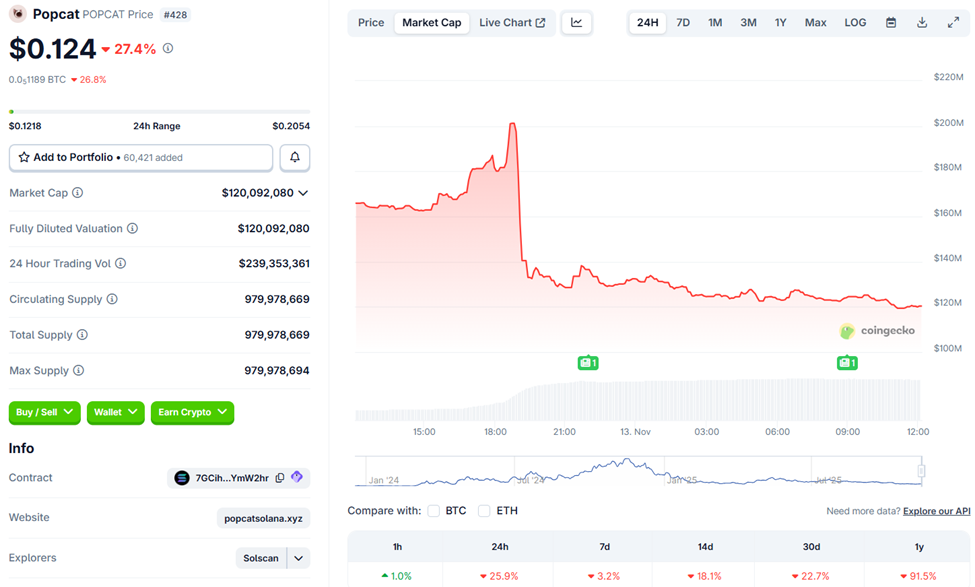

To amplify the chaos, the trader placed a $20 million buy wall at $0.21, creating the illusion of strong demand. As of this writing, the POPCAT price was trading for $0.12, down by almost 30% in the last 24 hours.

This strategic move attracted other traders to enter long positions, as they believed in a bullish momentum. Within minutes, the buy wall vanished, causing POPCAT’s price to collapse.

POPCAT Price Performance. Source:

CoinGecko

POPCAT Price Performance. Source:

CoinGecko

The sudden drop triggered mass liquidations across the market, with HLP absorbing the brunt of the losses.

“The attacker then placed an approximately $20 million buy wall near $0.21, creating the illusion of strong demand — only to cancel the orders, triggering a liquidity collapse that led to mass liquidations. HLP absorbed the positions and lost around $4.9M, while the attacker’s entire $3M stake was wiped out,” blockchain analyst Lookonchain noted.

Stress Test or Deliberate Attack?

Many in the crypto community suspect this was no accident. Vikas Singh, who observed the event live, compared it to previous manipulative scenarios, such as JellyJelly 2.0, noting the unusual stability of the long wall and its manual maintenance.

Did a JELLYJELLY 2.0 even happen yesterday with POPCAT?My analysis of yesterday Hyperliquid – Popcat orderbook: A 30-min shorts game.$POPCAT orderbook was crazy yesterday for a perp product. Why? because their was a long position which was having a sticky bid of $11M+ when…

— Vikas Singh (vikas.lens) 🌿, in Dubai 🇦🇪 (@HeyVixon) November 13, 2025

Analysts speculate this could have been a targeted stress test to probe Hyperliquid’s automated liquidity systems.

Some community members even speculated about Binance’s former CEO CZ’s involvement. However, CZ responded directly, denying any connection.

“I have not used any other CEX for 8 years,” the Binance executive articulated.

This marks the third major market incident on Hyperliquid this year, raising questions about how the exchange handles liquidity concentration and systemic risk. High-leverage meme tokens, such as POPCAT, are inherently risky and could expose vulnerabilities in decentralized liquidity systems.

Reportedly, the incident also sparked a temporary pause on Hyperliquid’s Arbitrum bridge, though deposits and withdrawals continued unaffected.

DeFi analyst Hanzo suggests exchanges may need stricter leverage limits, real-time monitoring tools, or platform-specific restrictions to mitigate similar attacks in the future.

$30M manipulation on Hyperliquid 🚨Roughly 13 hours before the event, an unknown trader withdrew $3M $USDC from OKX and split the funds across 19 wallets on Hyperliquid.Then he started opening massive long positions on $POPCAT, pushing the total exposure to around $20–30M.…

— Hanzo ㊗️ (@DeFi_Hanzo) November 12, 2025

While Hyperliquid’s team manually stabilized the market, the incident exposes the fragility of automated liquidity mechanisms in high-leverage meme markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: Solana Holds at $140—Will SIMD-0411 Trigger a Recovery or Extend the Decline?

- Solana (SOL-USD) trades near $140, constrained by EMAs forming overhead resistance after breaking key support levels. - Proposed SIMD-0411 disinflation plan aims to cut emissions by $2.9B over six years, accelerating inflation reduction to 1.5% by 2029. - Institutional interest grows with $390M ETF inflows and Coinbase's Vector.Fun acquisition, despite $3M in November spot outflows. - Technical analysis shows mixed signals: RSI improvement vs. $711M unrealized losses for major holders, with $172 retest c

Solana News Today: Institutional Interest Drives Solana Back to $130, Sets Sights on $250 Breakout

- Solana (SOL) tests $130 support with RSI rising to 50 and historical 100%+ rebound patterns suggesting potential recovery. - Institutional demand accelerates via $8.26M ETF inflows and GeeFi's $250K token presale success, boosting market confidence. - On-chain metrics show 18% YoY address growth and 9.1% 30-day transaction increases, reinforcing network fundamentals. - $170 breakout could target $250, but volatility risks persist as seen in BlackRock's $532M ETF loss amid crypto declines.

ICP's $4.92 Level Key as Energy Industry Drives Sustained Positive Outlook

- ICP token consolidates below $4.97 after failed $5.17 breakout, with $4.92 support critical for avoiding deeper correction. - Energy sector gains momentum as Constellation Energy secures $1B loan for Three Mile Island nuclear restart to support AI data centers. - GDS Holdings reports 74.4% data center utilization, reflecting strong demand for hyperscale infrastructure linked to AI expansion. - Analysts highlight energy-sector tailwinds for ICP's long-term potential despite near-term technical uncertainty

XRP News Today: XRP's Death Cross and $2.20 Breach Indicate Broad Market Downturn

- XRP跌破关键$2.20支撑位并形成死亡交叉技术形态,短期看跌信号显著增强。 - 技术分析预测价格可能进一步下探$1.25,跌破历史支撑区间引发持续性担忧。 - 加密市场整体承压,比特币/以太坊同步出现死亡交叉,显示行业性熊市趋势。 - 支持者指出XRP跨境支付优势或吸引抄底资金,但短期流动性紧缩加剧下行风险。