Bitget Daily Digest (Nov 12)|Solana financial firm Upexi posts record quarterly results; Nick Timiraos: “Fed increasingly divided over December rate cut”; Injective launches native EVM mainnet, advancing MultiVM roadmap

Today's Preview

- The 2025 Singapore FinTech Festival (SFF) will be held from Nov 12 to 14, with a focus on Web3 and digital assets.

- The Cardano Summit 2025 will take place in Berlin from Nov 12 to 13, connecting the Cardano ecosystem with global enterprises.

- Bitcoin Amsterdam 2025 kicks off on Nov 13 in the Netherlands, as Europe’s largest dedicated Bitcoin event.

- Bitwise: The Chainlink ETF (CLNK) is now listed on the DTCC website.

Macro & Hot Topics

- Nick Timiraos, “the Fed’s mouthpiece”: “Divisions within the Fed have cast a shadow over the path to rate cuts. In Chair Powell’s nearly eight-year tenure, this level of disagreement is almost unprecedented. Officials are split over whether persistent inflation or the sluggish labor market poses a bigger threat, and even a return of robust official economic data may not bridge the divide.”

- Bitcoin briefly dropped below $104,000 in the past 24 hours, down 1.91% on the day. It faces resistance near $107,000, with weak buying interest and growing short-term downside pressure.

- In Solana’s ecosystem, 23 projects raised over $211 million in Q3 2025, while weekly institutional inflows once topped $420 million. Despite SOL recently breaking below key support, the market remains optimistic for a move above $200.

- Crypto financial services firm SoFi became the first nationally chartered bank in the US to offer compliant Bitcoin and crypto trading, further integrating crypto into mainstream finance.

Market Updates

1.BTC and ETH remain weak and range-bound; market sentiment is cautious. In the past 4 hours, liquidations reached $45.81 million, with most being short positions.

2.US stocks closed mixed: the Dow rose 1.18%, the S&P 500 climbed 0.21%, and the Nasdaq dipped 0.25%.

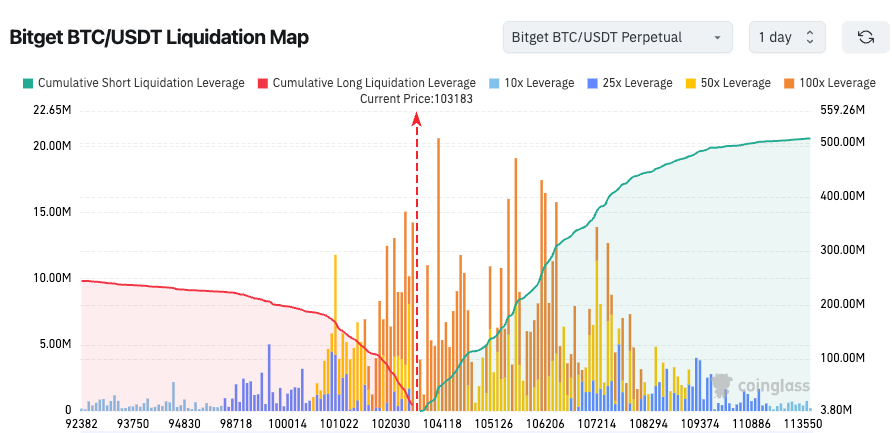

3.On Bitget, the BTC/USDT price currently stands at $102,950. Heavy leveraged long liquidations are clustered in the $104,044–$105,000 range; a breakout could trigger further short covering, amplifying short-term volatility risks.

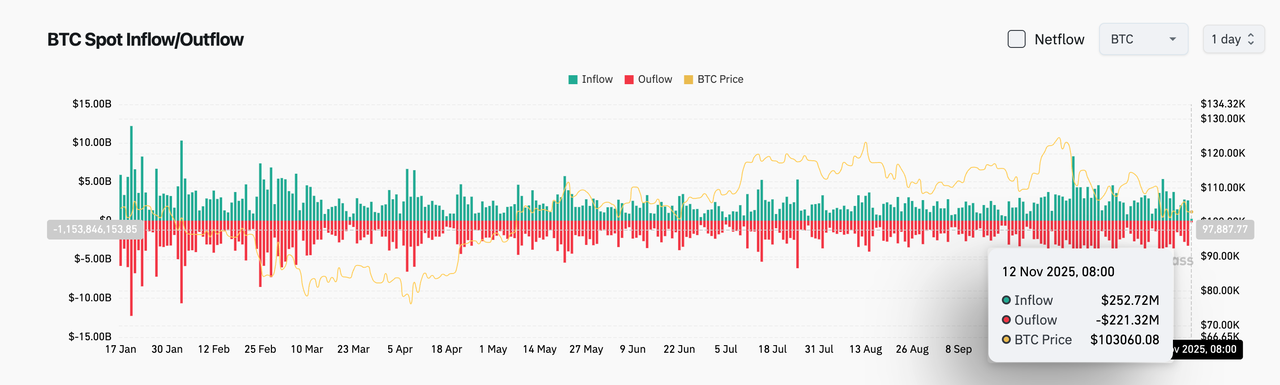

4.Over the past 24 hours, BTC spot inflows were $252 million, outflows $221 million, for a net inflow of $31 million.

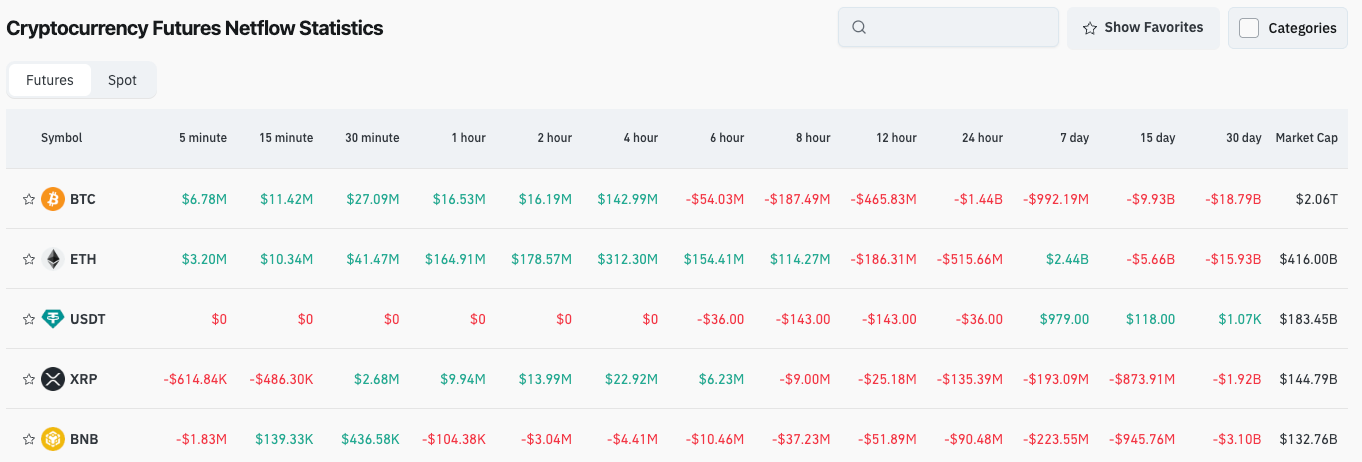

5.In the same period, BTC, ETH, USDT, XRP, and BNB derivatives saw leading net outflows—potentially signaling trading opportunities.

News Updates

- Arthur Hayes: Still hasn’t reached his ZEC allocation target, considering adding in the $300–350 range.

- US government shutdown bill enters the House. BTC holds above $104,000; most major coins pull back slightly. On the news, UNI surged 25% in a day to $8.64.

- ZCash’s shielded pool now holds assets equal to 23% of its total supply, as network usage surges.

- Tokenized assets on Ethereum have surpassed $200 billion, accounting for nearly two-thirds of the total across all networks.

Project Developments

- Lighter’s TVL has reached $1.17 billion, surpassing Linea.

- Sonic Labs announced its next phase: introducing a tiered fee monetization structure and opening an office in New York.

- Tether has hired former HSBC traders as it officially enters the gold market.

- The US Senate introduced a bill to give crypto regulation authority to the CFTC.

- The Central Bank of Brazil released a crypto regulatory framework, including a $7 million capital requirement.

- Injective launched its native EVM mainnet, advancing its MultiVM roadmap.

- DBS and JPMorgan are developing an interoperable framework for tokenized deposits.

- Solana financial firm Upexi posted record quarterly results, fueled by $78 million in unrealized SOL gains.

- ClearToken received FCA approval to launch a digital asset settlement platform.

- Kingnet AI announced its migration to BNB Chain and plans to launch V3.

Disclaimer: This report is AI-generated and human-verified for information only. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The 12 trillion financing market is in crisis! Institutions urge the Federal Reserve to step up rescue efforts

Wall Street financing costs are rising, highlighting signs of liquidity tightening. Although the Federal Reserve will stop quantitative tightening in December, institutions believe this is not enough and are calling on the Fed to resume bond purchases or increase short-term lending to ease the pressure.

Another Trump 2.0 era tragedy! The largest yen long position in nearly 40 years collapses

As the yen exchange rate hits a nine-month low, investors are pulling back from long positions. With a 300 basis point interest rate differential between the US and Japan, carry trades are dominating the market, putting the yen at further risk of depreciation.

Is a "cliff" in Russian oil production coming? IEA warns: US sanctions on Russia may have "far-reaching consequences"!

U.S. sanctions have dealt a heavy blow to Russia’s oil giants, and the IEA says this could have the most profound impact on the global oil market so far. Although Russian oil exports have not yet seen a significant decline, supply chain risks are spreading across borders.

Leading DEXs on Base and OP will merge and expand deployment to Arc and Ethereum

Uniswap's new proposal reduces LP earnings, while Aero integrates LPs into the entire protocol's cash flow.