KITE Price Forecast Post-Listing: Managing Market Fluctuations and Institutional Perspectives

- KITE's 2025 IPO details remain unconfirmed, with Black Kite's AI risk framework and Kite Hill's event communications shaping potential investor sentiment. - Black Kite's unified AI risk model could attract compliance-focused investors but faces adoption and regulatory uncertainties. - Kite Hill's hybrid tech-creative events offer diversification but risk volatility due to macroeconomic shifts and corporate spending trends. - Institutional investors may support Black Kite's ESG alignment yet hesitate over

The lack of officially confirmed IPO information for KITE in 2025 brings up important concerns regarding its potential in the market and its attractiveness to institutional investors. Although there are no set dates, pricing, or regulatory disclosures, the actions of two companies—Black Kite and Kite Hill—provide indirect clues about industry trends that could influence investor attitudes if KITE eventually goes public.

Sector Dynamics: AI Risk Management and Event Communications

With the introduction of the Global Adaptive AI Assessment Framework (BK-GA³™), Black Kite has established itself as a leader in the rapidly expanding field of AI risk management, especially as global regulations remain uncertain.

On the other hand, Kite Hill’s specialization in event communications—as seen in its role at the Artist and the Machine summit—

Institutional Sentiment: A Double-Edged Sword

Institutions frequently serve as indicators for IPO outcomes. For Black Kite, its collaboration with Shared Assessments, a nonprofit dedicated to third-party risk,

Kite Hill’s use of pre-IPO platforms like Forge’s marketplace to reach accredited investors

Market Volatility: Sector-Specific Risks

Both AI risk management and event communications are sectors known for their volatility. For Black Kite, changes in regulations—such as the EU’s AI Act or new U.S. federal policies—could impact demand for its framework. A visual review of AI industry patterns (including companies like NVDA and AMD) shows a mixed picture: while hardware firms in AI have seen significant gains, SaaS providers are under pressure to maintain margins. This contrast indicates that Black Kite’s market value after an IPO would largely depend on broader economic conditions and regulatory developments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple Commits $4B to Build Crypto’s Bridge to Wall Street

Bitcoin price risks deeper losses as Nasdaq correlation turns one-sided: Wintermute

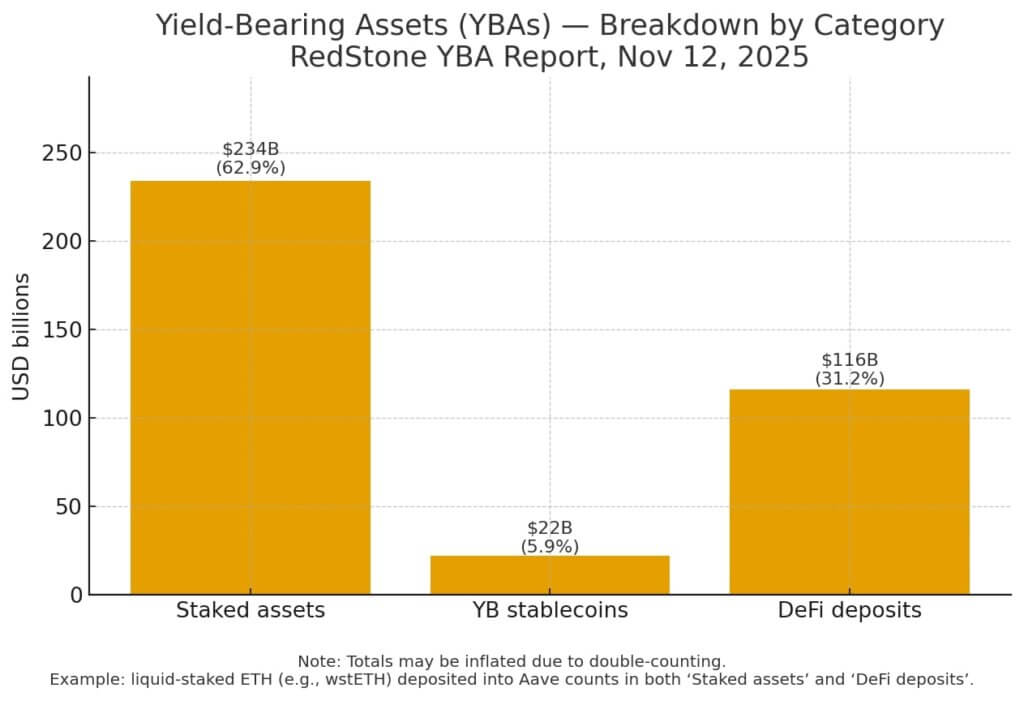

Only 10% of crypto earns yield now — why most investors are sitting on dead money

US President Donald Trump Signs 43-Day-Long Plan! The White House Makes Important Statement That the Fed Won't Like!