SEC's approach to tokens seeks to foster innovation in the crypto space while ensuring safeguards for investors

- SEC introduces flexible token classification framework under Project Crypto, using Howey Test to distinguish securities from commodities while allowing blockchain innovation. - Framework acknowledges decentralized networks may lose securities status as control disperses, creating dynamic regulatory boundaries for evolving crypto projects. - Plans include exemptions for certain tokens and collaboration with industry players like Tether to build infrastructure, aligning with CLARITY Act's regulatory clarit

The U.S. Securities and Exchange Commission (SEC) has introduced a new adaptable framework under its Project Crypto initiative to help define how crypto assets are regulated, aiming to provide clearer guidelines and support innovation while still protecting investors. On November 12, Chair Paul Atkins presented the "Token Classification Framework," which is based on the 1946 Howey Test—a legal benchmark used to decide if an asset is an investment contract and therefore a security, according to a report by

Atkins pointed out that the framework recognizes how blockchain projects can change over time, explaining that tokens might no longer be considered securities as their networks become more decentralized and original issuers relinquish control, as outlined in a

Industry experts, including the Wall Street firm Bernstein, have commended the U.S. regulatory direction as a driver for global leadership in crypto. The GENIUS Act, which helped stablecoins grow to over $260 billion in U.S. dollar-backed supply, along with the CLARITY Act, are viewed as key steps for institutional adoption, as

The SEC's plans also intersect with industry developments, such as

Atkins emphasized that the framework does not mean a reduction in enforcement, reaffirming that "fraud is fraud" and promising to address wrongdoing in digital asset markets. The SEC's Project Crypto approach seeks to balance innovation with regulation, positioning the U.S. as a potential frontrunner in global crypto oversight.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Filecoin (FIL) to Bounce Back? This Emerging MA Fractal Setup Suggests So!

Finloop and 1exchange Unite to Build Regulated RWA Tokenization Network for Crypto-Linked Assets

Why is the Crypto Market Down Today Amid the End of the U.S. Government?

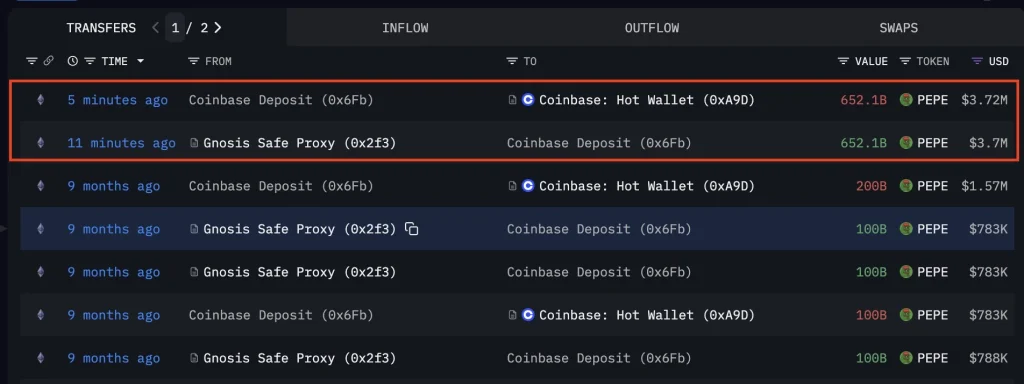

Pepe Price on the Cusp of Further Selloff as Top Whales Capitulate